Understanding the Operations and Structure of the Federal Reserve System

The Federal Reserve System, also known as the “Fed,” is the United States’ central banking system. You may have even wondered, “How many Federal Reserve Banks are there?”

Furthermore, it plays a crucial role in maintaining the nation’s economic stability by regulating the money supply, supervising financial institutions, and providing essential financial services to the public and private sectors.

This article offers an in-depth look at the Federal Reserve Banks, their operations, and their role within the central banking system.

Overview of the Federal Reserve System

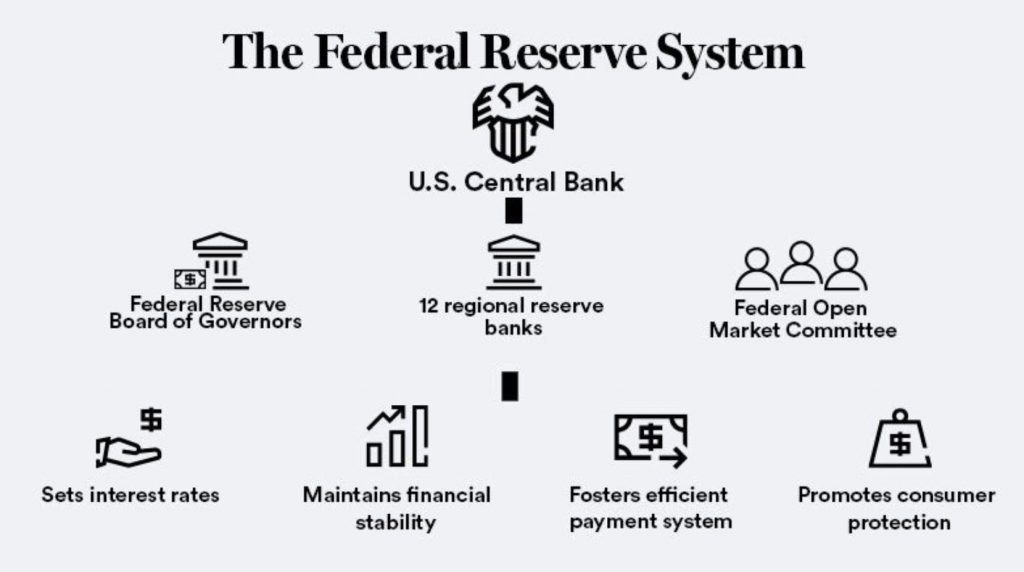

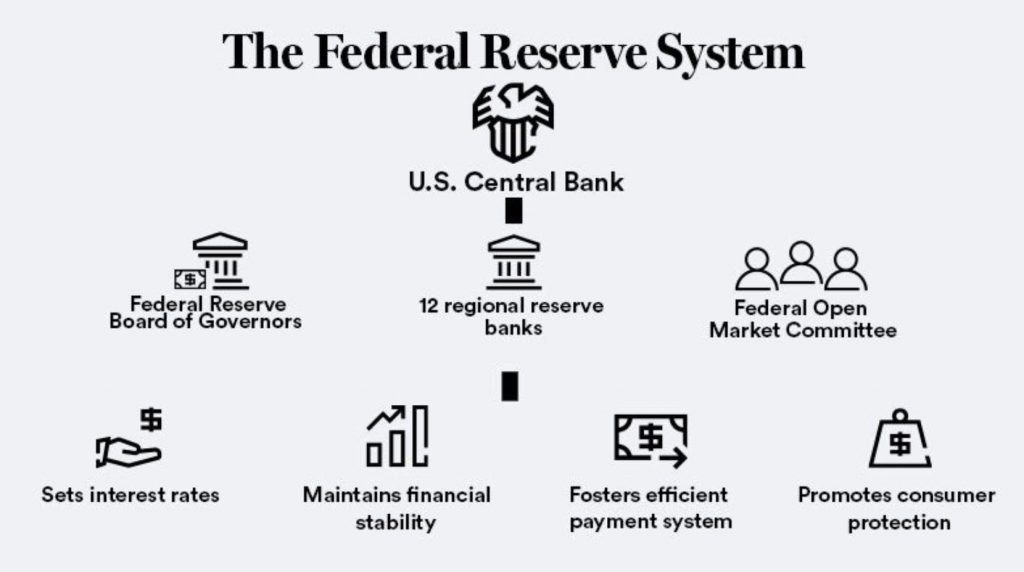

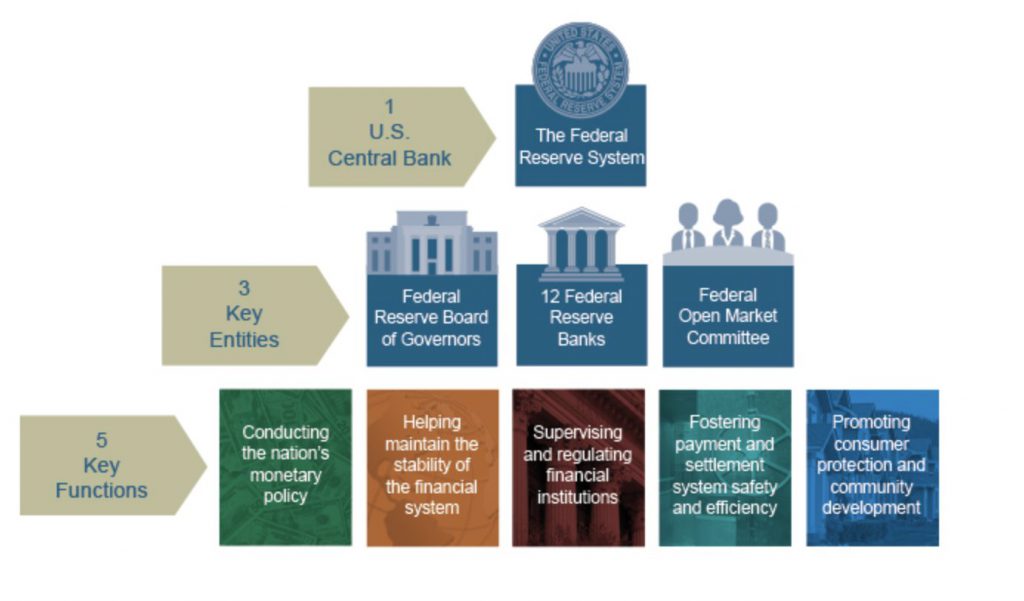

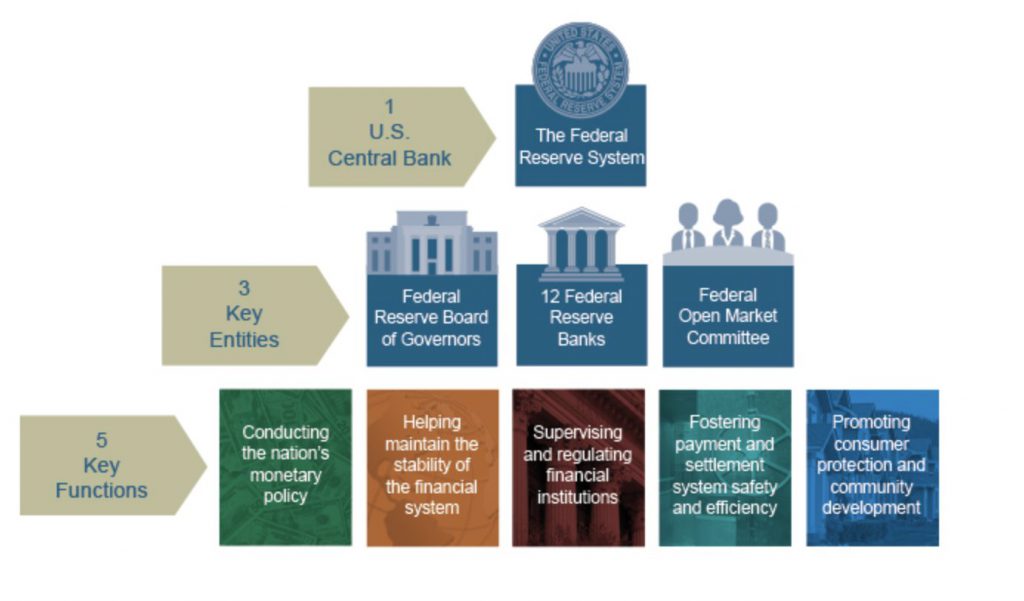

The Federal Reserve System comprises three main components: the Board of Governors, the Federal Open Market Committee (FOMC), and the 12 regional Federal Reserve Banks.

Additionally, the Board of Governors oversees the entire system in Washington, D.C. At the same time, the FOMC sets monetary policy, and the regional Federal Reserve Banks carry out day-to-day operations.

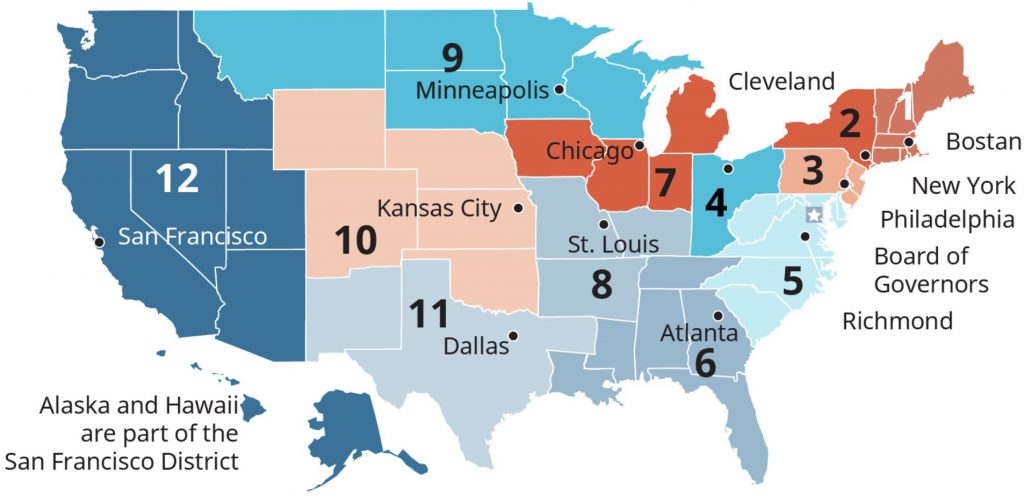

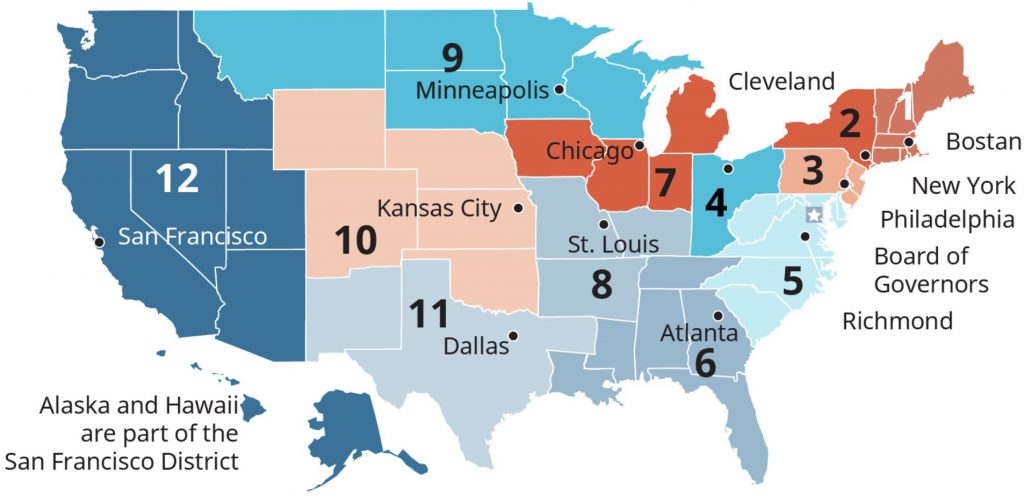

The 12 Regional Federal Reserve Banks and Where They Are Located

So, the central banking system is divided into 12 districts, each served by a Federal Reserve Bank. These banks are strategically situated in major cities across the United States, including:

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

This decentralized structure ensures that the Fed’s resources and decision-making processes are geographically distributed, considering the diverse economic conditions of communities throughout the nation.

The Federal Reserve Banks’ Role Within the Central Banking System

First, let’s grasp their responsibilities. Federal Reserve Banks implement monetary policy, supervise members, provide financial services, and support regional economies.

Second, let’s discuss leadership. Each bank has a president appointed by a nine-member board of directors familiar with the region’s economy.

The presidents meet with the Board of Governors every six weeks at FOMC meetings. They determine interest rate policies to promote stable prices and economic growth.

Also, the Federal Reserve Banks perform various functions, including supervising banks, providing financial services, supporting the government, and analyzing regional economies.

Supervision and Examination of Member Banks

Following its role within the banking system, the Fed has to supervise itself. Here’s how. The Feds monitor financial risk, supervise banks, and enforce consumer protection and fair lending laws.

By ensuring financial system stability, banks, and institutions can support households, businesses, and communities with resources.

Provision of Financial Services

Fed banks offer essential financial services to the nation’s payment system, such as issuing currency and coins to depository institutions and clearing checks.

They also provide loans, currency and coin storage, and safekeeping services to banks.

The Reserve Banks finance their operations through these services and interest on government securities, with excess gains being transferred to the U.S. Treasury.

Support for the U.S. Government

The banks serve as a bank for the federal government, maintaining accounts for the U.S. Treasury, processing government checks, and conducting government securities auctions.

Understanding Regional Economies

Each bank employs economists and staff with expert knowledge about their local economies.

This information is used during FOMC meetings and monetary policy decisions and factors into the decisions made by the Board of Governors.

The Evolution of the Federal Reserve Banks Over Time

The Fed has undergone several changes since its inception in 1913 when President Woodrow Wilson signed the Federal Reserve Act into law. This legislation established the nation’s first central banking system, designed to promote financial stability.

Reforms and centralization

The Banking Act of 1935 centralized the Federal Reserve System. It gave more power to the Board of Governors and increased its independence.

Furthermore, additional changes occurred in 1977 with the Federal Reserve Reform Act. It increased transparency, accountability, and selection criteria for Reserve Bank directors.

Conclusion

Furthermore, the Federal Reserve Banks play a crucial role in the US central banking system. They ensure financial safety and foster gainful growth. Its decentralized structure, member supervision, and financial services are vital for the economy.

In short, the Federal Reserve Banks will stay at the forefront of ensuring gainful prosperity as the central banking system evolves.