Bankrupt digital lender Voyager has been sending crypto tokens to centralized exchanges of late. Via a tweet on Thursday, blockchain security company PeckShield brought to light that ~9.6 million worth of assets has been transferred from Voyager to Coinbase, Binance US, and Kraken.

The tokens transferred included Voyager Token [VGX], Chainlink [LINK], Ethereum [ETH], and Shiba Inu [SHIB]. Ethereum and Shiba Inu accounted for roughly two third of the share, i.e. $6 million in total. The remaining $3.6 million was accounted for by Voyager token and Chainlink [$2.1 million and $1.5 million respectively].

As shown below, the source involved two addresses — Voyager, and Voyager 1. Most of the involved tokens were first sent to different addresses before finally being transferred to the centralized exchanges.

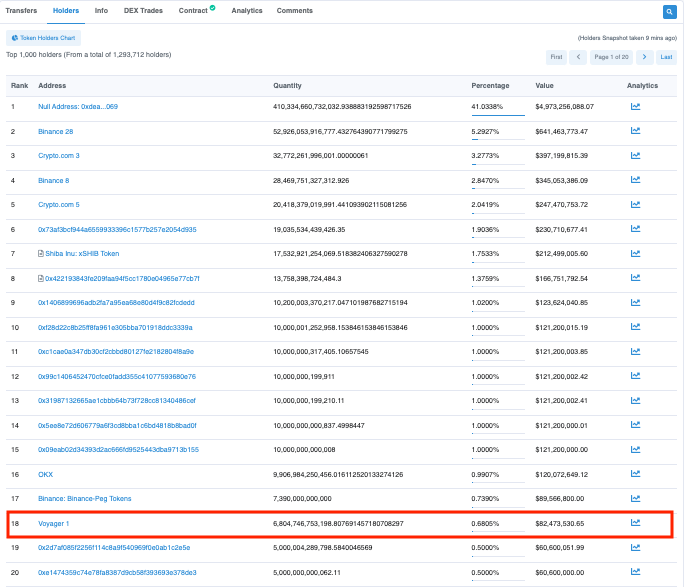

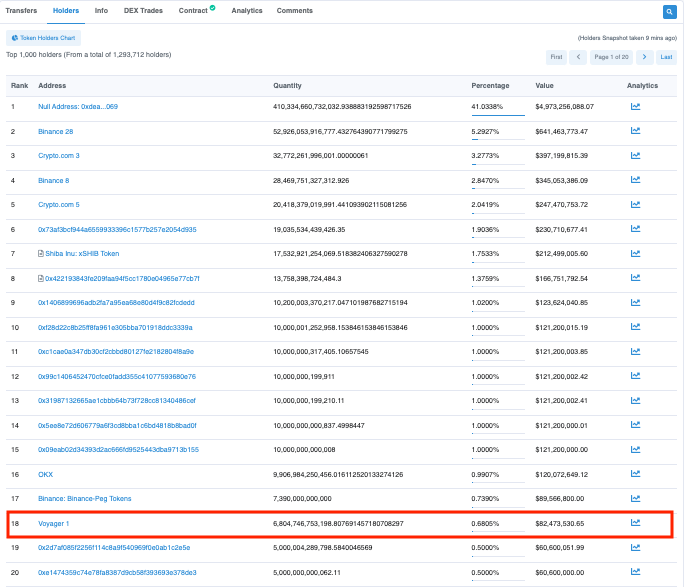

Despite transferring $3 million worth of SHIB, Peckshield revealed that the ‘Voyager 1’ address still held around 6.8T SHIB. Retrospectively, the said wallet is now the 18th largest holder of Shiba Inu.

As for the broader cryptocurrency market, most of the involved tokens have registered double-digit gains in 2023. When compared to Jan. 1’s lows VGX has almost increased in value by two folds, thanks to its 96% gain. Among the rest of the cryptocurrencies, Shiba Inu has registered the loftiest gain [~49%]. Ethereum and Chainlink, on the other hand, appreciated by roughly 40% and 31% respectively.

Also, Read – FTX: Alameda Research Sues Voyager Digital to Return $446M

Other Voyager-related updates

At the beginning of this week, Alameda Research thrashed Voyager Digital with a $446 million lawsuit. According to FTX lawyers, Voyager Digital played a role in its demise by “knowingly or recklessly” sending customer funds to Alameda.

However, as reported earlier, the said loan repayment was dismissed by Voyager as well as its creditors. According to the court filing, Voyager expects to see Alameda’s assertions be either reclassified as equity or given an equitable secondary position to all other creditor claims. The creditors involved were also on the same page.

Read More: Alameda’s $446M Plea ‘Dismissed’ by Voyager & Creditors