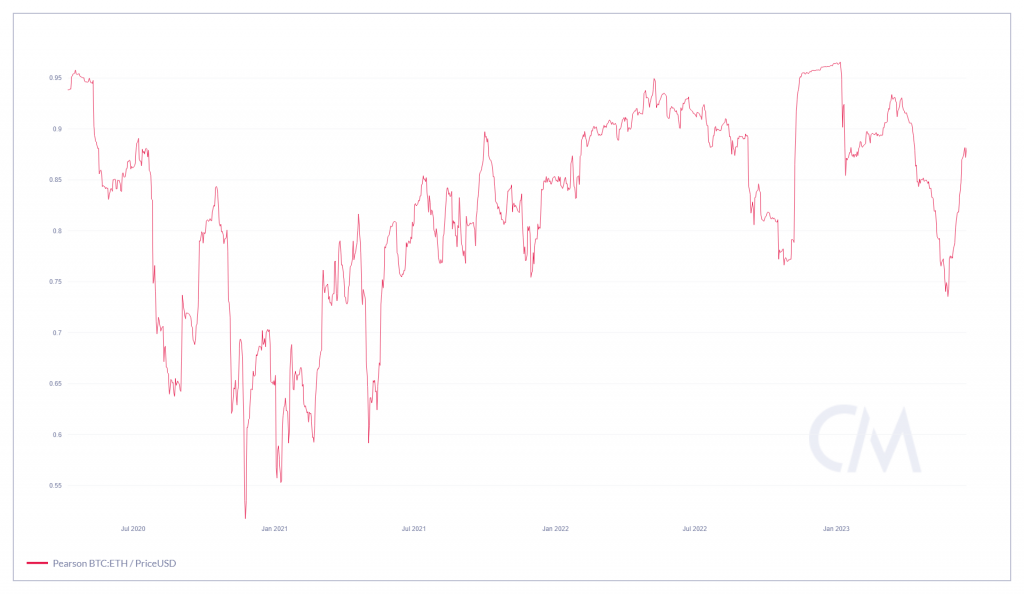

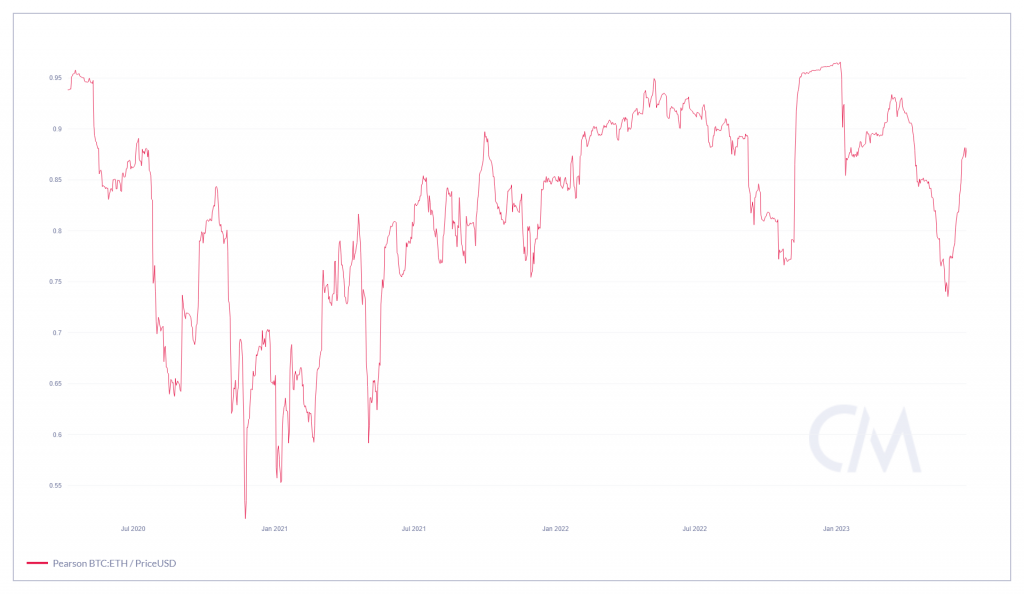

In 2021, there was a constant sense of exhilaration for Altcoins to rally, whenever Bitcoin took a step up. It is an obvious observation that during bear markets, BTC’s influence does not propagate to the same extent; at least not in 2023. At the moment, all eyes are currently on Ethereum, as it continues to hover above $1700. According to Coinmetrics, Bitcoin and Ethereum continue to share a high correlation.

As illustrated in the chart, both assets share a correlation level of 0.88. The correlation dropped to a low of 0.735 on May 26, and a downtrend was observed from March. However, the decrease in correlation doesn’t really match up with both assets’ price action. Let us take a better look into both asset side by side.

Bitcoin, and Ethereum: Different But Same?

As observed in the data set, the correlation dropped sharply from 0.93 on March 26th, to 0.735 on May 26th. Now, a reduced correlation would mean that both assets possibly registered different rallies or corrections. However, that was not the case.

Comparing both assets’ price actions during that period, rather than independent, a cohesive downtrend can be observed. Both the tokens are forming lower highs on the daily chart. On three occasions, BTC and ETH tested the descending trendline, with Bitcoin close to its resistance at the moment. Ethereum (lower high 4) still has to bridge the gap on the upside.

On further analysis, Bitcoin and Ether registered similar upswing ranges, and consolidation periods(highlighted by the boxes). Hence, it is clear that neither Ether nor Bitcoin commanded the upper hand during the uncorrelation period. Inference can be drawn that correlation might not be an appropriate metric to understand the market dependability of certain assets.

At the moment, analysts in the industry are expecting Ethereum to rally above $1800 and follow Bitcoin’s laid-out bullish path. But the above analysis indicated that Ether might be on its own for now.

Finding Factors

For Ethereum, the decreasing reliance on Bitcoin correlation is also somewhat positive. It allows Ether to sustain a strong rally whenever the market turns positive for the largest Altcoin. Staking on Ethereum and the recent withdrawals completely changes the market dynamics for ETH. After the Shanghai update, Ethereum’s expansion is much more comprehensive in the broader DeFi ecosystem. The rise of lending and LSD protocols should technically allow increasing liquidity for the ETH industry. Over time, increased liquidity on staked ETH should also lead to increased users and wider retail investors.