Over the weekend, crypto price movements lacked vitality. Most top coins from the space moved horizontally on their price charts. However, during the last few hours of Sunday, things changed. Bitcoin’s price climbed above $47k. In fact, in the day’s trade, it went on to cling to a level as high as $47,650.

The broader market acknowledged Bitcoin’s surge by reacting similarly. As a result, the cumulative worth of all the assets in the crypto market notched up by 5.48% over the past day, bringing their valuation to $2.11 trillion.

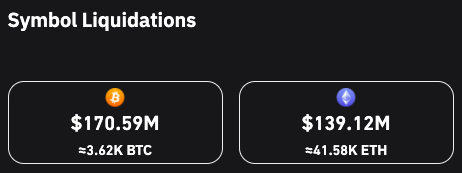

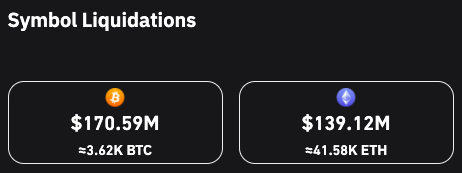

As the bearish sentiment was shrugged off within the snap of a finger, the liquidation numbers started ballooning up. Over the past 24-hours, over 78,818 traders were ‘rekt’ with the total crypto liquidations tallying up to $433 million.

BTC and ETH’s numbers together accounted for approximately 2/3rd of the said liquidations. Per data from Coinglass, close to $171 million worth of BTC and $139 million worth of ETH positions had forcefully been closed over the past day.

Greed continues to prevail in the Bitcoin, Ethereum market

Despite the liquidations, traders continued to indulge in high leverage trades. At the time of press, it was noted that Ethereum’s Estimated Leverage Ratio [ELR] was at an all-time high of 0.1811.

Even Bitcoin’s ELR readings, for that matter, hardly depicted any deviation from its all-time high number registered on Friday. High leverage, undoubtedly, multiplies the potential earnings, but at the same time also opens the risk door.

The current BTC and ETH readings on this front indicate that traders in the market are currently blinded by their chance to fetch more returns and are willingly putting their capital on the line.

The same was advocated by Bitcoin and Ethereum’s F&G index readings. This metric’s needles for both the assets were more inclined towards greed than fear.

Thus, with the rising greed, if the volatility in the market rises, we’d get to witness more price swings going forward. Goes without saying, when that happens, the liquidation numbers would inflate even more. On the other hand, if things stabilize over the next few hours, the said numbers would automatically come under control.