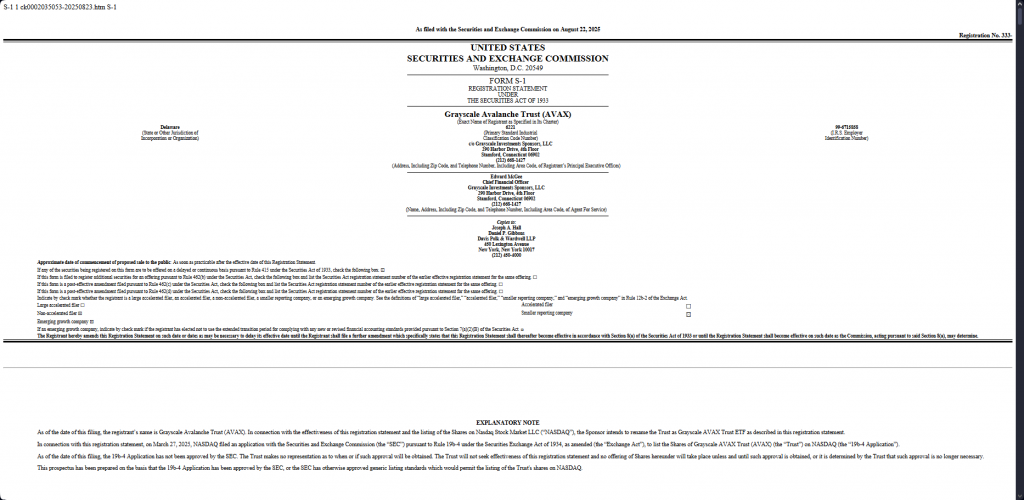

Grayscale’s Avalanche ETF has been officially filed with the Securities and Exchange Commission, marking a pivotal moment for Avalanche crypto investment opportunities. The digital asset manager submitted an S-1 registration statement for its Avalanche-focused exchange-traded fund, representing significant progress in the etf crypto market expansion. This SEC filing approval process demonstrates Grayscale’s ongoing grayscale crypto expansion strategy, potentially providing regulated access to AVAX tokens for institutional and retail investors.

JUST IN: Grayscale files S-1 for Avalanche $AVAX ETF.

— Watcher.Guru (@WatcherGuru) August 25, 2025

Grayscale’s Avalanche ETF Guides Investors Through SEC Filing, Crypto Expansion

According to PANews, Grayscale has submitted an S-1 filing for an Avalanche ETF with the U.S. Securities and Exchange Commission, as confirmed by the SEC’s official website. This strategic move represents another step in Grayscale’s efforts to expand its cryptocurrency investment space offerings.

Also Read: BlackRock, Grayscale, Fidelity Bought $500M ETH: What’s Going On?

Market Response to Grayscale Avalanche ETF Filing

The Grayscale Avalanche ETF submission also comes as AVAX trades at approximately $24.10, with the token maintaining its position among top cryptocurrencies by market capitalization. Current market data shows Avalanche’s market cap at over $10 billion, indicating substantial investor interest in this Avalanche crypto investment opportunity.

This regulatory development in the ETF crypto market reflects growing institutional acceptance of digital assets. The SEC filing approval process for the Avalanche ETF could also set precedent for future alternative cryptocurrency ETFs.

The Avalanche network’s focus on decentralized applications and smart contracts provides fundamental backing for this Avalanche crypto investment product. Grayscale’s experience managing cryptocurrency trusts also positions the firm favorably for navigating the regulatory approval process for this situation.

Also Read: SEC Pauses Grayscale ETF With BTC, ETH, XRP, SOL & ADA For Review

As part of broader grayscale crypto expansion efforts, this filing joins growing institutional demand for regulated cryptocurrency exposure through traditional investment vehicles.