Bitcoin’s price has been creating new records of late. This time, instead of going up, the coin’s valuation has been rolling down the cliff and setting local lows every other day. After shedding over 14% of its value over the past week, the king coin was priced at $33.2k at press time, bringing its price down by more than 50% when compared to its $69k ATH.

Reading through the ‘gaps’

On derivatives exchange platform CME, Bitcoin closed at a price of $35.9k on Friday. It, however, opened this week at a much lower level—at $34.4k. As a result, something called the ‘CME gap’ found its way back on the charts.

Technically speaking, the CME gap is the difference in the futures contracts’ trading price of the new week’s open when compared to the previous week’s close. The CME market, for its part, ain’t open all the time—24/7*365—like the crypto market. It follows the usual exchange working hours and also closes on holidays. As a result, the formation of gaps on its chart is not a very uncommon phenomenon.

In the past, CME gaps have more often than not been bridged within a few days. Consider instance 1 on the chart, for starters. Back in the Feb-March transition period, a gap wide as approx. +$900 was formed. Bitcoin ended up losing value over the next couple of days, and the gap got eventually filled.

Similarly, when Bitcoin’s price broke above its $44k barrier in Mid-March and rose to $46k [instance 2 on the chart], a +$2.1k wide gap was formed. Again, it was just a matter of time until the gap had been filled.

This time, nonetheless, Bitcoin has broken lower and the gap between two red candlesticks is in question. This means, that the price will have to climb up—and not down—to bridge the gap.

Bitcoin is known for pulling off dead cat bounces or fake relief rallies during downtrend phases. In an out-of-blue event of the same, the said gap can get filled right away. But, per technicals, the days ahead are set to be bloody.

Bitcoin loses key supports as CME OI peaks

Over the last few days, Bitcoin has let go of a couple of critical support levels. On the weekly, $37.3k was initially lost. Quite recently, the one around $34.1k was also unhanded, thus leaving Bitcoin at the mercy of $30k.

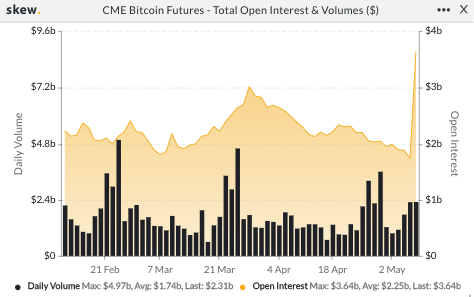

Notably, at this stage, the BTC CME OI just climbed to its 5-month peak in the 5 May to 6 May period. On the other hand, the volume comparatively remained the same in the said period, indicating that the market is currently over-leveraged.

A high OI during bearish periods usually implies that traders are vouching for the ongoing trend to become stronger.

The ultimate race

With the bearish trend already in play, it is interesting to note that Bitcoin is currently filling an age-old un-catered gap that was formed back in July last year. On 24 January this year, a cut-throat wick was formed, but couldn’t really bridge the gap completely.

Only upon reaching $32.2k, the said gap would be filled completely. So, keeping the current market conditions in mind, the case for this gap to be filled first seems to be much higher when compared to the $36k one.

Perhaps later, post Bitcoin fully bottoms out, the $36k gap would be tended to, en-route BTC’s actual recovery.