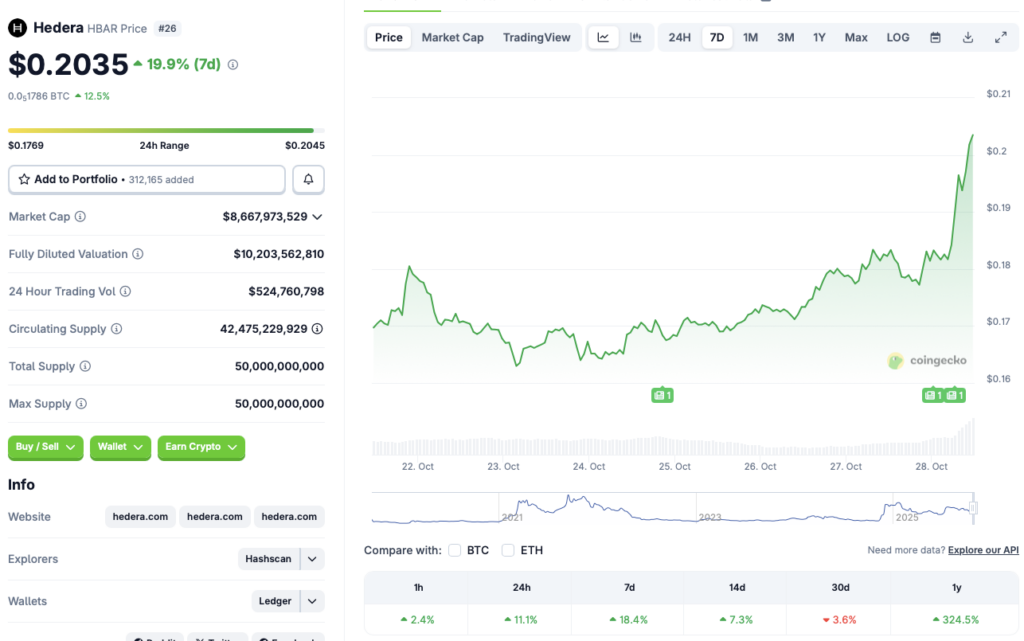

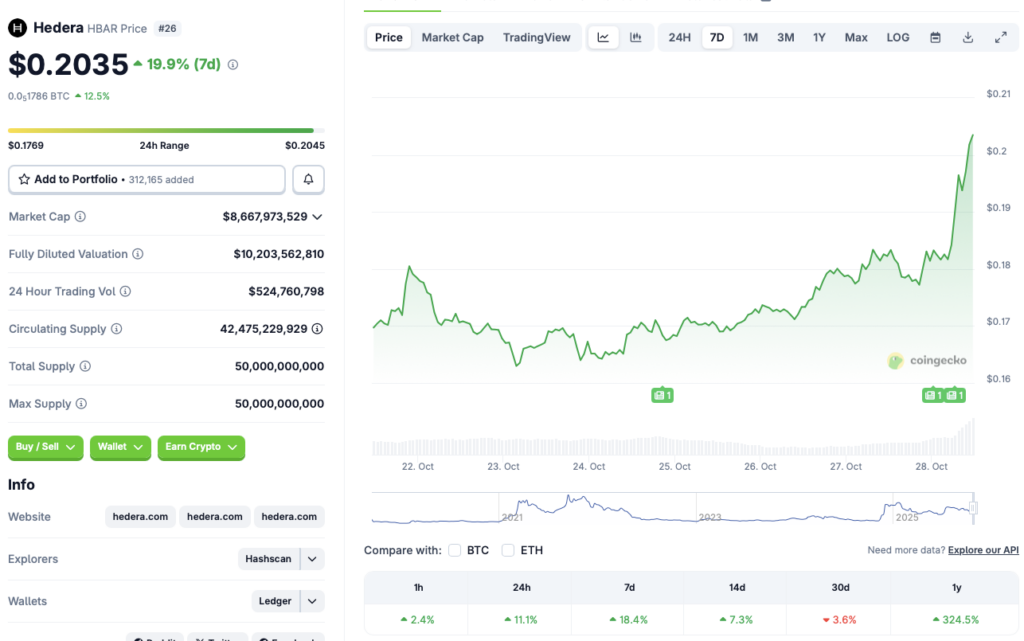

While the larger crypto market is facing a correction, Hedera (HBAR) is experiencing a breakout rally, following an ETF launch confirmation. According to CoinGecko data, HBAR has rallied 11.1% in the last 24 hours, 18.4% in the last week, 7.3% in the 14-day charts, and 324.5% since October 2024. Despite the massive upswing, HBAR is still down by 3.6% over the previous month. HBAR’s rally goes against the market-wide pattern. Bitcoin (BTC) has fallen 1.7% in the last 24 hours to the $113,000 price level. Let’s discuss why HBAR is rallying and if it will continue.

Will Hedera’s ETF Launch Sustain its Rally? Will We Face a Correction?

The latest rally comes after Bloomberg ETF analyst Eric Balchunas took to X and confirmed that Canary’s Hedera ETF will make its debut today, Oct. 28. 2025. The rally could have been triggered by investors anticipating a surge in institutional inflows after the ETF launch.

While Hedera’s (HBAR) rally is commendable, it is unclear if it can sustain itself. The larger crypto market is facing a correction, and the market is still plagued by heavy volatility. There is a possibility that HBAR will face a price dip over the coming days.

Also Read: Solana and Litecoin ETFs Launching Tuesday: Bloomberg Analyst

CoinCodex analysts present quite a bullish outlook for Hedera (HBAR). The platform anticipates the asset to continue surging over the coming weeks, hitting $0.36 on Dec. 12 of this year. Hitting $0.36 from current price levels will translate to a rally of about 80%.

Given the bearish market environment, it is unclear if Hedera (HBAR) will be able to sustain its rally. HBAR could see increased ETF inflows over the coming days. Such a development could greatly help sustain its rally. However, the chances of a correction are also very high. Trade tensions and macroeconomic uncertainties still hold the strings to the crypto market.