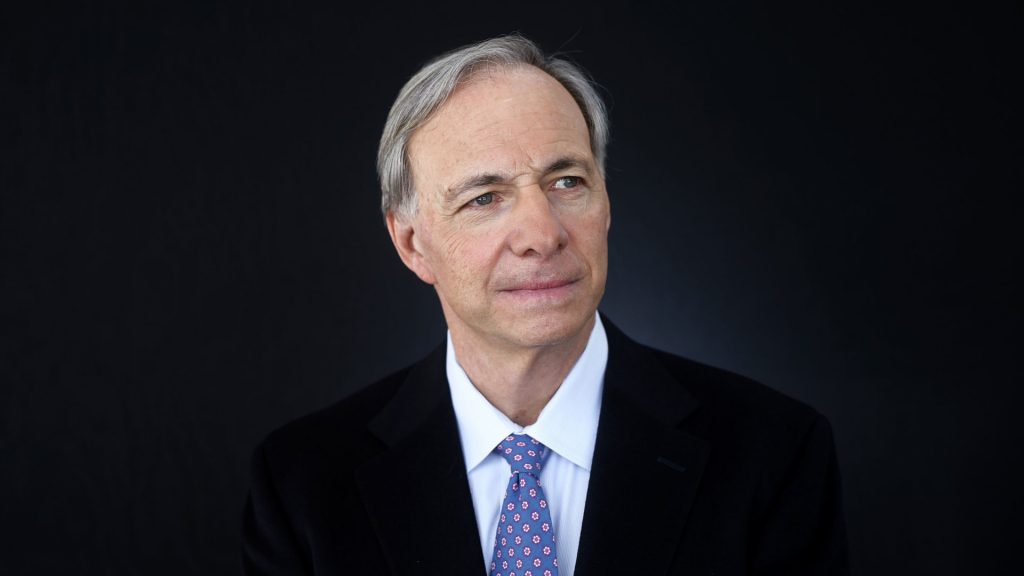

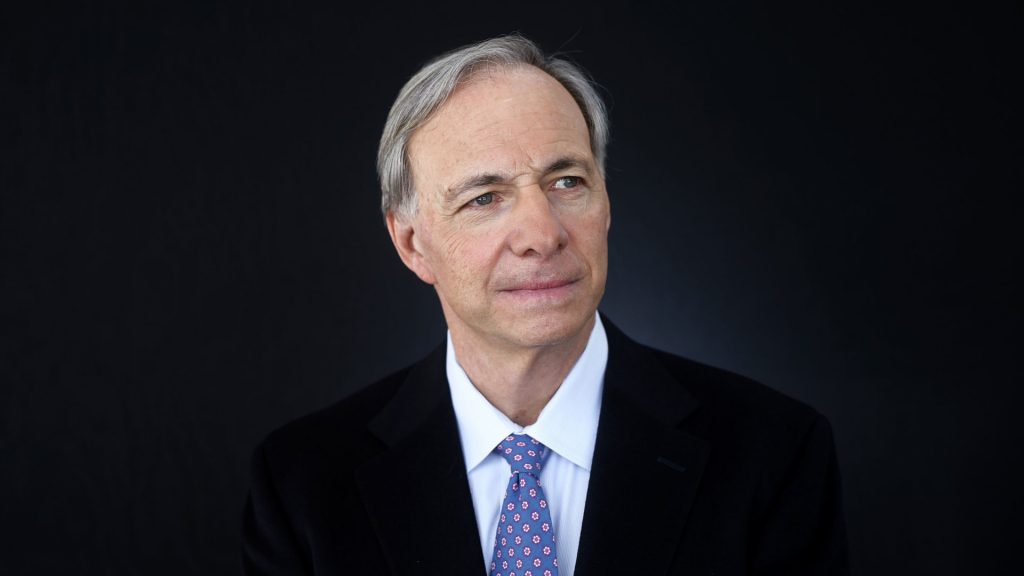

Gold is slowly emerging as one of the most trending metals to take note of. The precious yellow asset is now surging in demand, with leading experts like Ray Dalio openly vouching for the token. The former CEO of Bridgewater Associates has recently delivered a detailed statement on gold, adding how the asset is primed to hit new highs, and investors should diversify their portfolios towards gold no matter what.

Also Read: Trump Can’t Stop This: BRICS Buys 60,000 Ounces of Gold To Hammer USD

Dalio’s Gold Theory

Ray Dalio, a leading economic expert and former CEO of Bridgewater Associates, has once again shared his new economic theory. Starting with gold, Dalio has urged investors to diversify into the yellow metal, adding that such investments can protect investors from sudden debt market shocks.

As reported by Walter Bloomberg, Dalio was noted sharing this hypothesis at the Abu Dhabi Finance Week event. The expert was quick to add how the metal can be one of the safest hedge assets to explore during a market crisis.

“Bridgewater founder Ray Dalio advises investors to keep 10–15% of their portfolios in gold, calling it protection against debt-laden markets. He warned rising U.S. debt costs “squeeze out other spending,” comparing the risk to a clogged artery heading for a heart attack. Speaking at Abu Dhabi Finance Week, Dalio noted gold’s lack of correlation with other assets and its tendency to rise during crises.” Walter Bloomberg added.

RAY DALIO: HOLD 10–15% OF PORTFOLIO IN GOLD

— *Walter Bloomberg (@DeItaone) September 11, 2025

Bridgewater founder Ray Dalio advises investors to keep 10–15% of their portfolios in gold, calling it protection against debt-laden markets.

He warned rising U.S. debt costs “squeeze out other spending,” comparing the risk to a…

Dalio Continues to Back Gold

Expressing his deep appreciation for gold during the steep market crisis, Dalio took to X to share how he believes gold is a true breakout asset during stressful times.

The expert noted how the asset possesses stability, emphasizing its scarcity and everlasting demand.

“When I look at the US and global debt burdens. And how countries are likely to respond, I worry about the possibility of creating a stagflationary environment. Our financial system is dependent on the idea that you can take a debt asset and convert it into money. But now there’s not enough money to go around. That makes the idea of devaluing the dollar relative to other currencies appealing. But the other currencies won’t want much of an appreciation either. That’s one of the reasons I say that gold will be a better-performing asset.”

When I look at the US and global debt burdens and how countries are likely to respond, I worry about the possibility of creating a stagflationary environment.

— Ray Dalio (@RayDalio) September 8, 2025

Our financial system is dependent on the idea that you can take a debt asset and convert it into money. But now there’s… pic.twitter.com/Bx24y1chss

Also Read: AI Predicts Gold Price’s Next Big Move if September Cuts Are Announced