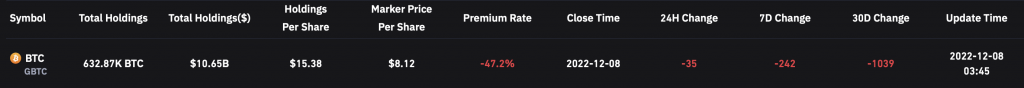

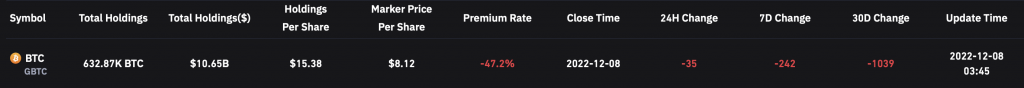

Grayscale Bitcoin Trust (GBTC) is trading at a record low of 47.2% below the BTC price on spot markets. GBTC is the largest institutional Bitcoin investment vehicle. The recent plummet is an addition to Grayscale’s already challenging economic scenario.

Previously, GBTC shares moved above BTC/USD, creating what was known as the “GBTC premium.” However, since 2021, that premium has decreased. Moreover, the ensuing “discount” has not riled institutional investors’ interest.

FTX caused liquidity issues in other parts of the DCG (Digital Currency Group) empire, raising questions about Grayscale and GBTC. Tensions increased last month when Grayscale refused to provide evidence of its Bitcoin holdings despite custodian Coinbase reiterating that its funds were secure.

Grayscale Investments is now being sued by Fir Tree Capital Management seeking information that could be used to compel changes to the way it manages its flagship Bitcoin Trust.

Is a falling GBTC bad for Bitcoin?

GBTC is in no way directly related to BTC. Willy Woo, a popular crypto proponent, contended that the impact of declining GBTC exposure was not detrimental to the stability of BTC’s price.

Woo recently held a poll on his Twitter page to find out why people were seeing GBTC. As per the results, most people wanted to buy spots to take custody (37.5%). This was followed by people who were bearish on the market, while the remainder needed the cash.

Woo noted that the GBTC/DGC/Genesis fears are a bearish cloud over the market. He added that selling GBTC does not impact the price of Bitcoin, but buying spot BTC does. Hence the fall of GBTC will not directly have an effect on the original crypto.

At press time, Bitcoin (BTC) was trading at $16,828.89, down by 0.5% in the last 24 hours. Moreover, the price of BTC has fallen by 75.6% from its all-time high of $69,044.77, attained in November 2021. Meanwhile, GBTC was trading at $8.11.