The state of the US Dollar Index has been withering since May. After peaking at 104.5 on 12 May, the index defied its multi-week uptrend and started dipping lower. By the end of May, it was down to almost 101, and as illustrated below, the said correction has been the steepest in over 6 months.

As the downtrend continued over the past week, the SPX pulled off a three-day rally on 25, 26, and 27 May. Right after, when the equity markets shut down during the weekend, the baton was passed down to the crypto market’s leader, Bitcoin. Resultantly, BTC rallied during the weekend and stepped into the fresh week too on a positive note.

Eliminating the odds of the aforesaid events merely being some random coincidence, it wouldn’t be wrong to assume that investors—out of precaution—started diverting their capital towards safe-haven asset classes gradually.

Well, equity already has the haven tag attached to it. During past turbulent phases, investors have parked their funds under its roof, so the said behavioral pattern adds credence to the afore-stated assumption.

Alongside, it shouldn’t be forgotten that Bitcoin’s accumulation trend is in play, which means that market participants have been amassing the king crypto at this stage, and perhaps, the OG crypto asset has already been placed as a trustable investment option among other traditional asset classes.

So what’s next – A happily ever after?

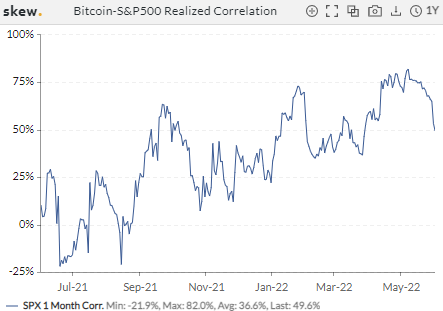

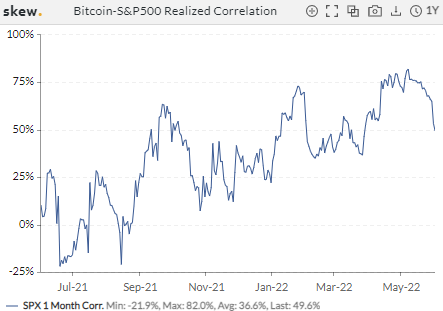

Well, as highlighted above, the recent rallies of Bitcoin and the SPX did not necessarily coincide with each other, and as a result, the break-up or decoupling narrative ended up getting stronger. In fact, per the latest data from Skew, the realized correlation between the S&P 500 and Bitcoin noted a free fall from 82% to 49.6% over the past month, justifying the same.

So, what does this mean? The positive/negative investment in one market wouldn’t rub off on the other henceforth? Likely not.

Take yesterday and today’s case itself, for instance. On Wednesday, the SPX closed on a red note after noting highs and lows of 4166.5 and 4073.8. Bitcoin, on the other hand, lost more than 5% of its value in the 24-hour timeframe and was trading sub $30k at press time, highlighting that the markets are still moving in tandem, despite the dip in correlation.

Now, as far as ‘who would likely follow who going forward’ is concerned, it looks like Bitcoin possesses the key at the moment. As can be noted below, the BTC-S&P 500 realized volatility has noted a substantial incline from 19.5% to 49.2% since the beginning of May. This means that the volatility in the Bitcoin market has shot up extensively when compared to that of the SPX and the king crypto asset is still in a position to continue dictating the broader directional bias.

Again, at the end of the day, investor psychology is what makes or breaks trends in the market. So, they’re [investors] the ones who possess the keys to both, bullish and bearish, locks. Based on how they are triggered by other macro-economic factors, the price pendulum would swing accordingly. Until then one thing is clear – the magnitude of BTC’s pumps/dunks is set to be more than that of what would be noted in the equity market.