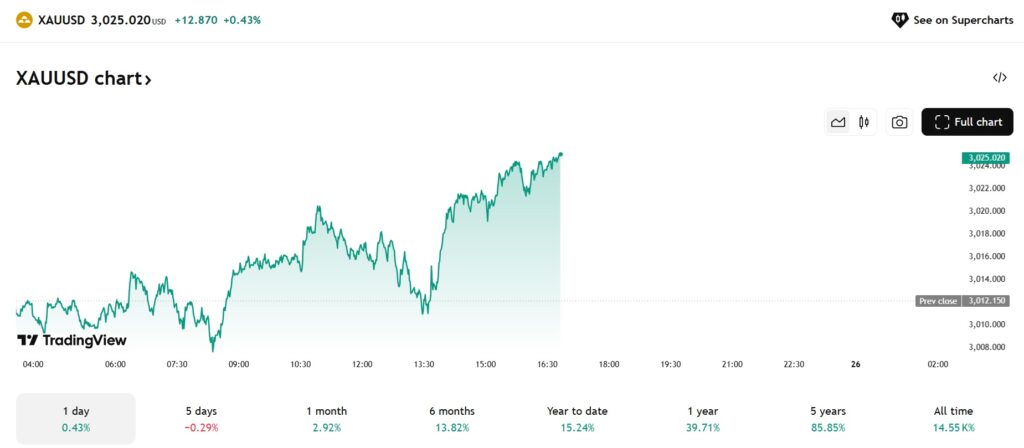

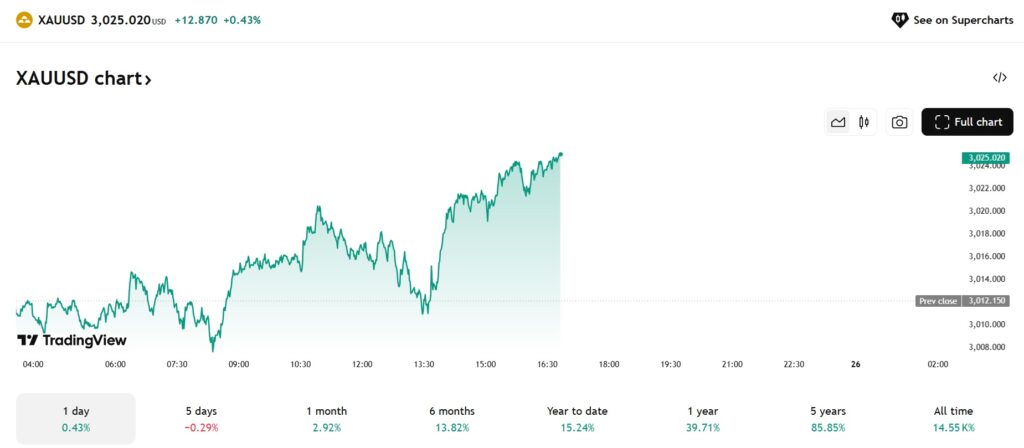

Gold prices are hovering around the $3,022 mark on Monday as prices remain stable in the last three trading sessions. The XAU/USD index could see minor corrections as commodity investors indulge in sell-offs and profit bookings. The precious metal has spiked nearly 16% year-to-date and is among the top-performing assets in the broader commodity markets.

Also Read: Ripple: AI Predicts XRP Price For March 31, 2025

Bulls are on the driver’s seat with bears experiencing bad trading sessions timing the gold prices. The surge in value has been steady as the precious metal sustainably scaled up in the indices. With the US dollar declining in value and the DXY index falling to 103.80 level, gold is gaining in the charts.

Also Read: Cardano Prediction: AI Sets ADA Price For March 31, 2025

Gold: Bulls Target $3,150

The US dollar’s dip has helped gold to maintain a positive momentum and the uncertainties on tariffs have pushed its price higher. “This dollar weakness has helped stabilize gold prices following the recent retreat, offering short-term support around the $3,000 level,” said FX Empire analyst James Hyerczyk. “A softer dollar typically supports gold by making it more affordable for overseas buyers,” he noted.

Also Read: Solana: Can $5000 Worth Of SOL Become $500,000 By 2030?

“Gold prices are holding steady at the start of the week, pausing after last week’s sharp two-day pullback,” Hyerczyk wrote. “Monday’s trade remains confined within Friday’s range, signaling indecision as traders await fresh catalysts. The precious metal remains in a broader uptrend, but near-term correction risks persist, especially with key macro data and tariff-related headlines on the horizon.”

“Markets remain alert to potential economic fallout from U.S. President Donald Trump’s proposed tariffs, set to take effect on April 2,” he wrote. “While Trump hinted at possible flexibility, concerns remain that retaliatory measures could stoke inflation and slow economic growth. Analysts suggest that a more aggressive tariff stance could push gold toward the $3,100 level, while a less severe outcome may open the door for brief dips below $3,000,” he summed it up.