The downward trend instigated by prominent crypto exchange FTX left the industry in fear and uncertainty. A plethora of projects collapsed this year, however, the one that had the most impact was FTX. The downfall of Sam Bankman-Fried’s empire led to the community speculating if the market would soon harbor coins part of the carnage. Yet, a report by Chainalysis noted how the crypto market would get back on its feet as it isn’t its first time.

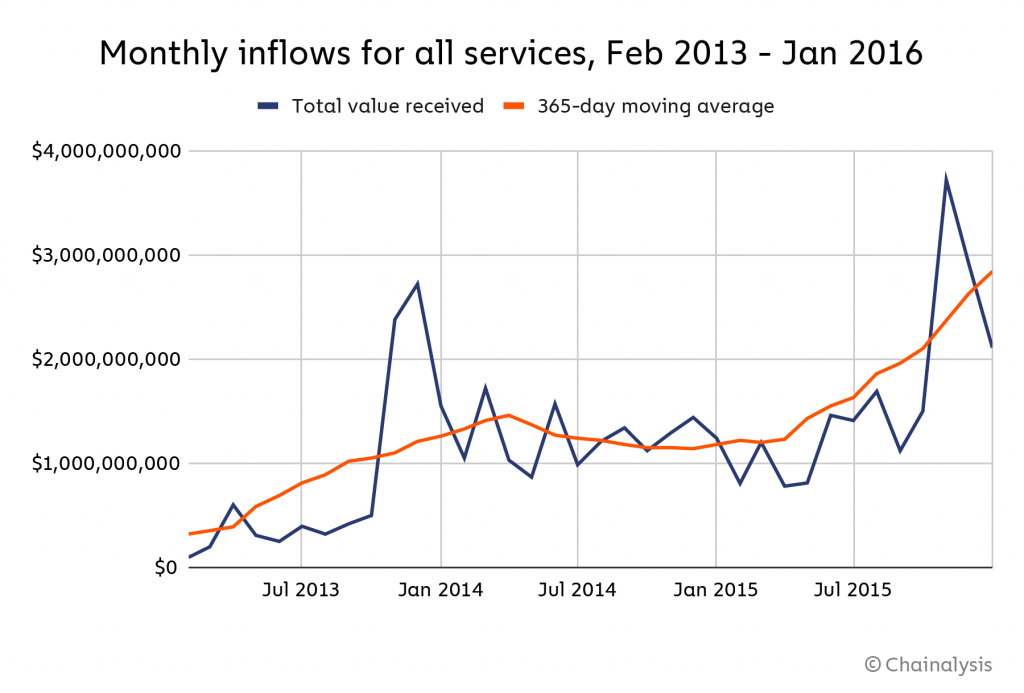

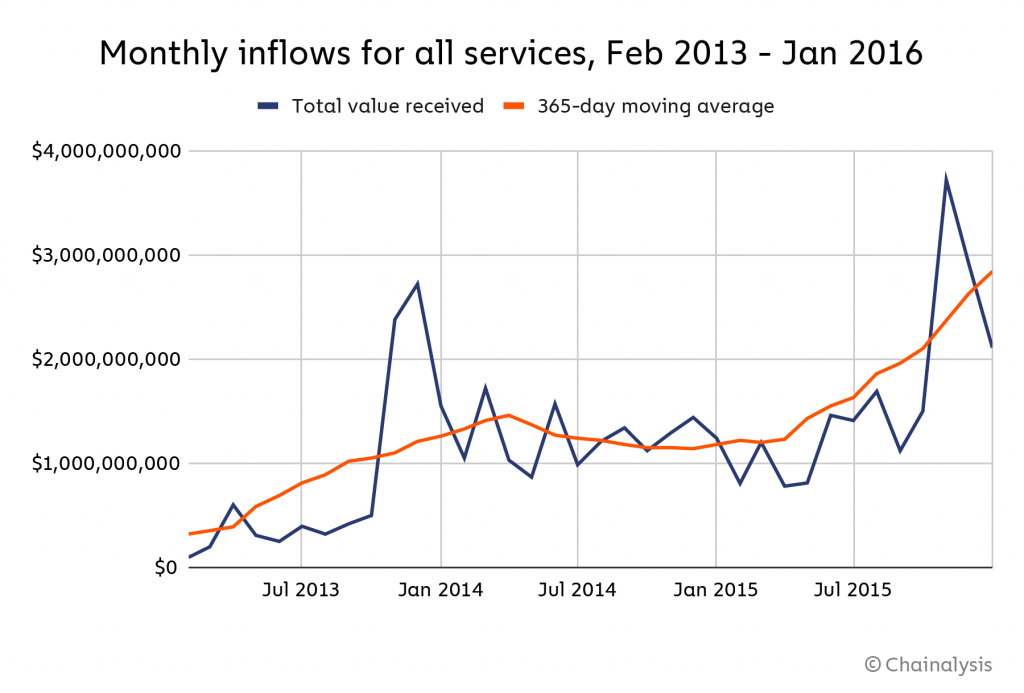

In a recent thread, Chainalysis brought back the infamous Mt.Gox hack that shook the industry. Accounting for a whopping 70 percent of Bitcoin’s global trading volume, BTC-e was hacked and forced to shut in 2014. During the hack over 700K BTC was stolen. Despite this, the market managed to thrive.

Further comparing the downfall of both these exchanges, Chainalysis noted how FTX’s share of all exchange inflows was at 13 percent. Before the hack, Mt. Gox’s exchange inflows stood at 46 percent. This highlights how FTX was comparatively small.

Before the collapse, taking into consideration just the inflows, it was brought to light that Mt.Gox’s volumes were surging. FTX’s volumes, on the other hand, were decreasing. Chainalysis’ research lead, Eric Jardine further elaborated,

FTX’s collapse not as harsh as Mt.Gox?

Despite FTX’s size, it remains quite pertinent in today’s market. Back in 2014, centralized exchanges were at the top of their game and constituted most of the economic activity. Now, however, decentralized exchanges account for about 50 percent of exchange inflows. Jardine said,

“Mt. Gox accounted for 10.9% of total service inflows in the 12 months before its collapse, vs 4.7% for FTX. […] In other words, Mt. Gox was a linchpin of the CEX category at a time when CEXes dominated. But as we all know, crypto survived Mt. Gox’s collapse and continued to grow and thrive. So, what were the immediate effects of that historical collapse?”

It should be noted that the transaction volume of Mt.Gox began picking up about a year following the hack. This further brings about some optimism in the industry.

It is likely that the industry would bounce back stronger despite its current state.