As Bitcoin exchange-traded funds (ETFs) received regulatory approval in the US, one ETF provider sees doors opening for additional digital asset offerings. Valkyrie Investments CEO Steven McClurg recently shared positive outlooks for both Ethereum and XRP, landing SEC-sanctioned ETFs in the wake of a long-awaited Bitcoin fund green light.

McClurg contends that with Bitcoin potentially establishing a viable path forward, filings tracking other top crypto assets could soon follow. Valkyrie itself aims to be part of those future waves, tailoring products to match growing institutional investment demand.

Also read: Here’s How Much $1,000 Invested in Solana (SOL) 3 Years Ago Would be Worth Now

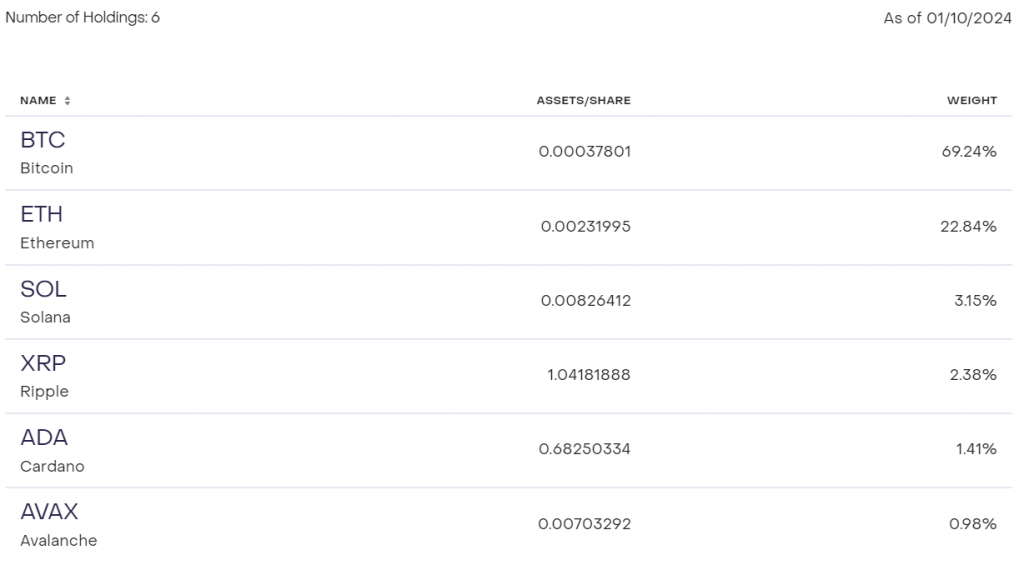

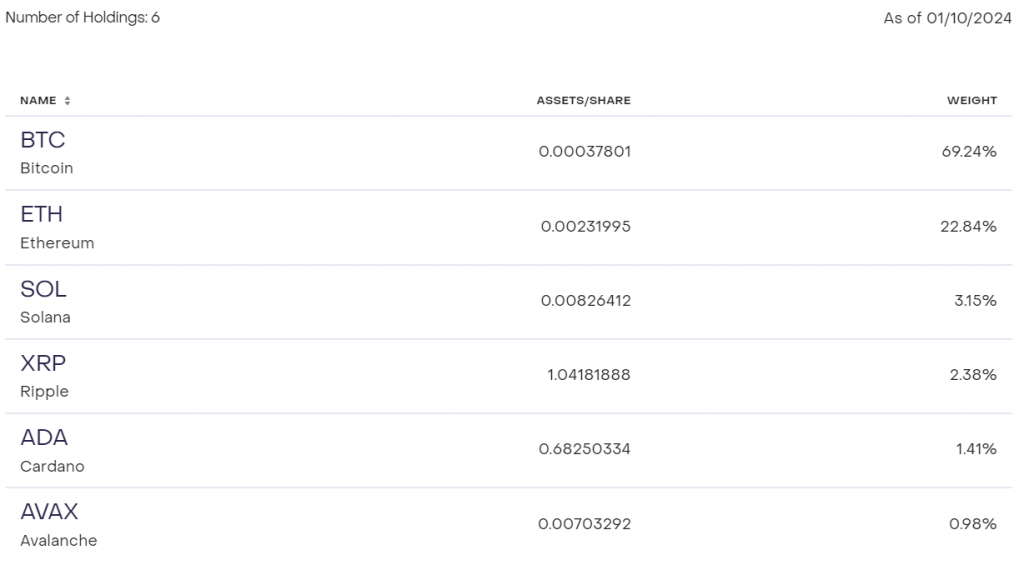

Grayscale adds XRP to crypto fund

In assessing XRP’s chances, McClurg pointed to recent progress around Ripple’s embattled native token. Grayscale’s surprising move last week to re-add XRP to its Digital Large Cap fund signals thawing sentiment toward the asset tied up in an SEC lawsuit.

McClurg believes this shift, along with advancing legal clarity and functionality for XRP, could incentivize ETF issuers to craft XRP investment vehicles. As for Valkyrie, he didn’t rule out getting involved under the right conditions.

Grayscale could launch a dedicated XRP Trust

The context around Grayscale’s change of stance is informative. After delisting XRP from its fund in early 2021, observers believe last week’s shock re-addition implies eventual plans for a standalone XRP investment trust.

Also read: Robinhood CEO Announces Plan to List Bitcoin ETF Soon.

Grayscale enjoyed massive success with its Bitcoin Trust product. If Grayscale seeks to replicate even a fraction of that phenomenon with a new XRP Trust, the creation of an SEC-approved XRP ETF likely won’t be far behind.

Of course, uncertainty still dominates the landscape for additional crypto ETFs. McClurg clarifies that Valkyrie sees beyond Bitcoin, with ambitions to satisfy investor appetites for products providing exposure to Ethereum, XRP, and other digital assets.

If the floodgates ever open, expect the ETF issuer landgrab across cryptocurrencies to be as intense as the ongoing competition to secure the first SEC Bitcoin ETF approval.