Gold prices are attracting buying pressure and climbed nearly 8 points in the charts on Thursday. Institutional investors are entering the commodity markets after the weakening of the US dollar. The Fed’s dovish stance to tame inflation has made the US dollar dip in the last two months. The move added inflows into the gold market as the precious metal is seen as a safe haven for investments.

Also Read: Russia Makes Huge Announcement On New BRICS Expansion

The price of gold is receiving support at the $2,050 level and is consolidating in price. If the yellow metal attracts another round of buying pressure this week, chances of a spike in price remain on the cards. The gold prices could break out from $2,050 and head towards the $2,077 mark if the buying pressure sustains this week.

Also Read: US Economy Avoided a Recession in 2023: What’s the Outlook For 2024?

Gold Prices Could Dip If the US Dollar Strengthens

The XAU/USD chart could next target the price mark of $2,100 if the buying pressure sustains until Friday. That’s a steady and decent rise of approximately 2.5% in the coming days from its current price of $2,050. However, on the flip side, if gold prices fail to keep up the momentum, a downward resistance at $2,030 is possible.

Also Read: 2 Stocks Warren Buffet Is Eyeing in 2024

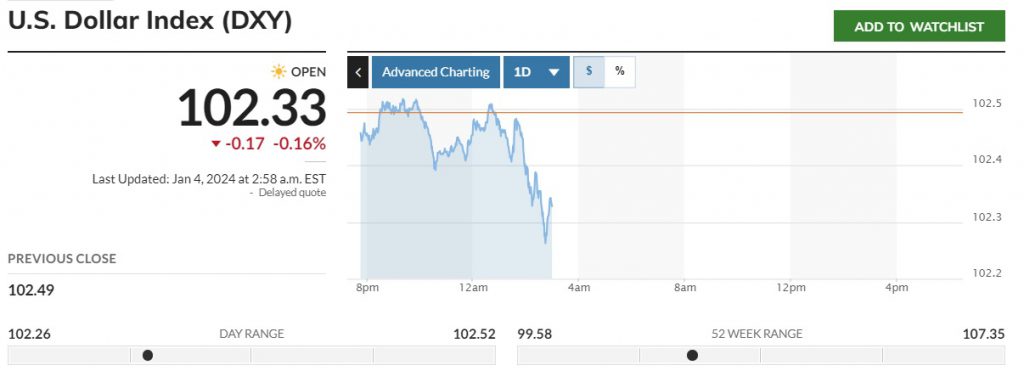

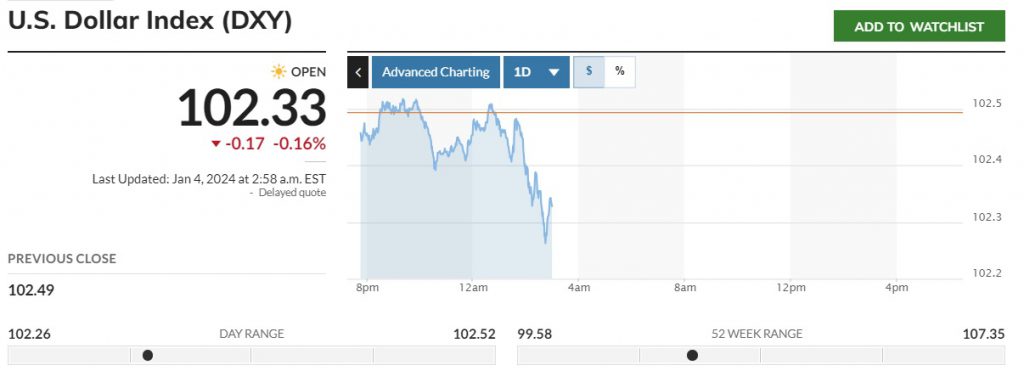

The risk factor affecting gold prices is that the US dollar is also consolidating in price. The DXY charts show that the US dollar is receiving resistance at the 102 level and is looking to break out. If the US dollar manages to pull itself from the decline, gold prices will be the first to be affected.

Also Read: 5 U.S. Sectors To Be Affected If BRICS Ditches the Dollar For Trade

The current market situation remains sticky as both gold and the US dollar are under consolidation. Both the wealth creators have found support levels and the markets will dictate its next moves. Also, read here for a realistic price prediction on how high gold prices could trade this year in 2024.