The broader crypto market has collectively been swinging up and down over the past few days. With no concrete trend being able to establish itself, market participants continue to be on the lookout for early uptrend/downtrend signs.

Is it spring season? Nah, it’s Bitcoin season!

Well, keeping up with Bitcoin’s sluggish performance and looking at the way how the likes of WAVES, RUNE, LUNA, and AVAX have performed over the past few weeks, it sure does seem like the market is in an alt season.

Beauty does lie in the eyes of the beHODLer, but assumptions solely cannot be made based on what the eyes of the perceiver see. More so, because there’s always a touch of personal bias to the same.

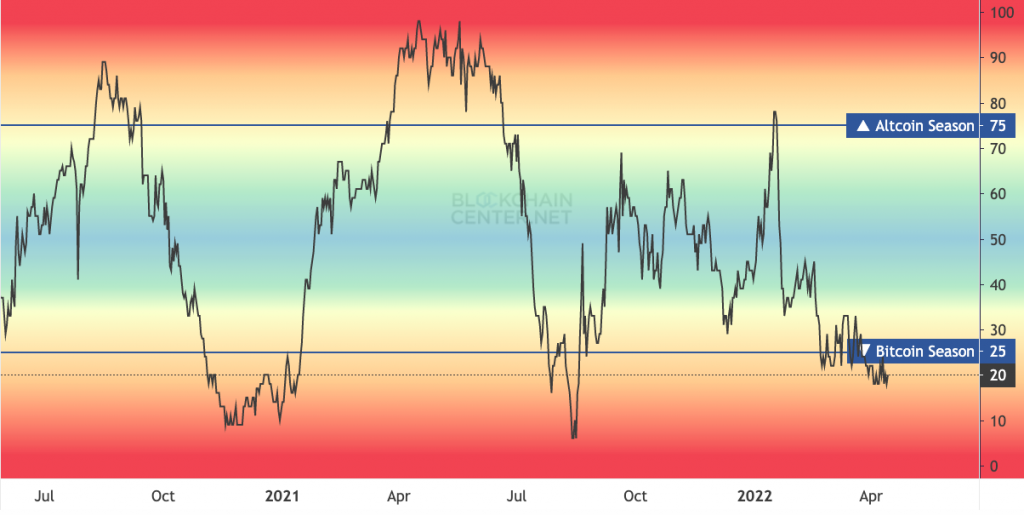

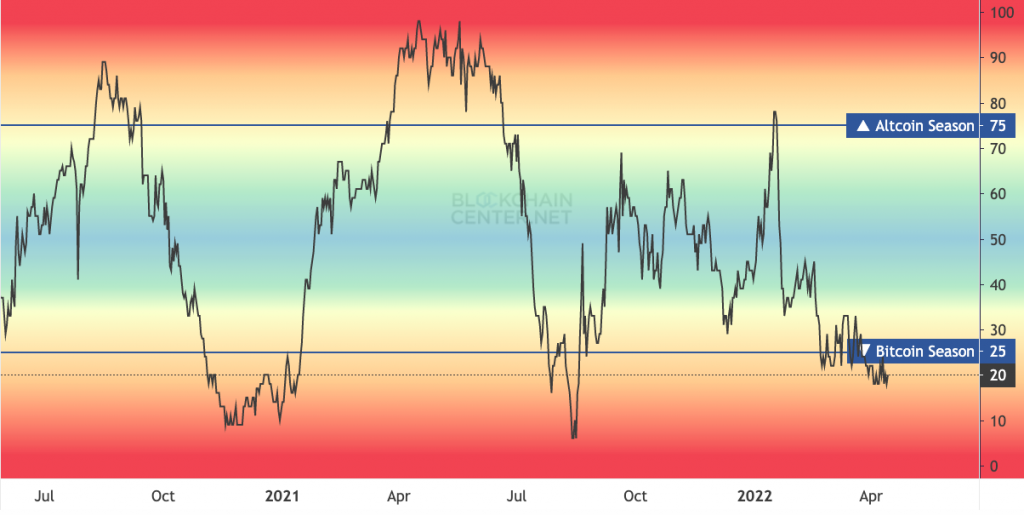

As such, an alt season only commences when 75% of the top 50 coins [excluding stablecoins] perform better than Bitcoin over the last season [90 days]. Per BlockChain Centre’s season meter, the market is currently in its Bitcoin season.

Since its inception, the crypto market has been operating in cycles and an alt-season has seldom cropped out of the blue. Usually, something like this plays out:

During bearish phases of any market cycle, market participants tend to accumulate Bitcoin. Then, as the recovery and consequential uptrend take place, altcoins lose their value in terms of Satoshi. And then, when Bitcoin consolidates at peaks, alts start ascending and their accumulation begins with the funds diverted from Bitcoin.

How things have played out in the recent past

Let’s consider the state of the Bitcoin market last two times when the alt-season index was hovering in and around the current 20 range.

Back during the 2020-21 year transition phase and during 2021’s July-September period, this metric was hanging loose and had tumbled below 20. As such, the said periods coincided with the warm-up stage of the respective bull runs. During the first instance, Bitcoin peaked at $64k in April, and then back in November, it created its double peak at $69k.

Now, as far as the current cycle is concerned, the alt-season index’s reading has already been hovering below 20 since the beginning of this year, indicating that Bitcoin has been prepping for another leg up. Rightly so. Just recently, the kind-coin had crossed its $45k barrier and was seen heading towards its psychological $50k mark. Of late, there have undoubtedly been hiccups, but on the macro-frame, things seem to still be intact for the king-coin.

Bitcoin to call shots for now

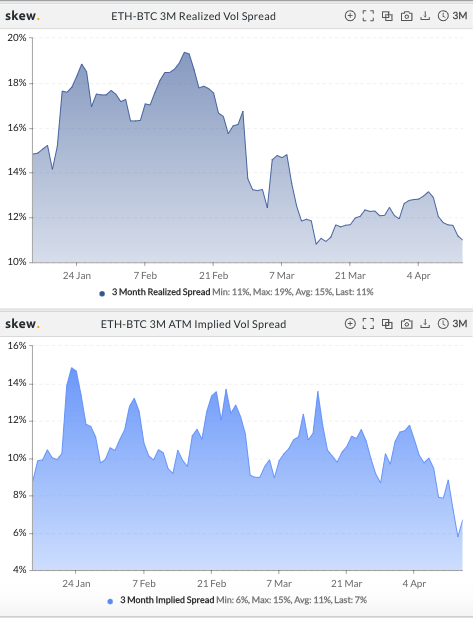

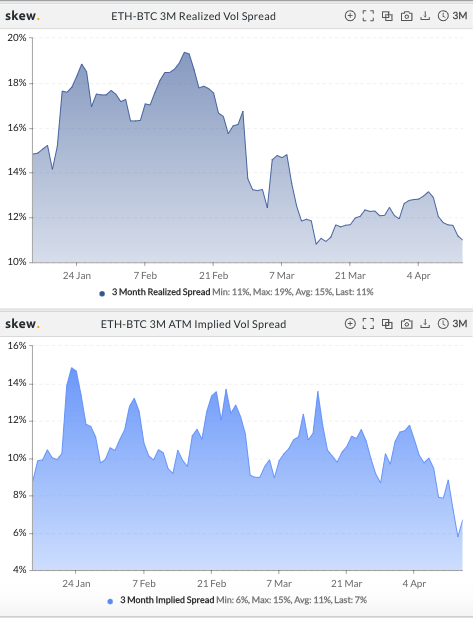

During the end of February, Ethereum’s price movements had more thrust and vigor when compared to that of Bitcoin. Post that, things slowly started changing and the baton was soon returned to Bitcoin.

As can be noted from the snapshot affixed, the ETH-BTC realized volatility spread started shrinking right after registering a local peak in February. This essentially means that volatility in the Ethereum market had gradually started evaporating when compared to that of Bitcoin. Even now, the current levels are quite close to their multi-week lows.

Even the ETH-BTC implied volatility spread has been stooping lower on the charts since the last couple of days of March. This means that towards the end of last month, traders expected Ethereum to take the lead and pave the path, but now, expect Bitcoin to do the same.

So, keeping in mind all of the aforementioned factors, it becomes quite evident that Bitcoin possesses the key to the lock and the magnitude of its pumps/dumps is set to dictate the movements of other coins in the market for now.