Exploring How to Bridge to Ripple: A Deep Dive into the XRP Ledger and DeFi Ecosystem

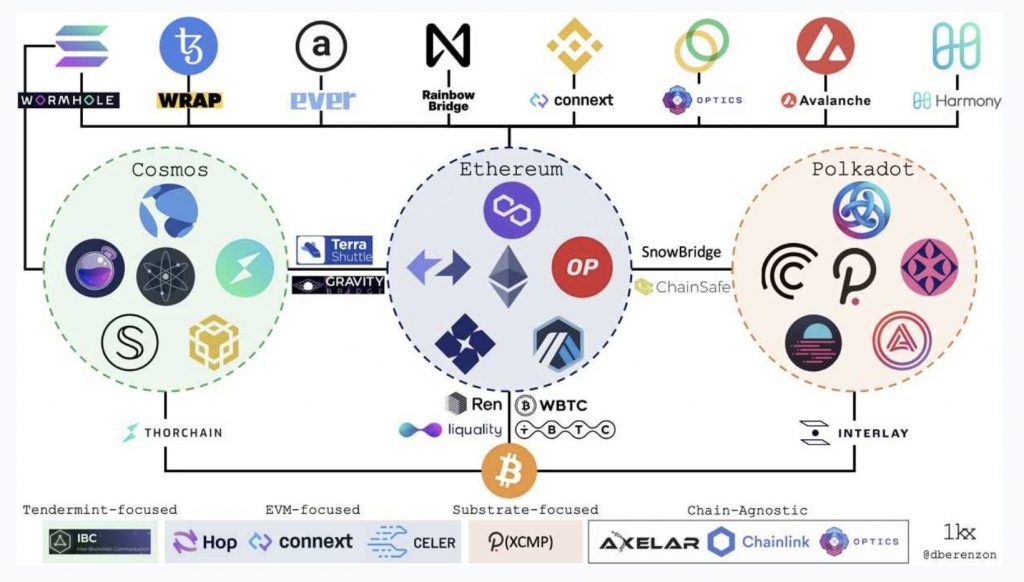

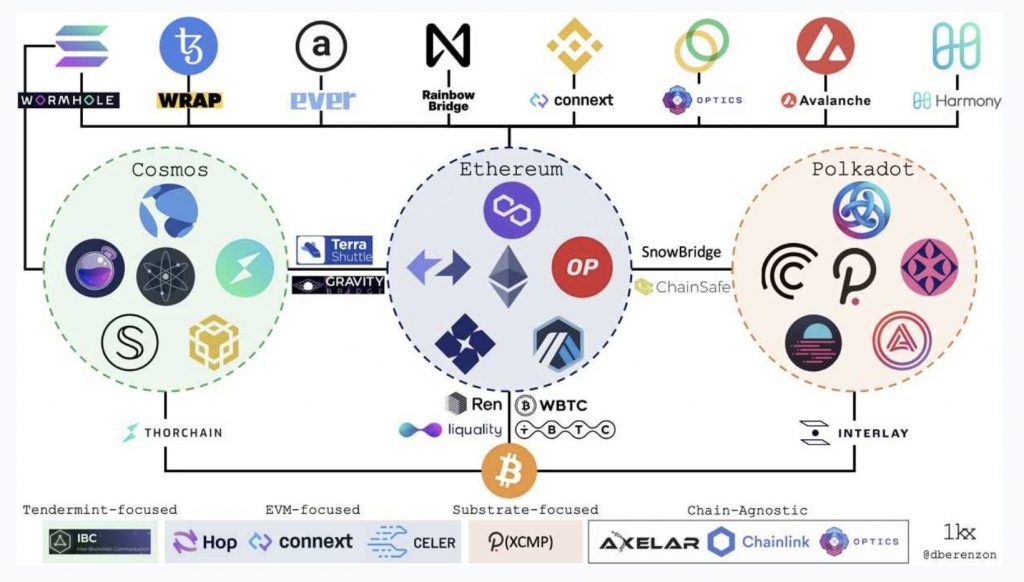

Cross-chain bridges have been a revolution in the world of decentralized finance (DeFi).

By allowing digital assets to move seamlessly between different blockchain networks, they have expanded the possibilities for traders and investors.

This comprehensive guide explores how cross-chain bridges work, focusing on the XRP Ledger (XRPL) and its role in the DeFi ecosystem.

We’ll also address some pertinent questions, such as “Will XRP be the bridge currency?” and “Can banks use Ripple without XRP?”.

Also read: Shiba Inu’s Shibarium Cross-Chain Bridge Open for Public Testing

Understanding Cross-Chain Bridges

Cross-chain bridges are a type of technology in the blockchain world that allows for transferring tokens from one blockchain to another.

Additionally, this process is also known as “bridging.” Cross-chain bridges have enabled investors to access a wider range of DeFi opportunities by creating a gateway between two or more different blockchains.

The Role of XRP in Cross-Chain Bridges

XRP is the native cryptocurrency of the XRP Ledger (XRPL), an open-source blockchain platform. XRP plays a crucial role in cross-chain bridges due to its ability to act as an intermediary currency in synthetic order books.

This process is facilitated through a feature known as auto-bridging, which improves liquidity across all currency pairs by using XRP when trading between two non-XRP currencies.

Consider this example: Anita, a trader, offers to sell GBP and buy BRL.

The market for this particular currency pair might not be very active, leading to insufficient offers to satisfy Anita’s trade.

However, GBP and BRL have vibrant, competitive markets when paired with XRP.

The XRP Ledger’s auto-bridging system can complete Anita’s offer by purchasing XRP with GBP from one trader, then selling the XRP to another trader to acquire BRL.

Anita gets optimal rates by combining the direct GBP: BRL offers with GBP: XRP and XRP: BRL rates.

The XRP Ledger and DeFi Ecosystem

The XRP Ledger (XRPL) is a decentralized blockchain technology that allows fast, low-cost international transactions.

XRP’s native token connects fiat currencies, making the XRP Ledger vital for DeFi.

The DeFi (Decentralized Finance) ecosystem refers to the network of financial applications built on top of blockchain networks.

DeFi aims to create a permissionless financial system that is open to anyone and operates without a central authority. The XRP Ledger, with its fast and efficient transaction capabilities, provides a robust platform for DeFi applications.

How to Bridge to Ripple

Using a Cross-Chain Bridge: A Step-by-Step Guide

Cross-chain bridge transfers seem complex but easy once you grasp the steps.

Here’s a simple guide to help you get started:

- Choose Your Networks: In the “From” field, choose the blockchain network from which you want to transfer assets. In the “To” field, select the blockchain network you want to transfer assets to.

- Choose Your Asset: In the “Choose Asset” field, select the type of asset you want to transfer.

- Connect Your Wallet: Click the “Connect Wallet” button and follow the prompts to connect your digital wallet.

- Enter the Receiving Address: Enter the receiving address on the destination blockchain network in the “Address to send your assets” field.

- Enter the Amount: Enter the amount you want to send in the “Amount to send” field.

- Approve the Transaction: Click the “Approve” button and confirm the transaction in your digital wallet.

- Send the Assets: Click the “Send” button to initiate and confirm the transaction in your digital wallet.

- Wait for confirmation. Once the transaction is successful, click the “Continue” button.

- Connect the Destination Wallet: You can now connect your wallet to the destination blockchain network.

- Receive Your Assets: Click the “Receive” button to receive your assets on the destination blockchain network.

These steps may vary slightly depending on the specific cross-chain bridge and the blockchain networks involved, but the general process remains the same.

Also read: South Africa’s Foreign Minister Hints Three Countries Are Set To Join BRICS

The XRP Bridge: An Example of a Cross-Chain Bridge

The XRP Bridge is a prime example of a cross-chain bridge, supporting the transfer of XRP between the Ripple network and other blockchains.

Orbit Chain, an interoperability-focused blockchain project, developed the XRP Bridge.

Orbit Chain’s XRP Bridge supports a number of blockchains, including Avalanche, BNB, Celo, Fantom, Gnosis, Harmony, HECO, Klaytn, Moonriver, OKC, Orbit, Polygon, and Ripple.

It also supports a range of wallets, such as Coinbase Wallet, DCENT Wallet, Kaikas, Klip, MetaMask, and WalletConnect.

The XRP Bridge has integrated protocols like KLAYswap (Klaytn) and Meshswap (Polygon), further enhancing its functionality.

By enabling the transfer of XRP to heterogeneous chains tied to centralized exchanges or personal wallets, the XRP Bridge has significantly expanded the cross-chain DeFi ecosystem.

Can Banks Use Ripple without XRP?

While Ripple’s payment protocol, known as RippleNet, does not require XRP, its On-Demand Liquidity (ODL) service does.

ODL leverages XRP as a bridge currency to facilitate real-time, cross-border transactions. This means that while banks can use Ripple’s payment protocol without XRP, they cannot use Ripple’s ODL service.

Can Ripple Succeed without XRP?

While Ripple, the company, has other products and services that do not require XRP, the success of XRP is closely tied to Ripple’s overall success.

XRP is a core component of Ripple’s ODL service and a major part of Ripple’s vision for enabling instant, low-cost international money transfers. Therefore, Ripple’s success is likely to be significantly impacted if XRP fails.

Will XRP be the Bridge Currency?

Given its use in Ripple’s ODL service, XRP has the potential to become a major bridge currency in the world of international finance.

By providing a common denominator between different fiat currencies, XRP can facilitate faster, cheaper cross-border transactions.

However, its success in this role will depend on a variety of factors, including regulatory developments and adoption by financial institutions.

Conclusion: How to Bridge the Ripple

Cross-chain bridges, with the XRP Ledger and XRP at their core, have the potential to reshape the DeFi landscape significantly.

By enabling seamless asset transfers between different blockchains, they can unlock many new opportunities for traders and investors.

As the DeFi ecosystem evolves, the role of cross-chain bridges and assets like XRP will likely become increasingly important.