How Does Dollar-Cost Averaging Work in Crypto: A Guide to Long-Term Investment

In crypto asset investment, a sound strategy is crucial to yield sizable returns.

One such long-term investment strategy that has gained traction among crypto enthusiasts is Dollar-Cost Averaging (DCA).

This article will show how Dollar-Cost Averaging works in crypto, its pros and cons, and how you can leverage it for your investment portfolio.

Also read: Shiba Inu: A $2,000 Investment in SHIB Could Have Fetched $1 Billion

Understanding Dollar-Cost Averaging (DCA)

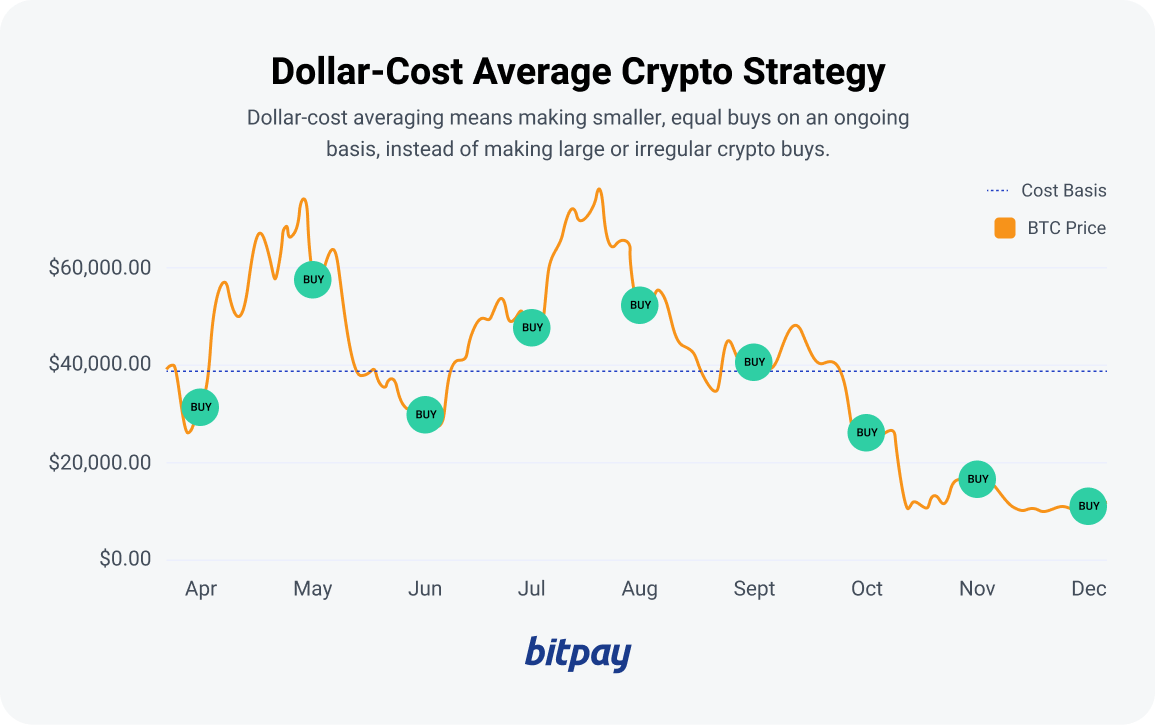

Dollar-Cost Averaging (DCA) is an investment strategy that involves investing a fixed amount of money at regular intervals into a particular asset.

The primary aim of DCA is to mitigate the impact of short-term price fluctuations in volatile markets. In simpler terms, DCA is the art of investing without trying to time the market.

An example of DCA would be setting aside a specific sum, say $100 every Monday, to buy Bitcoin.

This strategy is irrespective of whether the price of Bitcoin is high or low on that particular day.

The main idea here is to spread out the investment over time, thus reducing the average purchase price of the asset.

DCA in the Crypto Sphere

In the cryptocurrency world, DCA has a slightly different connotation.

It refers to making automatic recurring purchases of a crypto asset, regardless of market conditions.

This strategy is particularly beneficial for those who believe in the long-term potential of a particular cryptocurrency, like Bitcoin.

When you adopt the DCA strategy in crypto, you are essentially growing your holdings over time, irrespective of the market’s highs and lows.

This practice can lower your overall cost basis during market dips, setting you up for larger profits when the prices rise again.

Also read: Apple Users Face Crypto-Stealing Malware Bug

The Rationale Behind DCA

The rationale behind the DCA strategy is the inherent volatility of the cryptocurrency market.

Cryptocurrency prices can spike or plummet dramatically within short periods, making it challenging to time the market accurately.

Regularly investing a fixed amount of money eliminates the need to predict market trends.

Instead, you average out the cost of your investments over time.

Therefore, even if the prices drop after you purchase, you won’t be at a significant loss as you have not invested a lump sum amount at a high price point.

DCA vs. Lump-Sum Investments

Dollar-Cost Averaging and lump-sum investments are two different investment strategies with their benefits and drawbacks.

Lump-sum investing involves investing a large amount of money all at once. This strategy can yield substantial profits if the asset price increases significantly after the investment.

However, predicting the bottom of the market or the future price of a stock or cryptocurrency is almost impossible.

On the other hand, DCA allows you to spread out your investments over time, thus mitigating the risks associated with short-term price volatility.

A dollar-cost averaging strategy can be quite profitable even in a bear market, where asset prices are generally low.

Potential Drawbacks of DCA in Crypto

While DCA in crypto can be a good long-term investment strategy, it has drawbacks.

One potential disadvantage is that you might spend more money on smaller amounts of crypto if the market experiences a sharp uptick. This can inadvertently raise your cost basis, which is the opposite of what the DCA strategy aims to achieve.

Another concern with DCA is that it requires consistent investment over a long period. This might not be feasible for everyone, especially those with limited money to invest.

Is DCA Right for You?

If you are a beginner or do not want to spend much time monitoring the crypto market, then the DCA strategy might be an ideal fit for you.

This strategy allows you to invest in crypto in a consistent, simple manner without having to worry about short-term price fluctuations.

However, it is important to remember that all investments carry a certain level of risk. Therefore, it is advisable to only invest the amount of money you are willing to lose and always conduct thorough research before making any investment decisions.

DCA on Crypto Exchanges

Many crypto exchanges offer features that allow users to set up automatic recurring purchases, thus facilitating the DCA strategy. These features can be especially useful for those who want to adopt a “set it and forget it” approach to their crypto investments.

For instance, the Crypto.com Exchange offers a DCA Trading Bot that automatically places and executes orders based on your pre-set parameters.

This can be a convenient way to dollar-cost average your crypto investments without constantly monitoring the market.

Frequently Asked Questions About DCA in Crypto

1. How does dollar-cost averaging protect your investments?

By making regular investments over time, you effectively remove the emotional aspect of your investment decisions. This can prevent panic selling during market downturns and potentially lead to larger profits in the long run.

2. How do you calculate the dollar-cost average?

Many DCA calculators available online can help you determine how your regular investments will affect your cost basis. All you need to do is input the amount you plan to invest at each interval, and the calculator will do the rest.

3. How long should you use a dollar-cost average strategy?

The duration of a DCA strategy can vary depending on your financial goals and investment horizon. However, for the strategy to be effective, it should be implemented over a relatively long period, typically at least 6–12 months.

4. Is lump-sum investing better than dollar-cost averaging for crypto?

Both strategies have their pros and cons, and the best choice depends on your circumstances and risk tolerance.

While lump-sum investing can potentially yield larger profits, it also comes with higher risks. On the other hand, DCA offers a more conservative approach to investing, with potentially lower returns but also lower risks.

Final Thoughts: How Does Dollar-Cost Averaging Work In Crypto?

In conclusion, dollar-Cost Averaging can be an effective long-term investment strategy in the volatile world of cryptocurrencies.

Furthermore, by making regular, fixed investments over time, you can potentially reduce your average purchase price and mitigate the impact of short-term price fluctuations. However, like any investment strategy, DCA carries its risks and should be adopted only after careful consideration and research.

Please note: All information in this article is for educational purposes only and should not be interpreted as investment advice. Always consult with a professional before making any investment decisions.