Understanding the rapidly changing landscape of crypto mining is crucial as the crypto asset class evolves. Mining is also a lucrative business: total Bitcoin (BTC) miner revenue in 2021 was $17 billion, while Ethereum (ETH) miners earned a little over $18 billion.

The year 2021 marked a watershed moment in the industry. North American miners emerged as the new worldwide industry leaders following China’s abrupt restriction on crypto in spring 2021.

As per the data on Coin Metrics’ latest State of the Network issue, 2022 is shaping up to be another significant year in the space.

Hash Rate & Mining Difficulty of ETH and BTC

The hash rate is an assumed statistic based on the rate at which new blocks are added to the chain. It’s one of the most studied metrics when it comes to crypto mining.

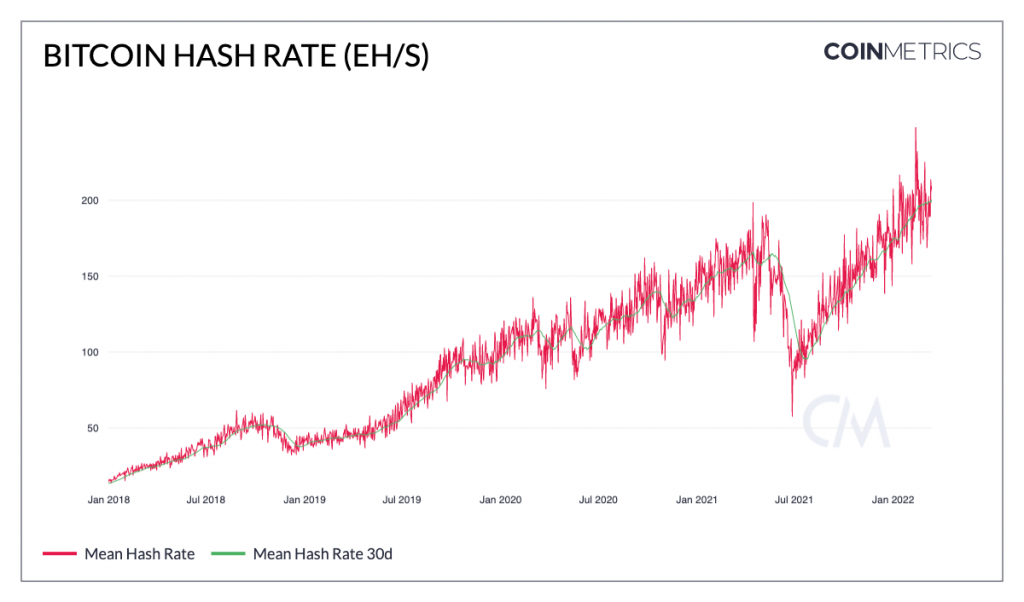

Bitcoin’s hash rate reached an all-time high of about 200 EH/s on March 29th, when calculated on a 30-day moving average, after plunging over 50% in the spring of 2021 during the exodus of China-based miners.

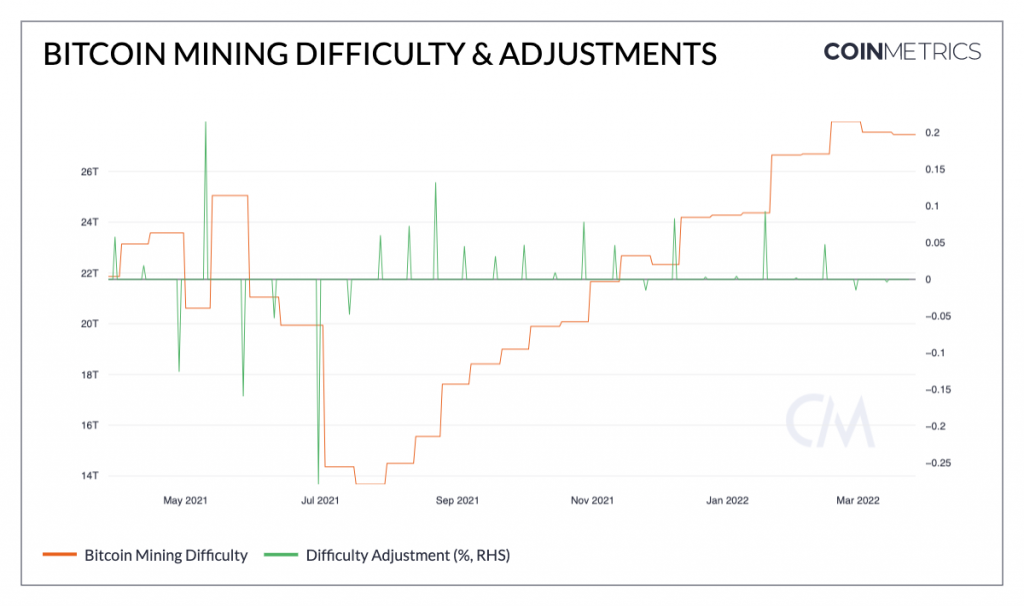

Another crucial indicator to keep an eye on is the difficulty of mining bitcoins. The difficulty is a network-controlled metric that adjusts every 2 weeks (2,016 Bitcoin blocks) to maintain a 10-minute block interval. In July 2021, mining difficulty dropped by 26%, the greatest in the network’s history. As a result of the improved hash rate, most difficulty modifications have been beneficial.

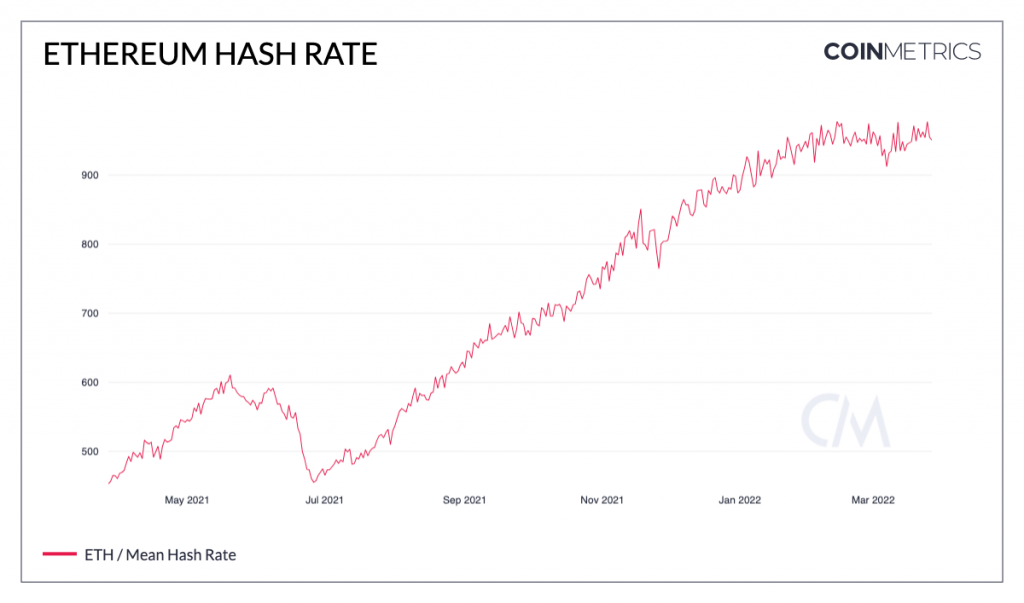

Apart from Bitcoin (BTC), the hash rate of Ethereum has also increased in 2022. Although recent growth has slowed, the network’s hash rate is on the verge of surpassing 1,000 TH/s for the first time.

Miner revenue

Bitcoin miners have made over $3 billion in income so far in 2022, with block rewards accounting for the great majority of it.

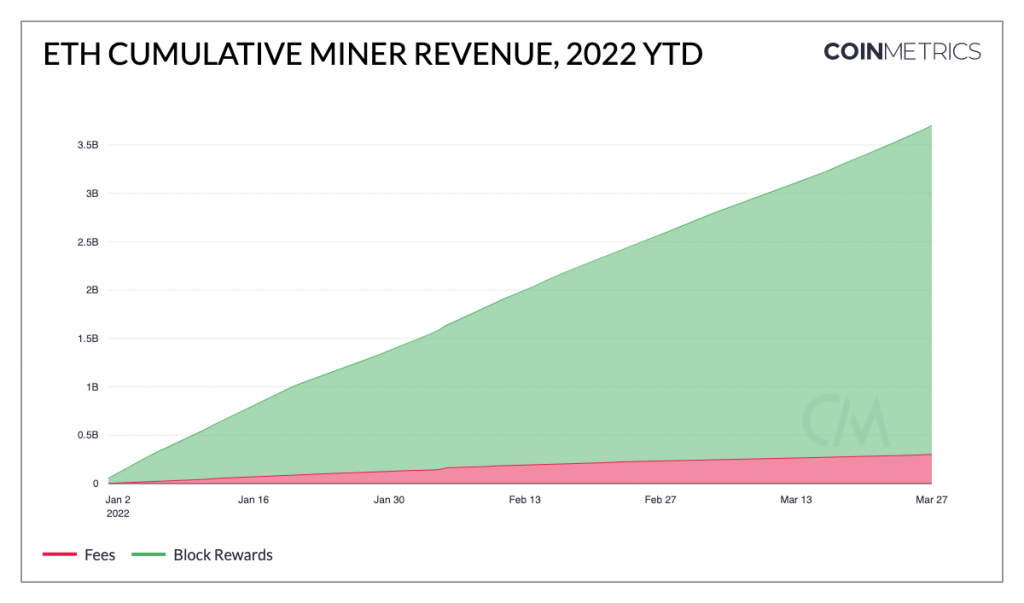

In the meantime, Ethereum miners have amassed about $3.7 billion in revenue over the last 12 months, averaging over $1 billion per month. Miner tips (priority fees) have so far accounted for $300 million, or around 8% of Ethereum miner earnings in 2022. However, this is slightly lower than Q4 2021, where 10% of the miner’s revenue accounted for the fees.

Ethereum miners have collected an additional $90 million in MEV incentives.

Hashprice & Hashvalue

Bitcoin’s goal block interval of 10 minutes is maintained in part because of difficulty modifications. However, they have a significant impact on the mining industry’s profitability. However, regardless of how cost-effective a miner’s operation is, all participants are reimbursed equally for their incremental hashrate contribution.

Bitcoin-denominated daily revenue per TH/s (“Hash value”) and USD-denominated daily revenue per TH/s (“Hash price”) are the most frequent measures for determining a miner’s bottom line.

Bitcoin-denominated revenue is a considerably more predictable measure due to price volatility.

While there is an obvious link between difficulty adjustments and Bitcoin-denominated earnings, USD-denominated revenues have a much more unpredictable input variable: Bitcoin price.

Only a year ago, the mining landscape was drastically different. New opportunities have emerged as tectonic movements in the geographic distribution of Bitcoin mining. The depth of U.S. capital markets is being tapped by the increasingly institutional and mature mining industry, while synergies between existing energy infrastructure and Bitcoin mining are beginning to emerge. With these new improvements in place, mining in 2022 is set to be another fascinating year.