Non-fungible tokens have become synonymous with Ethereum, which hosts the largest marketplace for NFTs, OpenSea. However, the gas fees at OpenSea are extremely dynamic due to a variety of reasons and it’s not uncommon for users to pay excessively high amounts to trade NFTs on the platform. If you’re an NFT enthusiast who is tired of paying extra fees on the platform, these pointers might help you save some money. Here’s a guide on how to avoid paying high gas fees on OpenSea.

Ethereum gas is the cost or ‘fees’ paid to miners for verifying transactions on the blockchain. The total gas fees are calculated by multiplying the Gas Unit(limits) and the (Base Fee+ Tip). The gas unit is the total amount of gas one is willing to pay for in a transaction, while the base fee is the minimum quantity of gas to record transactions. ‘Tips’ are the priority fees paid to fasten a transaction, which is set automatically by hot wallets.

If one transacts on OpenSea using the Ethereum blockchain, the process is similar. Buyers pay gas fees while purchasing fixed price items while sellers pay the gas when accepting offers. However, just like the prices of altcoins, the gas price also varies depending on the laws of supply and demand, and identifying them can help one time their purchases accordingly.

How to avoid high gas fees on OpenSea

Look at Ethereum’s network activity

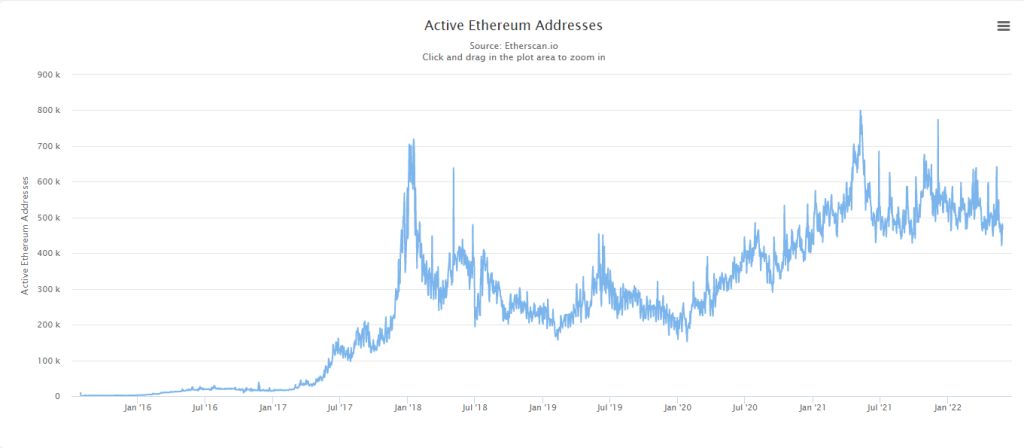

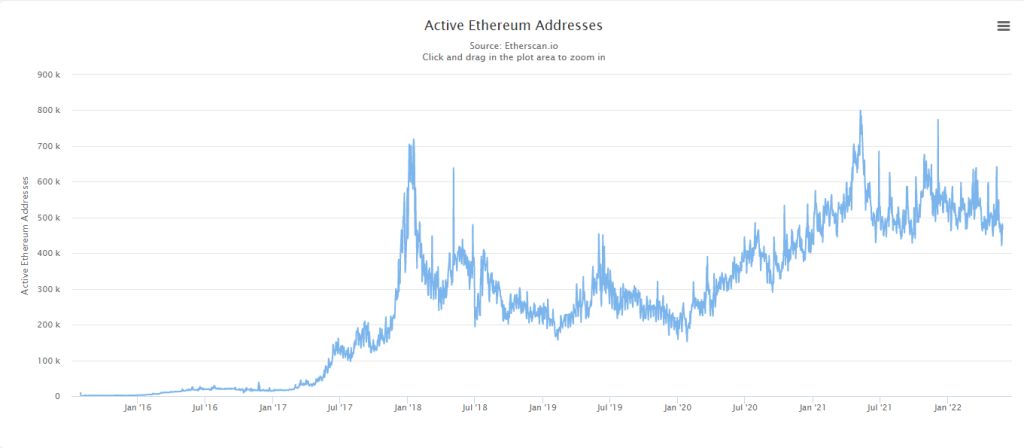

OpenSea gas fees are primarily related to the base gas fee on Ethereum, which is dependent on several network and price-related factors. One reason why ETH’s base fee increases is because of the number of users transacting on the network, which can spike to half a million transactions on some days.

Thus, users can identify periods when ETH’s network activity is relatively low and time them with their NFT transactions. Users can look at metrics such as daily active addresses, which measure the number of users actively transferring tokens on the network. While there isn’t always a direct correlation between the two, users would likely have to pay lesser gas fees during periods of low network growth.

Identify when gas fees are lowest in a week

If your goal is to limit the gas fees as much as possible, you should look at transacting on OpenSea when fewer users are operating on the platform. The busiest and most expensive times are on weekdays from 8 AM to 1 PM (EST) since users from Europe and the U.S. are in full flow during this period. In particular, Tuesdays and Thursdays are when the markets are the busiest.

Hence, an ideal time to make OpenSea transactions are on Saturdays and Sundays from 2 AM to 3 AM (EST)—that’s when ETH gas prices are at their lowest.

Use software tools

Several free-to-use software can tell one to identify whether the gas prices are high or low before a transaction is made. For instance, ethereumprice.org/gas tracks gas prices every day in a given week. The tool will help, you will tell the best time to transact on the blockchain and even avoid congestion, known for high transaction fees.

Avoid failed transactions

Notably, OpenSea transactions utilize gas fees whether the transactions are successful or not. The default gas limit settings for transactions are automatically calculated on crypto wallets and altering these settings may increase the chances of a failed transaction. Hence, users should avoid setting an extremely low gas limit and adhere to the predefined limit set on their wallets.

Use layer 2 solutions/alternative blockchain

Ethereum Layer 2 solutions, such as Immutable X and Loopring, reduce the number of gas units needed for a transaction since these solutions only work with the base blockchain during the validation process. Users can transact on OpenSea using these scaling solutions rather than limit the overall gas fees paid during transactions.

If this doesn’t solve the issue, one can consider using a separate blockchain altogether. Those disgruntled with high fees are turning their heads towards Polygon, which boasts lower gas fees compared to Ethereum.