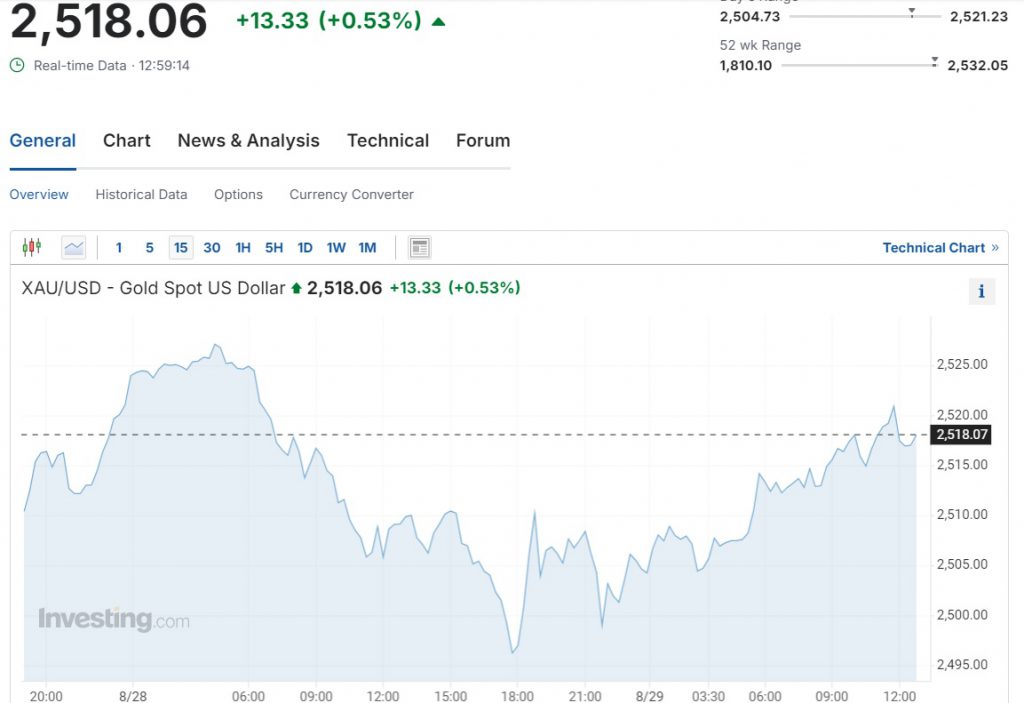

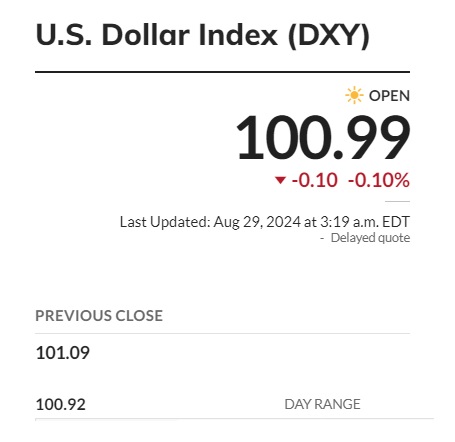

Gold remained safe above the $2,500 mark on Thursday’s opening bell, surging more than 13 points in the charts. The XAU/USD index shows gold prices reaching $2,518 today, with a 0.53% surge in the indices. While gold prices are going up, the US dollar remains on a slippery slope, trading at the 100.99 mark.

Also Read: The Worst Is Over For Copper as Prices March Towards $9,500

Gold’s Rise Amid US Dollar Challenges

The US dollar aims to climb above 101, but the bearish grips pull the currency down. Institutional investors are opening positions in gold as the metal looks promising and is currently skipping the US dollar. The next few weeks could be challenging for the leading currency due to investments drying up from global investors.

Also Read: BRICS: Payments in Chinese Yuan Surpasses the US Dollar by 2.5%

DXY Index Performance

The DXY index, which tracks the performance of the US dollar, began dipping from 106.20 to 100.9 in two months. Fears loom that a fall below the 100-point mark could send the currency trading below leading local currencies. The development is adding pressure on the USD while gold remains in bullish territory.

Also Read: BRICS: India To Accept Local Currencies For Trade, Sideline US Dollar

Commodity Markets: What’s Next For Gold & the US Dollar?

The speculation of a Fed interest rate cut is holding the US dollar back. The upcoming Fed meeting will decide the prospects of the USD, as traders are expecting a rate cut. Therefore, the currency markets could experience volatility in September, dampening the prospects of the USD.

Also Read: BRICS: Russia To Officially Use Cryptocurrency For Trade Settlements

On the other hand, gold could touch $2,600 by the end of the year, predicted leading investment bank JP Morgan. The price rise forecast comes after central banks of developing countries are accumulating the precious metal. “Overall, the vigorous level of central bank purchasing, as well as the continued ascent in gold prices since the end of the first quarter, has us thinking about the price sensitivity of central bank demand,” read the prediction.