According to a new Securities and Exchange Commission filing, Goldman Sachs has been selling customers exposure to ETH (Ethereum) through Galaxy Digital’s Ethereum Fund.

Galaxy Digital is a crypto-focused financial services company founded by billionaire Mike Novogratz. As of the end of Q4 2021, it had $2.8 billion in assets under management (AUM).

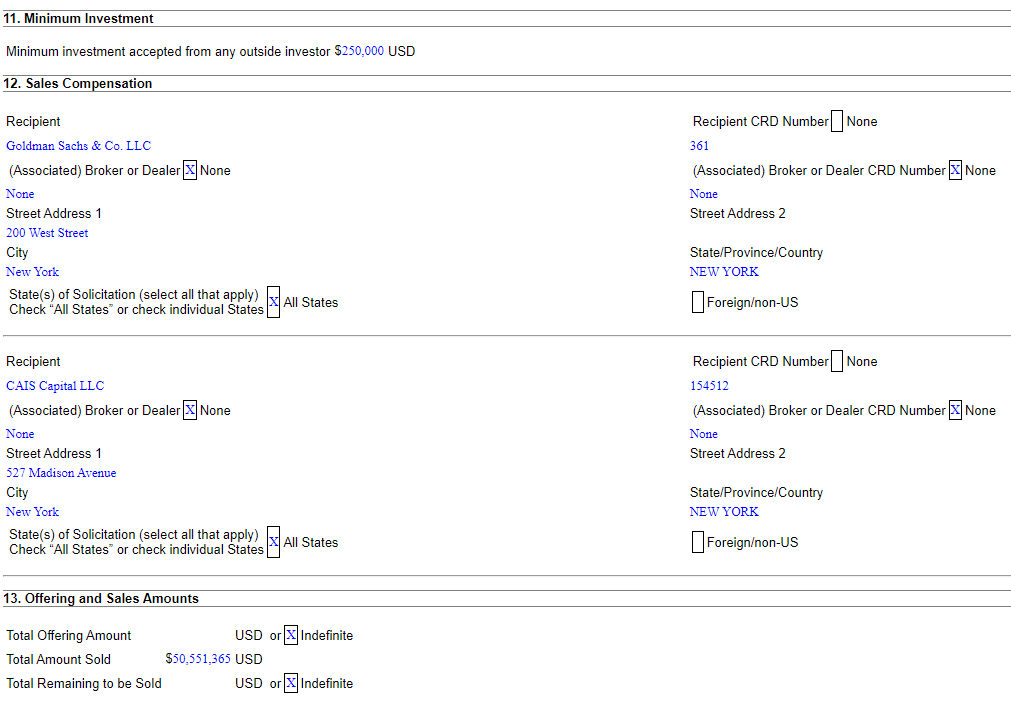

Clients of Goldman Sachs who want to invest in Ethereum (ETH) on the spot have been offered a position in Galaxy’s Ethereum (ETH) Fund. Goldman was mentioned as a receiver of introduction fees for introducing clients to the fund in a Galaxy filing dated March 8, revealing this practice.

According to records, the company has sold over $50 million to 28 clients with a $250,000 minimum investment. Because Goldman was not involved when it first began, it’s difficult to establish how much, if any, flow the investment bank is responsible for.

Goldman Sachs heavily bullish on Ethereum and Bitcoin?

This isn’t the first time Goldman and Galaxy Digital have collaborated. Goldman started trading Bitcoin (BTC) futures via CME Group Bitcoin futures in June, with Galaxy Digital providing liquidity.

Employees at Goldman Sachs are also becoming more interested in cryptocurrency. Goldman Sachs executive Roger Bartlett revealed on February 25 that he was leaving the traditional financial institution to join the Coinbase cryptocurrency exchange.

Goldman Sachs most likely wants to introduce Ethereum (ETH) to its clients, just as they had done with Bitcoin (BTC). The second most prominent cryptocurrency has revolutionized the space, with the introduction of newer innovations like NFTs, blockchain gaming, etc.

Lloyd Blankfein, Senior Chairman of Goldman Sachs, is likewise intrigued by the crypto area. In view of extraordinarily high inflation rates and individual bank accounts being frozen around the world, he questioned, via a tweet, on March 7 why cryptocurrency was not “having a moment.”

Blankfein’s viewpoint drew a wide range of reactions on Twitter. Micheal Saylor, a leading proponent of Bitcoin, was one of the respondents. Traditional traders who view Bitcoin as something to buy or sell depending on their current risk assessment and interest rate expectations, according to Saylor, are at odds with fundamental investors who just want to buy it all and hold it forever.

Saylor stated,

“Over time, the HODLers will win.”

At the time of publication, Ethereum was trading at $2,714.96, up 8.3%. Bitcoin (BTC) on the other hand was trading at $41,519.82, up 8.9%.