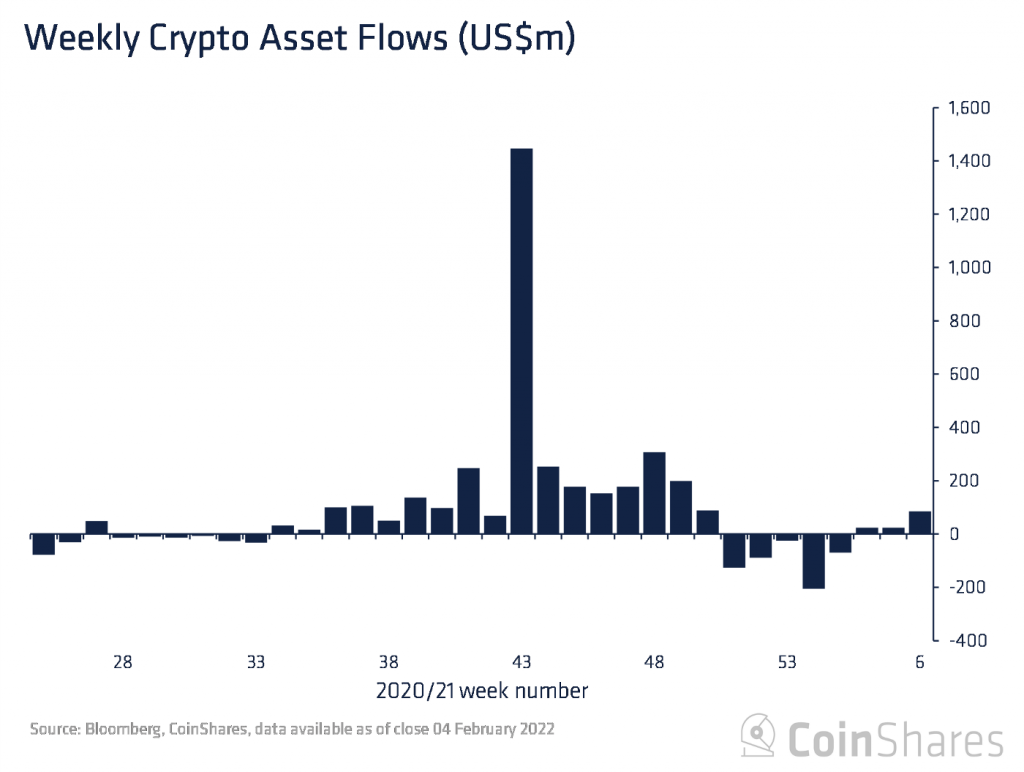

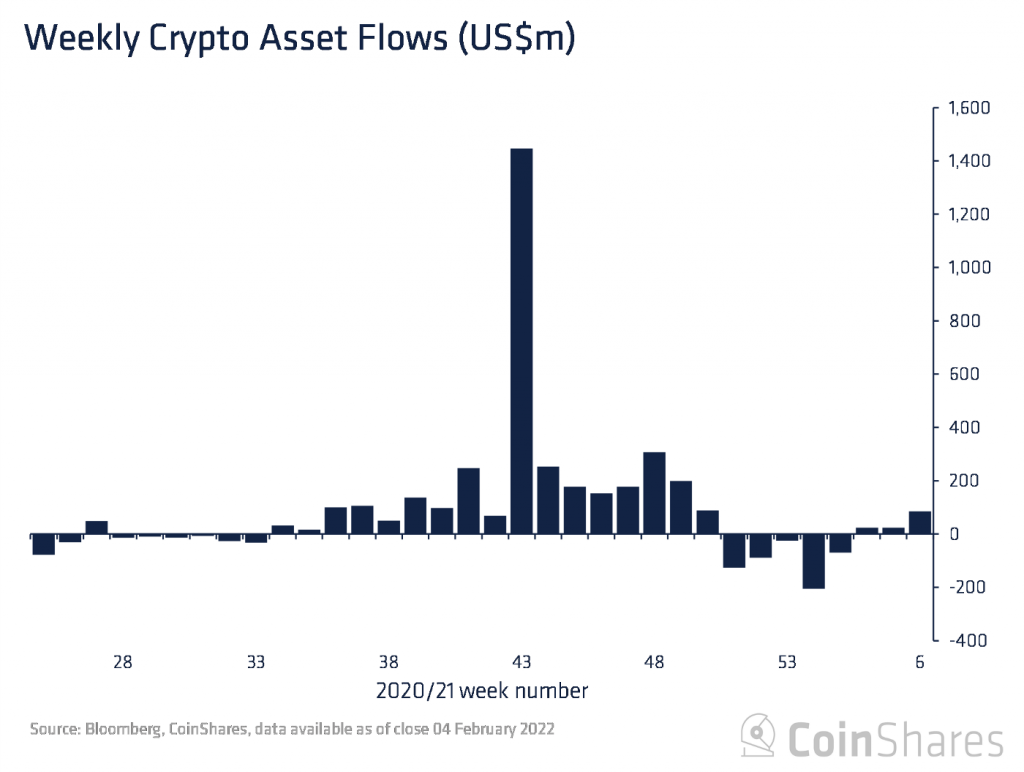

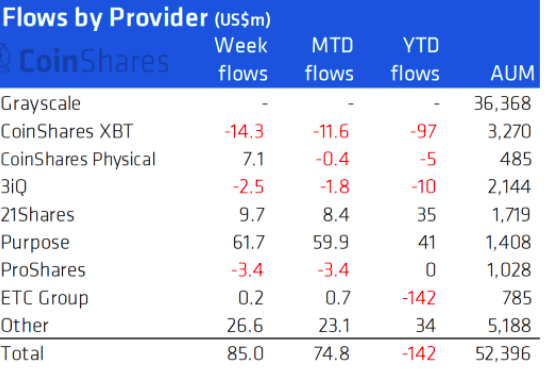

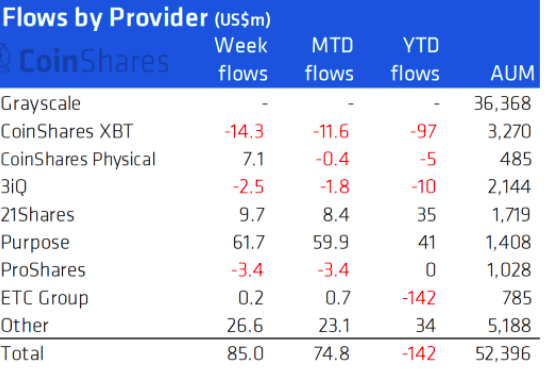

Until quite recently, digital asset investment products were witnessing significant outflows. The trend was, however, broken in the week that ended on 21 January. Since then, the inflow game has been getting stronger. The sentiment continues to improve as crypto-centric investment products witnessed their third consecutive week of inflows amounting to $85 million.

Last week’s numbers were quite ripened and were at par with the ones observed in the late November to the early-December period back last year.

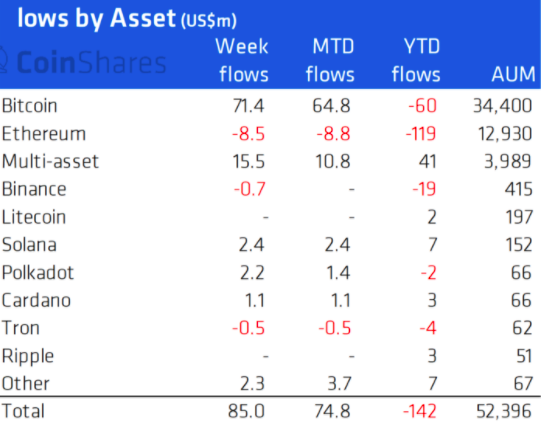

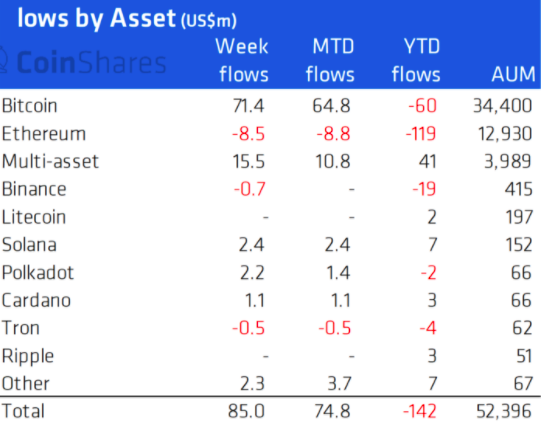

Bitcoin continued to lead the inflows with $71 million last week, the largest since early December. Currently, the cumulative value of BTC inflows over the past three weeks stands at $108 million.

However, Ethereum’s garden did not look all that rosy. Even last week, it resorted to continuing its same sluggish trend. The $8.5 million investment products outflow for the alt pack leader suggested that a few big investors continue to remain bearish.

Other alts, however, treaded on Bitcoin’s path and saw inflows. The same for top coins like Solana, Polkadot and Cardano reflected values of $2.4 million, $2.2 million, and $1.1 million respectively. Terra’s LUNA, curiously, saw its first significant inflows totaling $1.4m last week, representing 26% of the AuM.

The Canadian twirl to the inflow tale

Quite interestingly, the inflows last week were led by Purpose Investments. The Canadian investment company registered positive weekly flows worth $61.7 million.

Furthermore, just a day back, KPMG Canada proclaimed that it had added Bitcoin and Ethereum to its corporate treasury as part of its commitment to emerging technologies and asset classes. With this, KPMG Canada has become one of the highest-profile mainstream firms to invest in cryptos.

When both the aforementioned developments are coupled and viewed in conjunction, an interesting trend can be chalked out – the rise in institutional appetite for cryptos in Canada.

Experts weigh their opinions

KPMG Canada’s investment exemplifies the firm’s outlook on emerging technologies stimulated on blockchains. Kareem Sadek, Advisory Partner, Cryptoassets and Blockchain Services co-leader at KPMG in Canada believed that the crypto-asset industry “needs” to be considered by financial services and institutional investors. The exec went on to say,

“We’ve invested in a strong cryptoassets practice and we will continue to enhance and build on our capabilities across Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs) and the Metaverse, to name a few. We expect to see a lot of growth in these areas in the years to come.”

Further, Benjie Thomas, Canadian Managing Partner, Advisory Services of KPMG in Canada opined,

“This investment reflects our belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.”

Seeing smart money flowing into large-cap assets like Bitcoin and Ethereum, novel retail demand in the North American country can be expected to rise going forward. The ripple effect has the potential to foster mainstream adoption and rub off positively on the long-term valuation of the said coins.