The fervor surrounding non-fungible tokens or NFTs was incredibly high. The increased interest in this digitized art and its early inclination towards the industry put OpenSea at the top as the largest NFT marketplace. From celebrities to the average Joe, everyone wanted in one all the NFT fun. This further forced mainstream firms to venture into the NFT space. However, things have started to look bleak in this part of the crypto-verse.

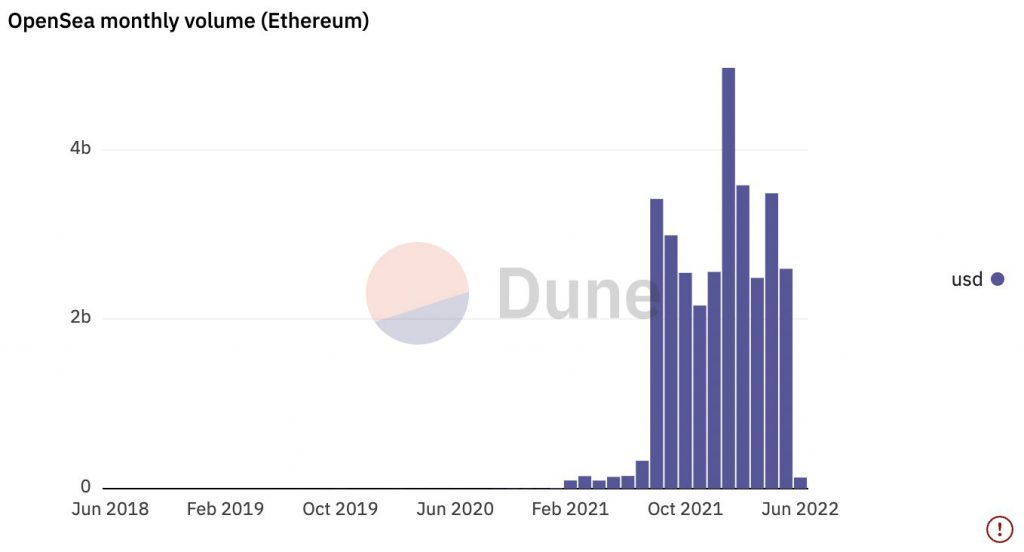

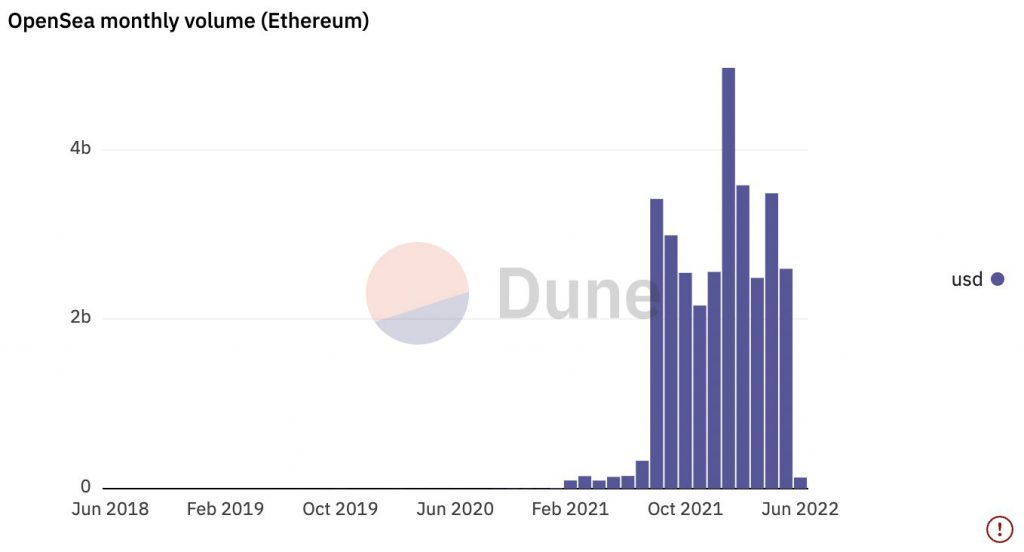

The interest in NFTs has certainly taken a hit. Just last month, it was revealed that NFT volume dropped by 92 percent since its peak in September 2021. It seems like OpenSea in particular had lost its hold on the market. As per Dune Analytics, OpenSea witnessed a staggering 25 percent decline in its Ethereum transaction volume in May from April.

As seen in the above image, OpenSea’s Ethereum transaction volume soared to a high of about $3.5 billion while the volume in May was just $2.596 billion.

In addition to this, the number of monthly active users in the Ethereum network on OpenSea was only 422,300. This was an 11 percent plummet since April.

Are the constant hacks in the NFT space hindering its growth?

The crypto-verse isn’t new to hacks. However, the NFT space entails naive users unaware of these hacks. OpenSea has been a constant victim of this.

From its Discord being hacked several times to phishing scams that emptied the wallets of its users, a lot of funds were lost. The infamous case of the $2.8 million worth Bored Ape Yacht Club [BAYC] collection that went missing, continues to haunt the community. A mere Google search will point out how many times the platform has been hacked.

Moving over to other platforms, Yuga Labs was hacked last night causing the loss of 200 ETH worth of NFTs. Similar to OpenSea, BAYC has been a frequent target of hackers. The platform’s Instagram and Discord were previously hacked.

Since BAYC is built on the Ethereum blockchain, several speculated that the recent surge in hacks could have led to the decrease in the interest surrounding these NFTs. The possibility of recovering a stolen NFT is close to zero. Therefore, the community could be staying wary of any potential hacks.

In addition to this, an array of users were seen shifting to a Solana-based NFT marketplace, Magic Eden. Solana emerged as an Ethereum killer. Things were seemingly getting real as Magic Eden reported daily NFT-related transactions of over 376,000 while OpenSea was at a low of 72,000.