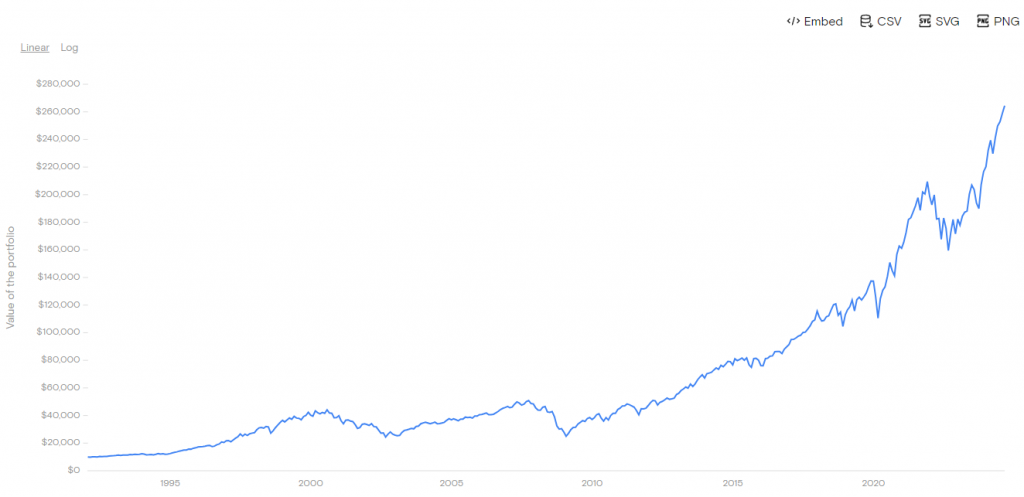

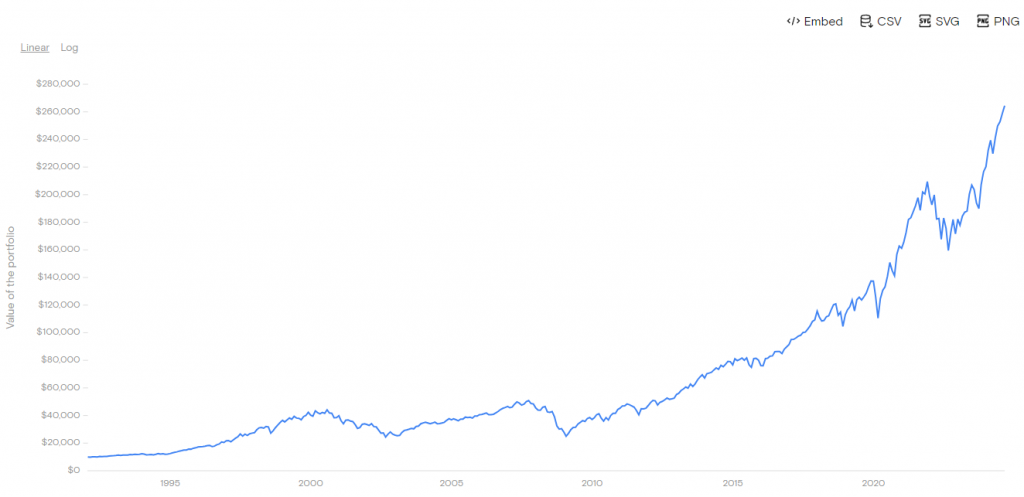

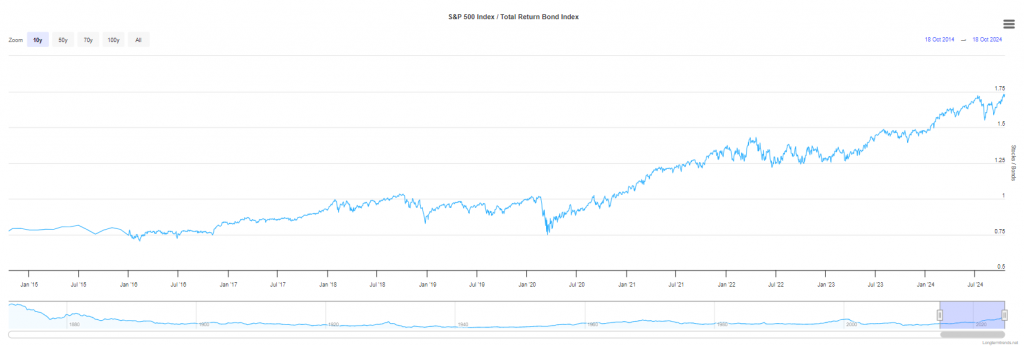

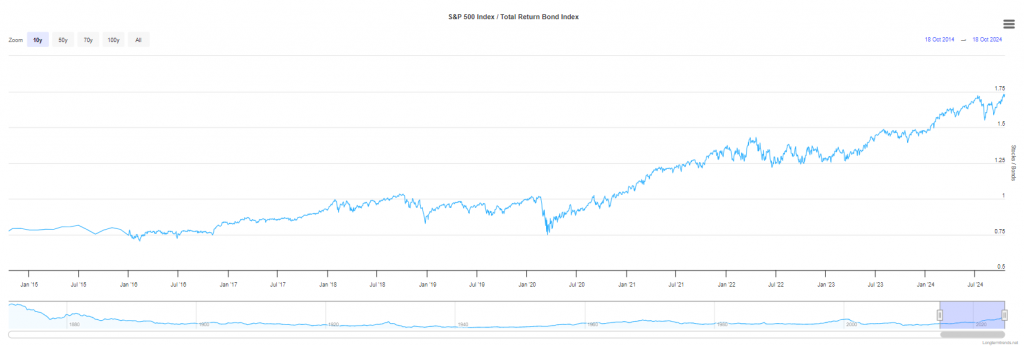

The US stock market faces major changes ahead. Goldman Sachs strategists have projected much lower returns for the next ten years. They expect returns to drop from 13% per year to just 3% through 2034, signaling the end of a remarkable period of market gains.

Also Read: Ripple: Will XRP Hit $1 If Donald Trump Wins The US Elections?

Goldman Strategists’ Prediction: What’s Next for the US Stock Market?

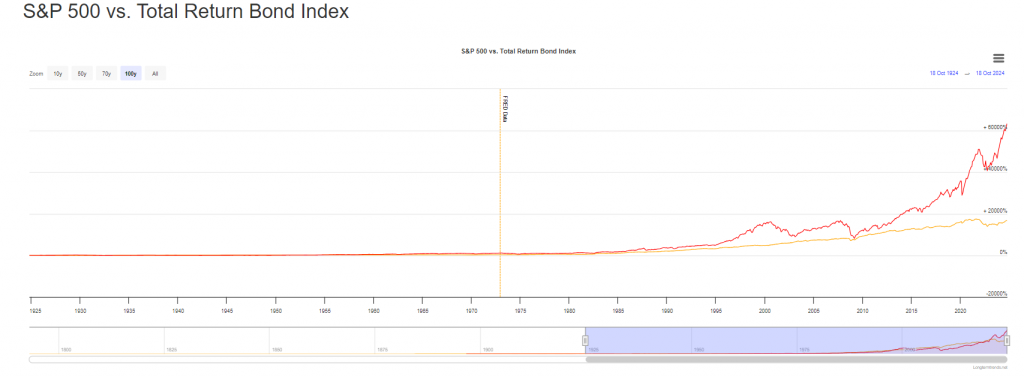

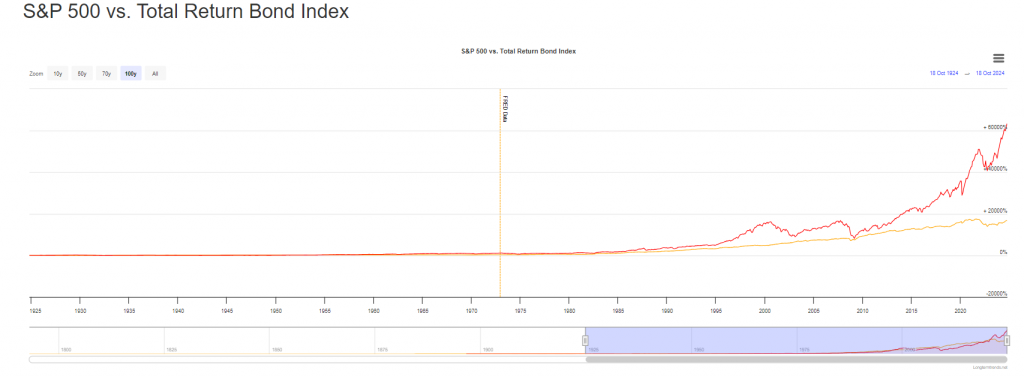

Bonds May Outperform Stocks

Goldman strategists see a 72% chance that US Treasury bonds will perform better than stocks until 2034. Their research team, led by David Kostin, warns of a possible 33% risk that stocks won’t keep up with inflation rates.

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team stated in their October 18 note.

Tech-Driven Rally Shows Signs of Change In The US Stock Market

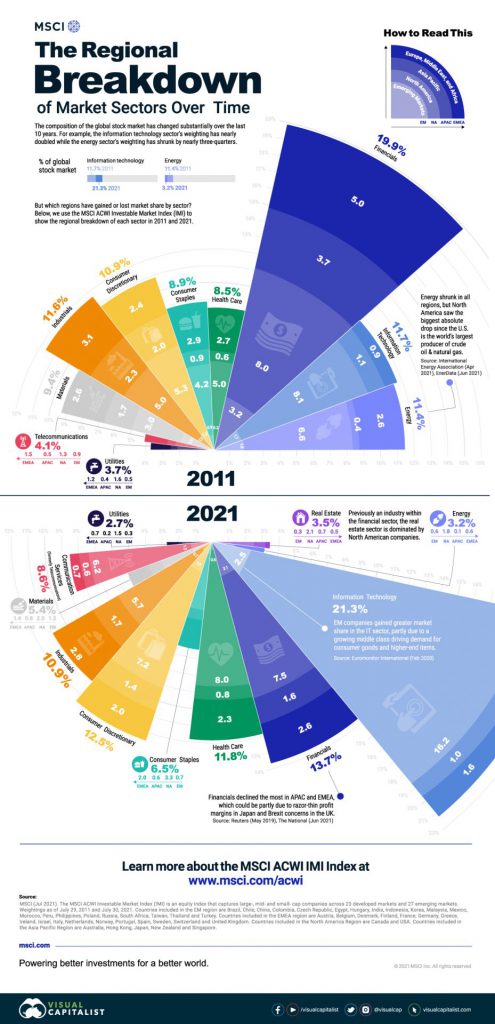

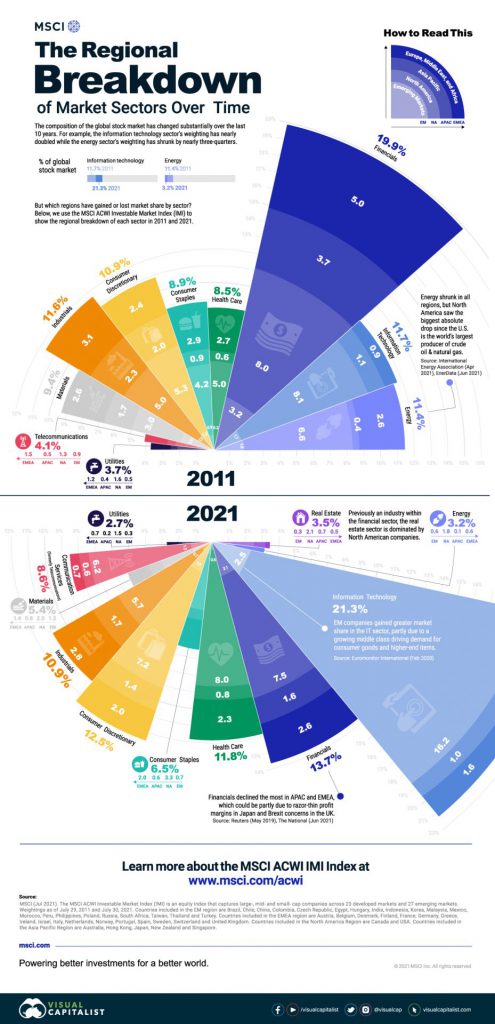

The US stock market saw 23% growth in 2024. Most of these gains came from large technology companies. Goldman strategists now predict this trend will change. They expect companies across all sectors to contribute more evenly to future returns. The equal-weighted S&P 500 might soon outperform the current market-cap weighted version.

Also Read: US Sanctions Fail: Russia’s 95% Trade Shift Explained

Corporate Performance – US Stock Market Takes Center Stage

Bloomberg Markets Live Pulse recently found that company earnings matter more than presidential elections or Federal Reserve decisions. The outlook remains modest. Even if big tech companies maintain their strong position, returns would reach only 7%. This falls well below the usual market performance.

Historical Context and Future Implications

The S&P 500 beat global markets in eight out of ten recent years. This winning streak looks set to end. Investors now need different strategies for the changing market environment.

Also Read: Bitcoin: This 2009 BTC Miner Made Over $80 Million

The drop from the long-term average of 11% to an expected 3% yearly return marks a significant shift in market gains. This change suggests investors should reconsider their approach to achieve their financial goals.