Bitcoin’s current volatility is causing a wave of panic to spread among the masses. The crypto market is heavily blanketed in fear as the BTC fear-to-greed index drops to predict the ultimate market fear. Moreover, BTC is down 20% from its earlier ATH, spreading chaos among crypto traders. This narrative is also compelling experts to come up with unique theories, trying to calm the masses down. In one such event, one portal has calmly explained how BTC volatility is part of its nature and not a flaw that one should solely focus on.

Also Read: Relax: Bitcoin’s Worst Declines Have Always Preceded Records

Bitcoin’s Volatility: An Innate Part of Its Anatomy

According to the Kobeissi Letter, frequent falls and plunges in the prices of leading assets are a natural part of their nature. These massive plunges often act as catalysts for a better ascent, shaping the asset’s future for the better. Per KL, Bitcoin and Ether averaged 2 declines in more than a year, with the S&P 500 recording 4 declines worth 5% in a year.

The portal later outlined how the Nasdaq 100 documents 4 declines worth 5% in a year, followed by gold recording 1 sharp decline of 10% each year.

In short, the portal emphasized the importance of volatility in the market, adding how such plunges play a crucial role in shaping the assets’ future for the better.

“Some perspective: 1. Bitcoin averages 2 declines of -20% or more per year. 2. Ether averages 3 declines of -20% or more per year.. 3. The S&P 500 averages 4 declines of -5% or more per year. 4. The Nasdaq 100 averages 4 declines of -5% or more per year. 5. Gold averages 1 decline of -10% or more per year. 6. The VIX spikes above 20 roughly 40 times per year. 7. The average S&P 500 stock declines -20% once every 12 months. Zoom out and ignore the noise.“

Some perspective:

— The Kobeissi Letter (@KobeissiLetter) November 18, 2025

1. Bitcoin averages 2 declines of -20% or more per year

2. Ether averages 3 declines of -20% or more per year

3. The S&P 500 averages 4 declines of -5% or more per year

4. The Nasdaq 100 averages 4 declines of -5% or more per year

5. Gold averages 1 decline…

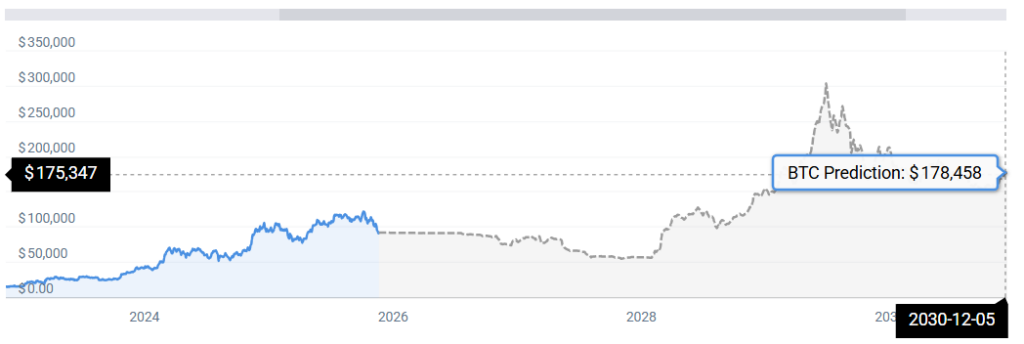

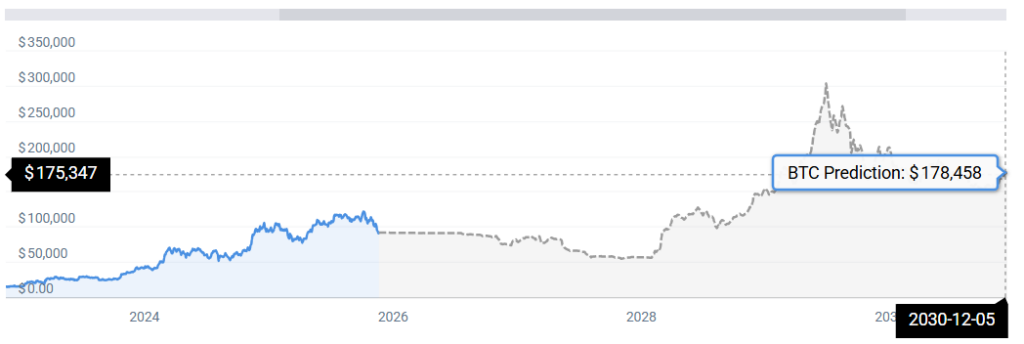

Zooming Out For Real: The Projected BTC Future

According to CoinCodex BTC stats, Bitcoin has already started to carve out its own path. CC adds how Bitcoin may hit $177k by 2030.

“According to our latest Bitcoin price prediction, BTC is forecasted to rise by 92.50% and reach $177,747 by December 12, 2030. Per our technical indicators, the current sentiment is bearish, while the Fear & Greed Index is showing 11 (Extreme Fear). Bitcoin recorded 14/30 (47%) green days with 5.83% price volatility over the last 30 days. Last update: Nov 19, 2025 – 06:00 AM (GMT+5).”

Also Read: Bitcoin Falls to $89000 For The First Time in 7 Months