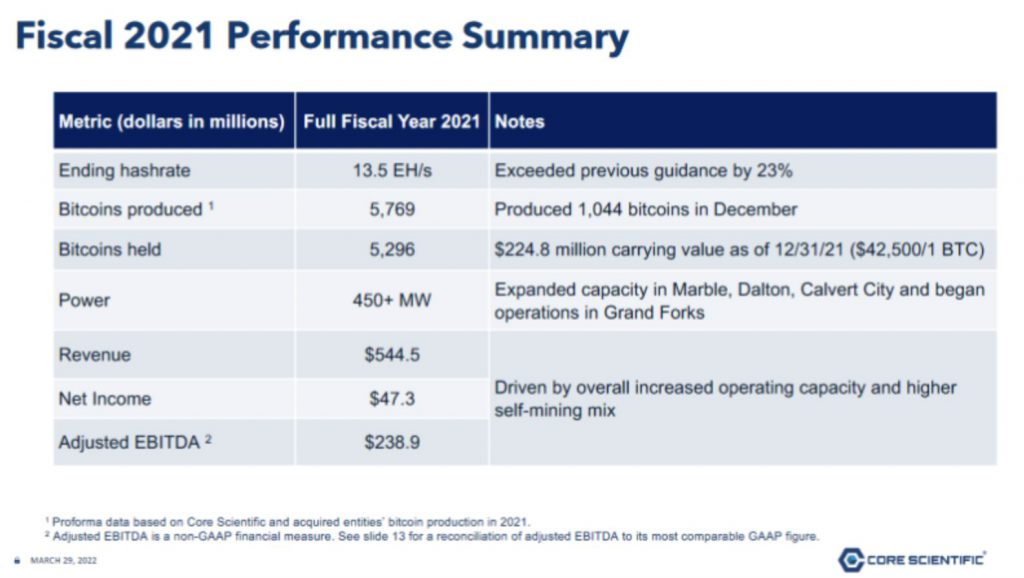

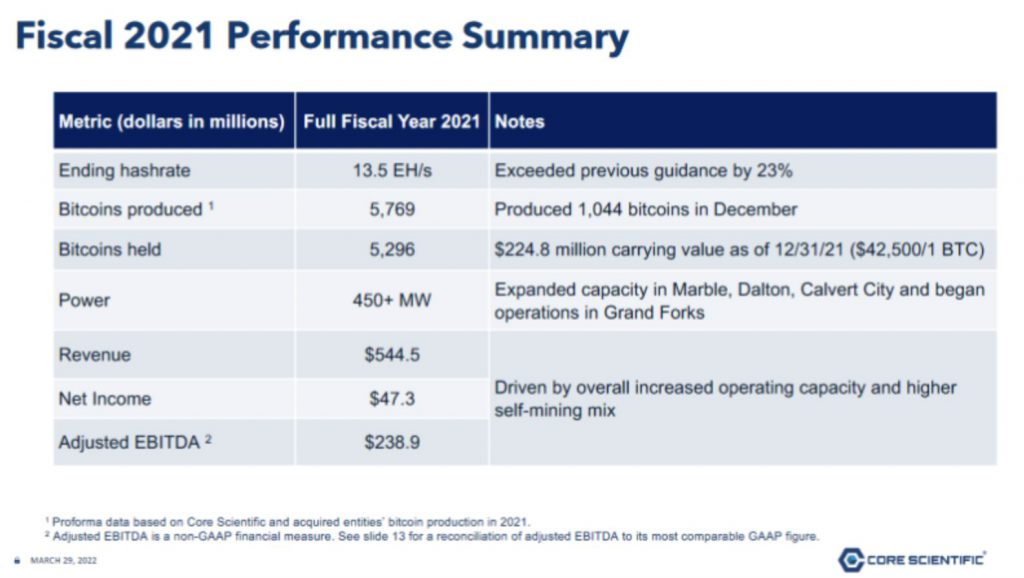

Core Scientific, a Bitcoin mining company based in the United States, has reported strong fiscal year 2021 results, with revenue up 803 % to $544.5 million and gross profit up 2,443 % to $238.9 million.

The figures, which were released on March 29 and indicate a total net income of $47.3 million (take-home pay after expenses) for the previous year. The amount is a significant rise above the net loss of $12.2 million in 2020.

The top Bitcoin (BTC) miner attributed the increased performance to an increase in hash rate, mining equipment sales, hosting revenue, and digital asset mining income. The soaring price of Bitcoin (BTC) undoubtedly helped as well.

Core Scientific founder Darin Feinstein slammed Greenpeace and Ripple chairman Chris Larsen after the two teamed together last week to start the “change the code, not the climate” campaign, following the company’s outstanding 2021 findings. The movement intends to transform Bitcoin into a more ecologically friendly consensus architecture, such as Proof of Stake. Greenpeace, according to Feinstein, has sold out Bitcoiners.

Bitcoin mining companies’ stocks to the moon?

On Monday, the value of Bitcoin mining-related equities increased as the price of Bitcoin rallied. At 3:30 p.m. ET, Bitcoin had gained 7.3 % in the previous 24 hours and 17.4 % in the previous week.

Riot Blockchain (RIOT) shares have risen as much as 15% as a result of this. Hut 8 Mining (HUT), a competitor, went up as high as %. And Canaan (CAN) was up 11.7% at its all-time high.

Miners will certainly make more money as the price of Bitcoin grows, as their operating costs will not climb, but their revenues will. This is similar to a physical materials miner’s commodity rising in value.

A general surge in bullishness for cryptocurrencies drove the move across the cryptocurrency market, rather than any one piece of news. According to sources, the United Kingdom is about to reveal cryptocurrency legislation, which is believed to be pro-crypto. If that’s the case, it’ll be beneficial for crypto prices and digital assets, building on the White House’s positive executive order from earlier this month.

At the time of publication, Bitcoin (BTC) was trading at $47,383.91.