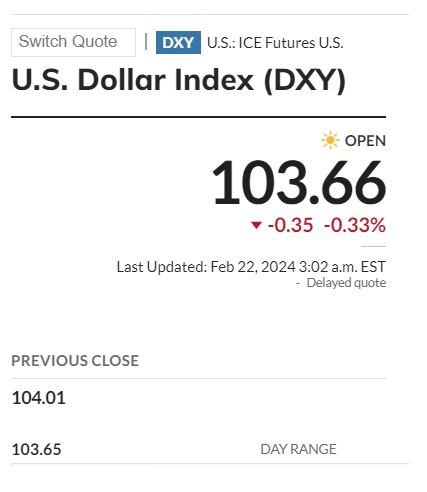

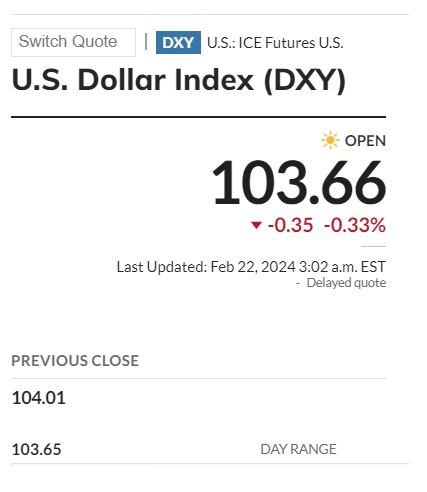

After a tumultuous month in February, gold prices breached the $2,030 mark on Thursday rising by 5 points in 24 hours. The XAU/USD charts remained on the back foot showing little to no price spurts in the indices. Gold’s rise comes at a time when the US dollar index (DXY) saw a slump this week. The US dollar index stood tall at 104.80 but dipped to 103.70. While gold is benefiting, the US dollar and the broader commodity markets, including oil prices are taking a hit.

Also Read: Warren Buffett Invests Nearly 50% of His Portfolio in Only 1 Stock

Why Are Gold Prices Rising?

Gold prices inched forward today as investors await the Fed minutes meeting. The Fed meeting influences the US dollar prices as markets believe the Federal Reserve will pause interest rate hikes. Predictions are doing the rounds that the Feds will not initiate rate cuts in March but might do it in June or July. Commodity traders are speculating that the Feds might ease 95 basis points this year.

Also Read: $5,000 Invested in Nvidia Stocks in 2000 is Worth $2 Million Today

Investor sentiments shifted towards gold prices as the US dollar reached peak at 104 and is correcting itself in the charts. The commodity markets are also breathing a sigh of relief as the tensions in the Red Sea are cooling down. The development gives oil prices a chance to scale up after being on the back foot for nearly two months.

Also Read: Gold Prices To Reach New Highs in 2024 as Central Banks Buy 387 Tonnes

However, things can take a U-turn for gold prices if the Fed minutes meeting hint at interest rate hikes. The US dollar would strengthen then making gold go soft. It is advised to carefully watch the markets and the Fed minutes meeting before taking an entry position.

Gold prices, the US dollar, oil, and other commodities now remain highly volatile due to the Feds’ pending decision. Taking an entry position at this moment remains to be risky unless investors know what could be the Feds’ outcome.