Bitcoin has been subject to much speculation in 2022, with many experts suggesting that the Ukraine-Russia crisis would dampen risk-apatite and restrict a BTC recovery. However, the king coin has risen past common consensus, overtaking key levels in March. The price was now tackling the daily 200-SMA (green) for the first since December 2021 but Bitcoin’s supply data suggested a period of stability before any further advancements in price.

Tremors of Russia’s invasion of Ukraine can be felt on global stock and forex markets even today, but Bitcoin has rebelled against the macro trend. Since the war broke out, Bitcoin’s price has climbed past important levels at $38K, $42K, and $45. Its monthly ROI is up by 25% and its year-to-date performance flipped positive just as the price inched towards $48K.

Bitcoin – What’s Next?

As per the chart, the next major technical targets lay at $50K and $52K. However, Bitcoin had to get past a prickly obstacle to advance further – the daily 200-SMA (green).

BTC has yet to flip its long-term moving average to bullish thus far in 2022. The 200-SMA, which covers price movement of roughly 40 weeks, is widely used to determine the overall market trend. As a general rule of thumb, the price is considered bullish when an asset trades above the 200-SMA and bearish if it trades below it. With BTC on the verge of a key breakout, supply data showed that although a breakout was incoming, investors might have to wait before $50K is realized.

A Glassnode chart showed that the percentage of Bitcoin supply that hadn’t moved in a year was close to record levels, indicating that investors were holding BTC rather than selling them on exchanges. Notably, similar levels were observed in September 2020, after which Bitcoin climbed by 50% the following month.

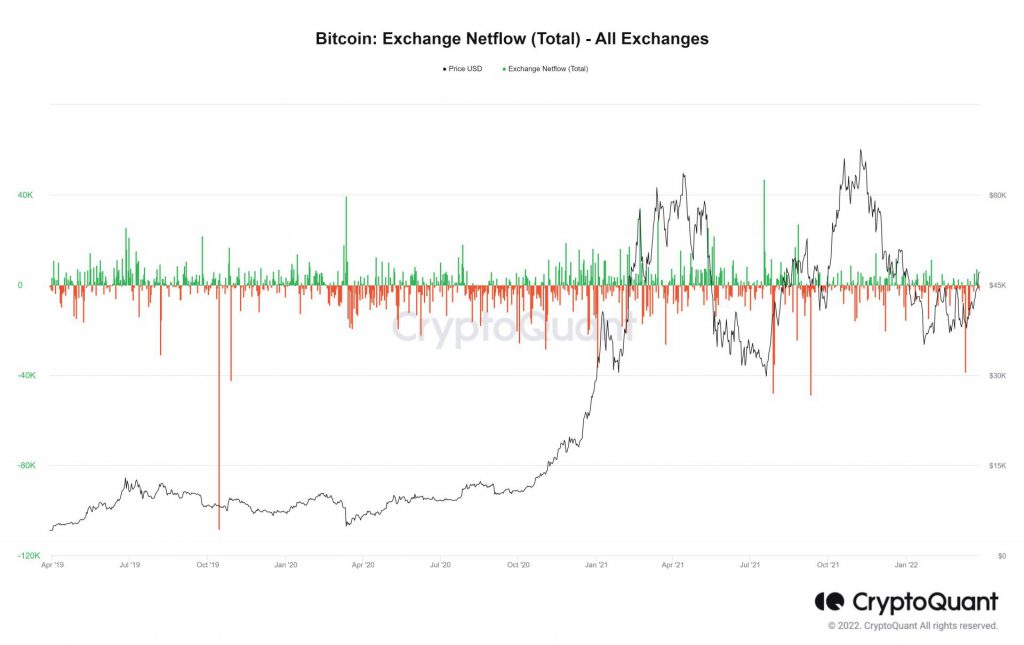

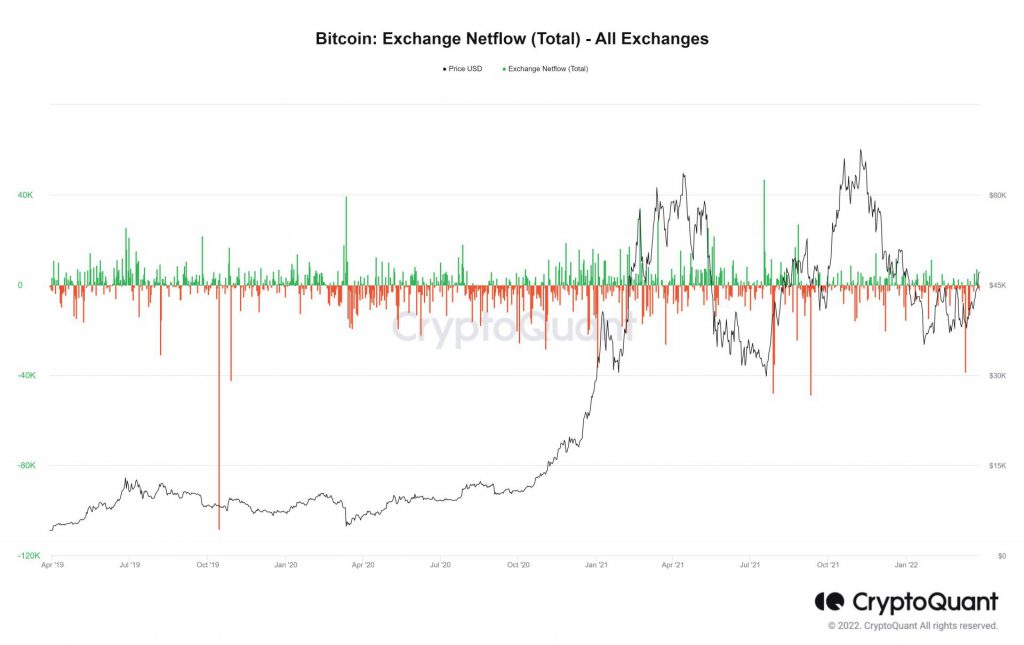

Furthermore, Bitcoin’s exchange NetFlow of -2.8 suggested that investors were buying BTC from exchanges just as BTC closed in on $48K. On the flip side, volatility was low. This meant that the current reading would not be able to dictate BTC’s near-term movement as strongly as before.

Conclusion

Considering the overhead 200-SMA, resistance at $48K, and a low exchange NetFlow volatility, Bitcoin’s price could settle around the $47-$48K price mark over the next few days. Once selling pressure is overcome, Bitcoin’s price can be expected to make headway toward the $50K mark. However, a failed breakout above the 200-SMA (green) would invalidate the bullish outcome and in such a case, caution must be maintained.