The cryptocurrency market is brutal this year after experiencing regular and timely crashes for seven months straight. Top cryptos are down more than 60% from their all-time highs, and several altcoins have slumped below 80%. Investors who poured in their money last year face losses, and recovery is nowhere on the cards. The crypto market is testing investors’ patience, but not everyone is in a financial position to brace for the storm. Several investors jumped ship during the crash by selling their crypto holdings at a loss in fear of further slumps.

Also Read: Shiba Inu Turns 2: Here’s How Many Zeroes it Deleted Since Launch Day

Who Sold the Majority of Crypto Holding During the Crash?

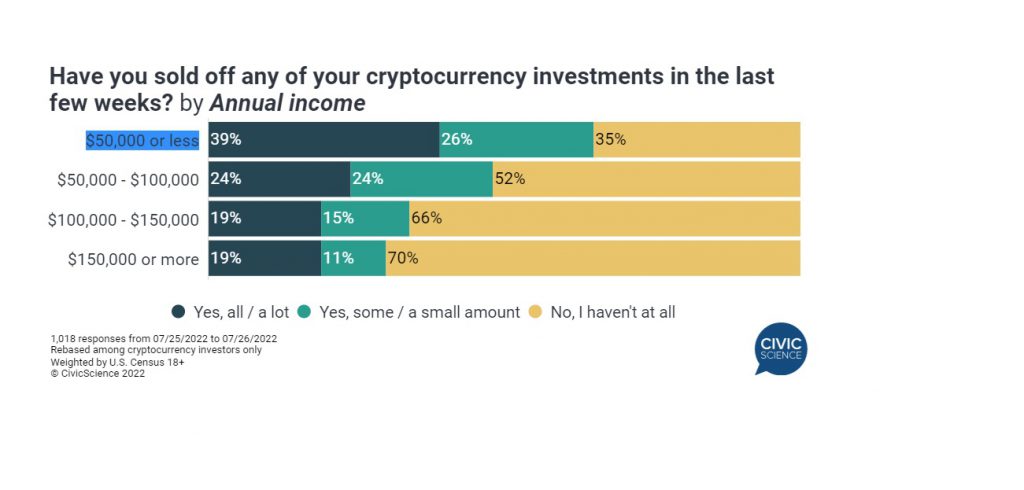

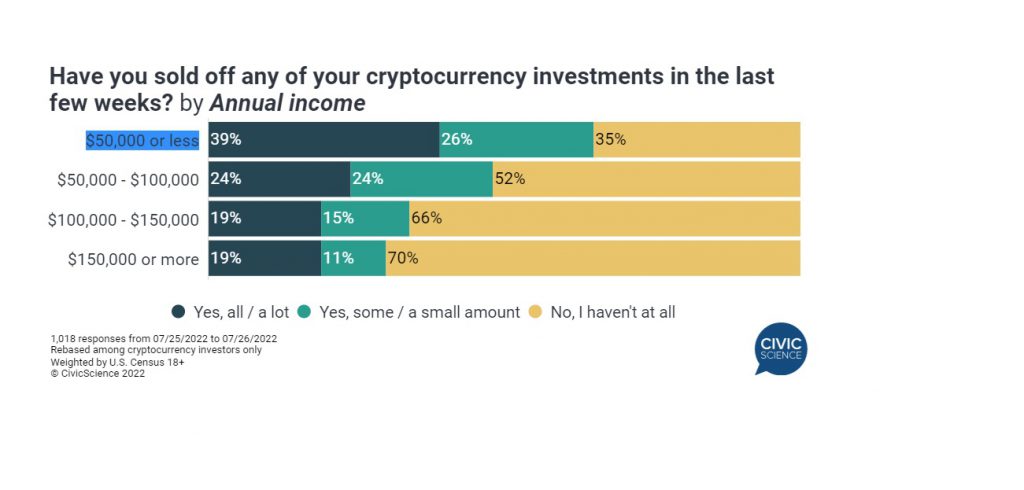

US-based business intelligence firm Civic Science published a survey that shed light on ‘which category of investors’ sold most of their holding this year during the crash.

As per the survey, nearly half of all low-income investors sold their crypto holdings at a loss this year during the crash. 46% of low-income investors admitted that they sold their cryptos this year as money required for their day-to-day needs.

The survey polled investors with an annual salary of less than $50,000, and 39% admitted they sold all their crypto holdings. An additional 26% of low-income investors admitted to selling a portion of their investments. Only 35% of investors in the category revealed they still hold on to their cryptos despite the dip.

Also Read: Cardano is Just Another ‘Ghost’ Chain in The Crypto Sphere?

Coming to investors with a middle income of $100,000 per annum, only 24% admitted that they sold their crypto holdings. The higher income class of people with an annual salary of $150,000 and less likely to sell their holdings during the crash. Only 19% of high-income investors revealed that they sold their cryptos this year.

Therefore, the survey concluded that low-income investors require their investments and cannot hold on to the long term. Only the middle and higher-income investors are positioned to take risks and hold on for a long time.