Ethereum is inching towards a transition to a proof-of-stake network and increased participation among validators indicates that many are eagerly awaiting the upgrade.

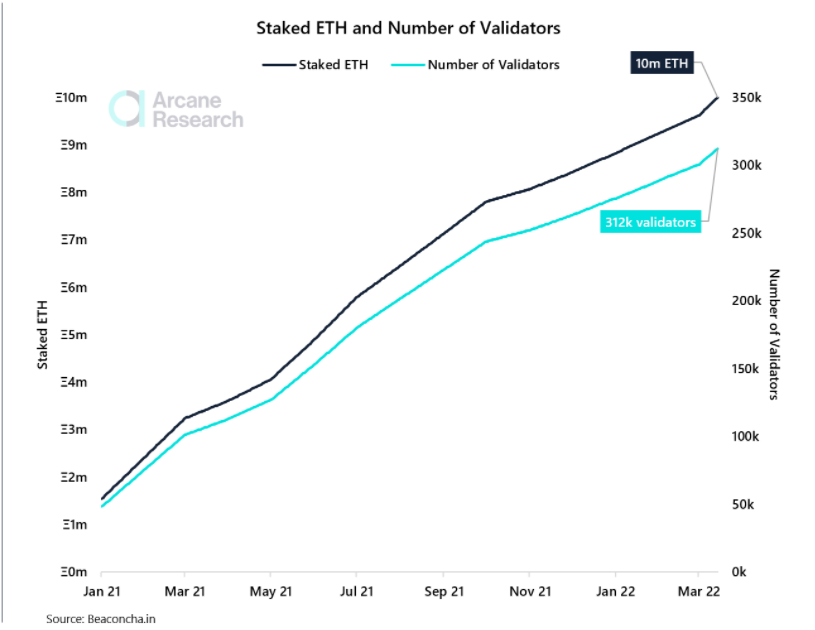

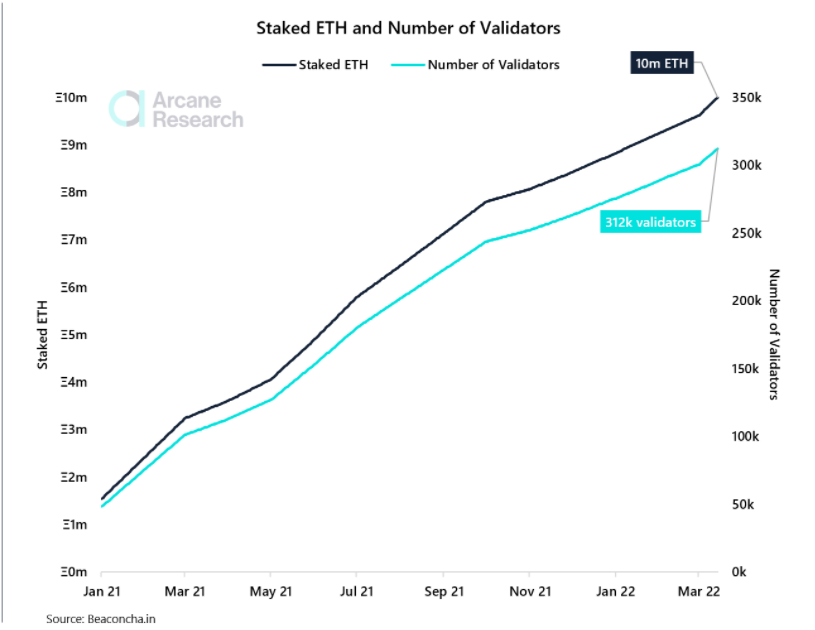

The number of validators and the amount of staked Ether have consistently risen since late January – a report by blockchain aggregator Arcane Research showed. As of 16 March, a total of 312K validators have staked over 10 Million Ether on the Beacon chain, which represents a mammoth 8.3% of Ethereum’s circulating supply.

The data goes to show confidence in ETH’s long-term success is high even though uncertainties remain with respect to the crypto market’s near-term health. Ethereum’s current year-to-date ROI sits at a negative 28.7% as per Messari.

A quick recap

To solve the nitty-gritty of high gas fees, scalability issues, and low transactions speeds, Ethereum proposed ”Ethereum 2.0″ – a sequential upgrade to the network. The end of the ‘merge’ phase would completely unite Ethereum’s old proof-of-work blockchain with the new proof-of-stake blockchain, called the ‘consensus layer’. The consensus layer holds the Ethereum 2.0 deposit contract, on which validators stake their ETH tokens. Earlier this week, Ethereum merged on Kiln testnet, which is expected to be the final merge testnet before existing public testnets are upgraded.

Supply Crunch?

Arcane Research’s report highlighted that $25.8 Billion of Ether tokens were locked in the ETH 2.0 contract, essentially decreasing Ethereum’s circulating supply by 8.3%. Most analysts expect that ETH supply could further decrease once the update is live, fueling more demand over the long run.

At the time of writing, ETH was reaping the benefits of a broader market recovery. Its price was changing hands at $2,681, up by 5.5% over the last 24 hours.