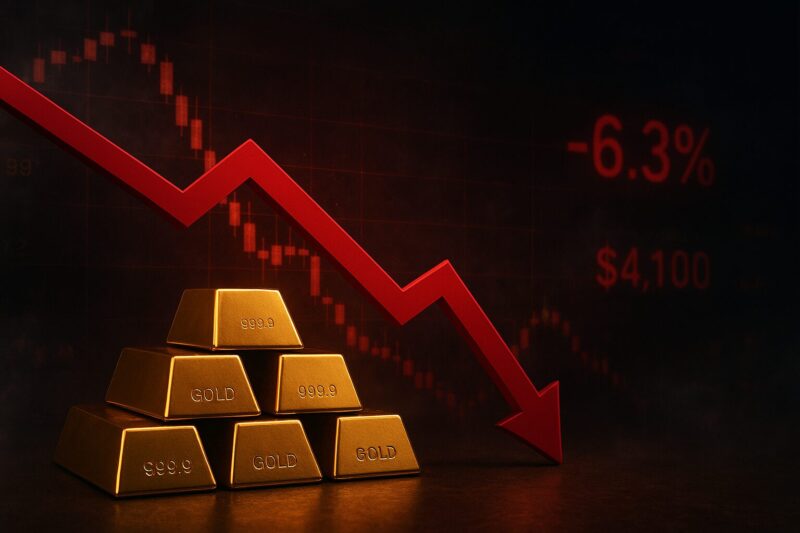

Gold prices crashed more than 5% on Tuesday, and right now investors are trying to figure out if this is the end of an incredible run or just a temporary dip. The gold spot price fell as much as 6.3% to just under $4,100 per troy ounce—the biggest single-day drop since 2013, which is pretty significant when you think about it. Silver prices weren’t spared either, tumbling more than 8% in what traders are calling the worst day since 2021. So why is gold down today? Well, analysts are pointing to easing trade tensions between Washington and Beijing, a stronger dollar, and the fact that gold futures had simply run too hot after hitting record highs.

Also Read: Zambesi Gold (ZGD): A Gold & Precious Metal Supported Token Backed by Real Mining Operations

Gold And Silver Tumble As Precious Metals Rally Grinds To A Halt

Technical Resistance Stops Rally

Gold prices tried multiple times to push past $4,400 but just couldn’t break through that ceiling. Trade Nation senior market analyst David Morrison wrote in a note on Tuesday:

“Gold had several attempts to push above $4,400, starting last Thursday. But on each occasion, it ran into resistance.”

At the time of writing, gold prices have given up a big chunk of recent gains, and traders are now watching to see if buyers will step in at these lower levels. The move was also driven by improving relations between the US and China, which typically reduces demand for safe-haven assets like gold. And with the US dollar getting stronger—the dollar index rose 0.4% on Tuesday—gold became more expensive for overseas buyers, adding even more pressure.

Profit-Taking After Unsustainable Gains

Standard Chartered analyst Suki Cooper said the market is going through a “technical correction” as the “universe of investors has expanded rapidly.” It’s worth noting that Bart Melek, TD Securities’ global head of commodity strategy, told Bloomberg that precious metal dealers are “taking profits after a very robust rally,” and he pointed out that the recent gains were historically unsustainable.

Silver prices and platinum were hit even harder than gold. Futures for Silver dropped 6.7% while platinum fell 7.2% as investors locked in profits across the board. Gold futures settled around $4,130 by afternoon, which was down significantly from the morning’s lows but still represented a major pullback.

Just A Temporary Setback?

Many analysts believe this drop is nothing more than a healthy correction, and the fundamentals for gold remain strong. Sevens Report Research founder Tom Essaye told Yahoo Finance on Tuesday:

“This is just a bump in the road. You still have elevated inflation. You have low real interest rates. You’ve got geopolitical concerns, you’ve got US government disfunction. That’s all a bullish cocktail for gold.”

Gold prices have climbed 28% since mid-August, fueled by central bank purchases and inflows into gold-backed exchange-traded funds. Investors have been piling into the metal to hedge against trade uncertainties, and those fundamental drivers haven’t really changed.

Also Read: Wall Street Buys 1,300+ Tonnes of Gold Before BRICS Currency Launch

David Morrison also stated:

“The first major test to the downside comes in around $4,000. But it’s also quite possible that this is all we get from the dip and that buyers come back in around $4,200.”

Investors bought the dip last Friday when gold briefly fell more than 1.5%, which suggests there’s still strong underlying demand for the metal. The gold spot price may have taken a hit, but many traders see this as an opportunity rather than a reason to panic.

Wall Street Still Bullish On Gold Prices

Despite Tuesday’s sharp decline, major banks are sticking with their optimistic forecasts for gold. Bank of America analysts recently reiterated their “long gold” recommendation and are forecasting a peak of $6,000 per ounce by mid-2026. The firm also raised its price target for Silver prices to $65 an ounce, which shows they’re not backing down from their bullish stance.

Michele Schneider, chief strategist at Marketgauge.com, recently told Yahoo Finance:

“What would break the back of gold would be if all of the sudden we greatly reduced our debt — not happening yet — and peace broke out in the world.”

With inflation still running hot and real interest rates remaining low, the structural case for gold prices remains intact. Tuesday’s drop may have rattled some investors, but the long-term bulls aren’t backing down just yet. Gold futures have climbed 54% for the year, and one bad day won’t erase that kind of performance.