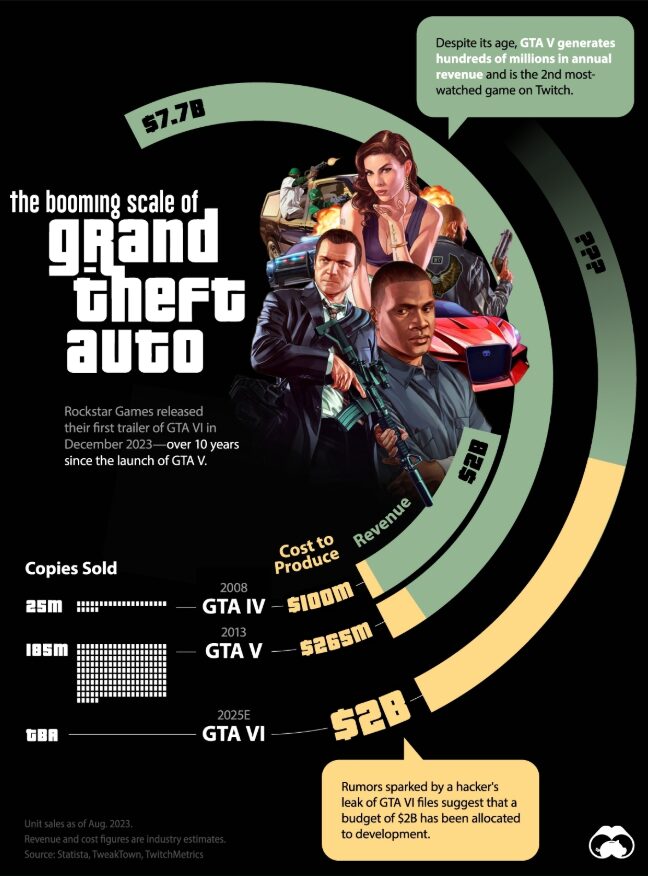

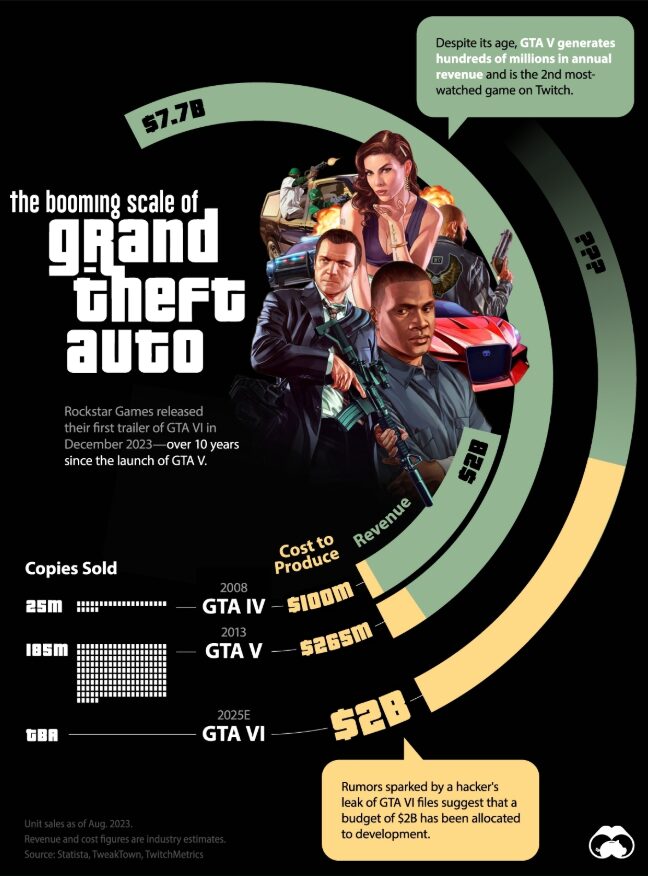

GTA 6 investment strategies have, at the time of writing, captured all the attention of gaming industry analysts as Rockstar Games prepares to launch what could be, and probably will be, the most expensive video game ever created. With GTA 5 revenue reaching an astonishing value of $7.7 billion from a $265 million investment, the upcoming Grand Theft Auto title faces the challenge of justifying its rumored $2 billion budget. The remarkable video game investment potential shown by this great franchise has, over the years, also transformed Rockstar Games into one of the industry’s most valuable studios in the world.

Also Read: Putin’s “Temporary Admin” Plan for Ukraine Could Shift Europe’s Oil and Gas Flow

Analyzing GTA 6’s Revenue Potential & Investment Strategy

The Evolution of GTA’s Budget and Revenue

The Grand Theft Auto franchise has, for many years now, seen its production budgets grow exponentially with each major release. GTA 4, released in 2008, cost $100 million to develop and generated approximately $2 billion in revenue through 25 million copies sold. This represented a five-fold return on investment, and that’s an impressive figure for any entertainment property, really.

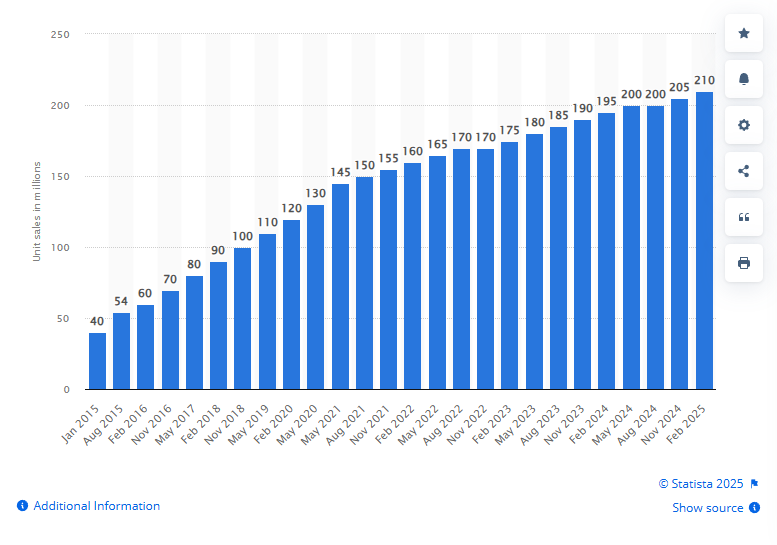

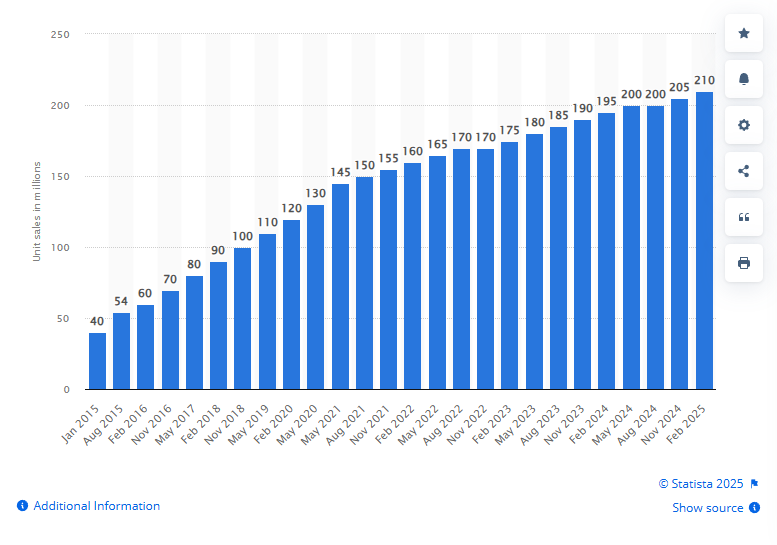

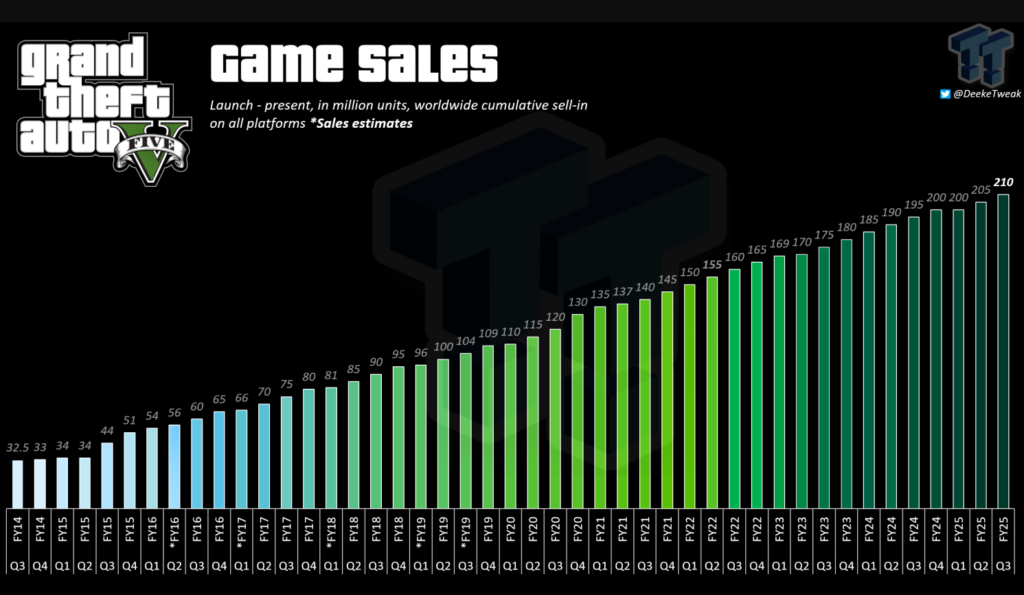

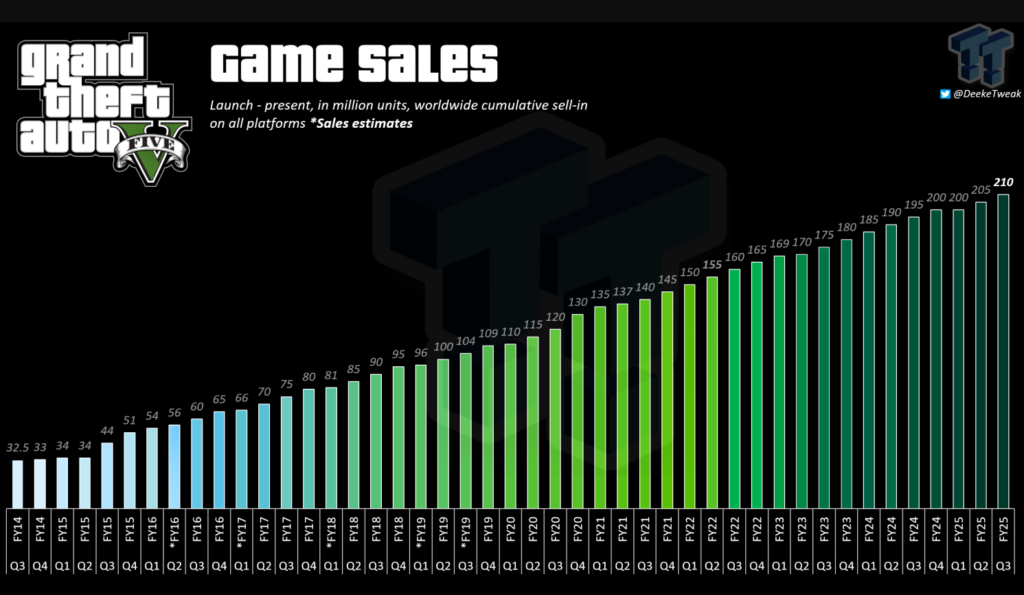

Five years later, GTA 5’s development costs more than doubled to $265 million. The results, however, have far exceeded expectations, to say the least. With 185 million copies sold and $7.7 billion in revenue generated as of 2023, GTA 5 achieved a staggering 29x return on investment, setting an almost impossible standard for its successor to match.

The $2 Billion Question

For GTA 6, Rockstar’s parent company Take-Two Interactive has reportedly, as of now, allocated a whopping budget of about $2 billion, which is almost eight times more than GTA 5’s entire set of development costs. This mind-blowing investment also includes marketing expenses and also the creation of a brand-new game engine to power the Miami-inspired “Vice City” open world.

Also Read: $10,000 In Dogecoin (DOGE) 10 Years Ago, Here Are Your Return

This enormous budget is viewed also by many analysts as a well-calculated risk based on GTA 5’s long-term performance. A substantial portion of GTA 5’s revenue has been generated through its online component, with subscription fees and in-game purchases accounting for, at present, 78% of Take-Two Interactive’s 2023 revenue.

Subscription Model and Long-Term Revenue

GTA 6’s investment strategy focuses on replicating and expanding the subscription-based revenue model that has sustained GTA 5 for over a decade now. Industry experts also believe that with its massive budget, GTA 6 could potentially, in the long run, generate even more long-term revenue than its predecessor.

“GTA 5 continues to generate hundreds of millions in annual revenue despite being over 10 years old,” notes the data from Statista and TweakTown. This ongoing revenue stream has been cited as key justification for the unprecedented development budget allocated to GTA 6 at this point.

Comparing to Industry Standards

The $2 billion investment in GTA 6 significantly exceeds industry norms, as we can see from available data. For comparison, Rockstar’s own Red Dead Redemption 2 and Cloud Imperium’s Star Citizen – previously considered among the most expensive games ever produced – each had reported budgets of around $500 million.

Also Read: Top 3 Cryptocurrencies To Watch This Weekend

Market Confidence

Despite the enormous financial commitment, market confidence in the GTA 6 investment appears strong right now. Take-Two Interactive’s shares rose more than 50% in 2023, suggesting investor optimism about the potential returns from what will likely become gaming’s most expensive production to date.

To achieve the same 29x ROI as GTA 5, GTA 6 would need to generate an almost unfathomable $58 billion in revenue. While this figure seems unlikely, and maybe even impossible, the gaming industry’s continued growth and the franchise’s proven ability to capture audience attention for extended periods suggest that GTA 6’s massive investment may ultimately be justified by its long-term revenue potential, all things considered.

Also Read: South Carolina’s Bold Move: Proposes 1M BTC State Reserve