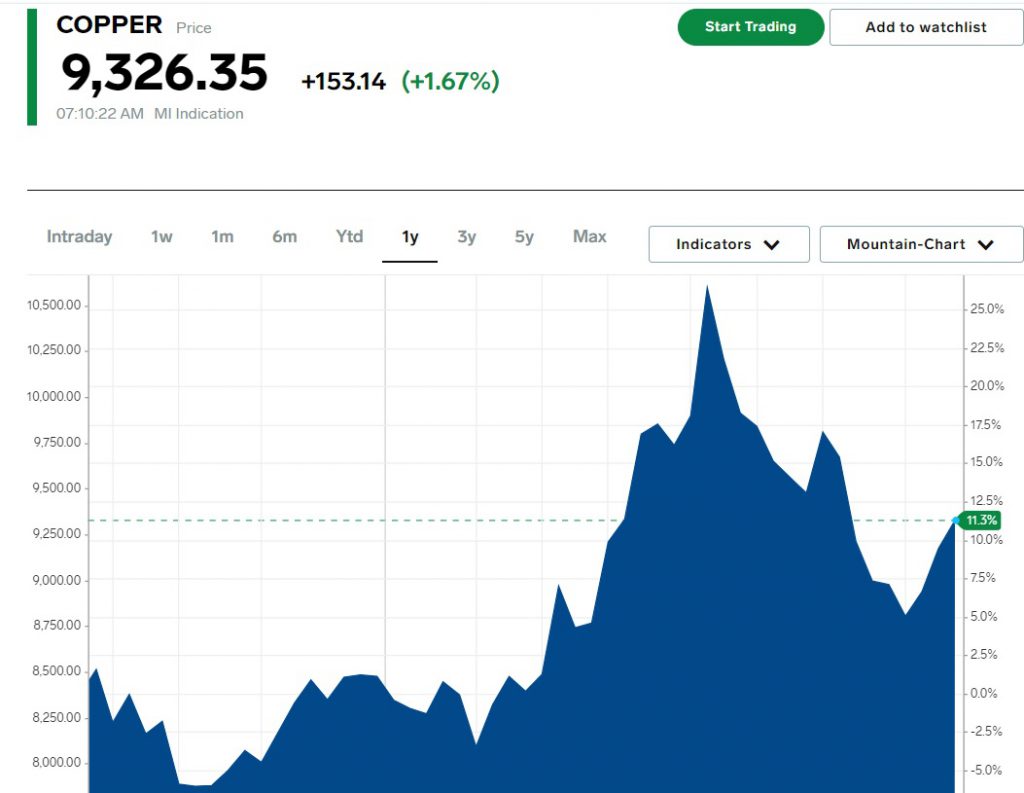

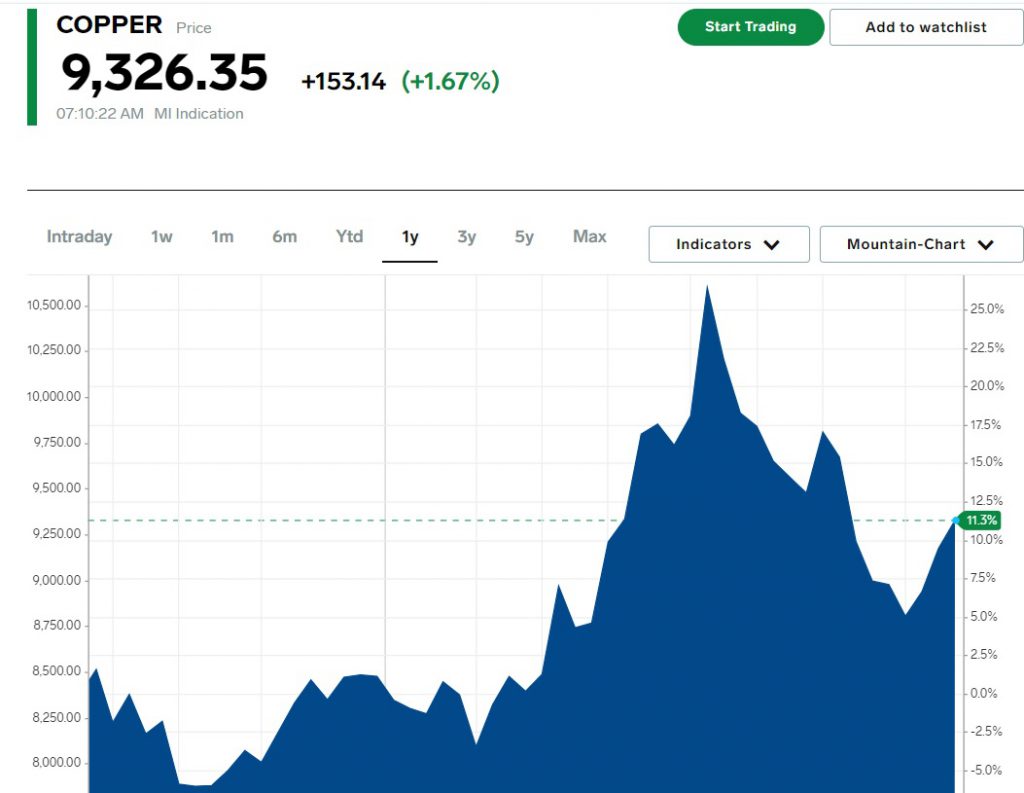

This year, the commodity markets saw the rise of gold, copper, silver, and the US dollar, printing double-digit gains. While the US dollar dipped, erasing most of its profits, the hard metals stayed afloat with minimal falls. Copper prices fell below the $8,500 mark early this month, sending fears that it could dip to the $7,900 level.

Also Read: U.S. Dollar Snaps 4-Day Losing Streak With a 0.39% Rise

However, the markets rebounded, sending copper prices climbing above $9,000 this week. The metal is currently trading at $9,326. It surged 153 points on Wednesday’s opening bell by rising 1.67% in the charts. The metal is attracting bullish sentiments again and is receiving an influx of funds from institutional investors.

Also Read: Currency: Fed Rate Cuts To Strengthen Yuan By 10%, Pushing Dollar Down

What Next For Copper Prices?

Ole Hansen, the Head of Commodity Strategy at Saxo Bank, explained that the worst is over for copper prices. He stressed that the steep correction has bottomed out and the only way for copper prices are up. However, he added that a price rise could come only if demand for the metal increases from corporations, that use it to manufacture products.

Also Read: BRICS: Payments in Chinese Yuan Surpasses the US Dollar by 2.5%

“We believe the worst of the correction is over. But before copper can mount a stronger recovery, demand fundamentals need to improve, potentially supported by restocking through lower funding costs once the (Federal Open Market Committee) starts its long-awaited rate-cutting cycle,” Hansen said in a research note.

He added, “Until then, traders will continue to look out for signs of improvement. Not least through the reduction of elevated stock levels at warehouses monitored by the three major futures exchanges.”

Also Read: Vitalik Buterin’s Salary: How Much Does the Ethereum Founder Earn

Hansen added that the next target for copper prices is breaching the $9,500 mark. “From a technical standpoint, a break would open up for an extension to $9,500, respectively,” he said. If copper prices resist the $9,500 level, the next leg could catapult to $10,000.