The digital asset industry maintains a host of opportunities and entry points for investors. Moreover, your intrigue in the sector will be confronted with a host of questions, such as, What cryptocurrency do you favor? And what are your profit goals when investing? Subsequently, we’re going to discuss one of the most prominent assets and divulge how to long Ethereum (ETH).

There are a large variety of ways that one can approach the purchase of digital assets, and how to handle that acquisition. Moreover, understanding trading strategies, when to buy or sell, and the difference in long or short positions can only inform your trading. Thus, we uncover a step-by-step approach to longing ETH, and why that could be so beneficial.

Why Ethereum?

In the digital asset industry, there are two assets that have risen among the host of competitors. Specifically, those are Bitcoin (BTC) and Ethereum (ETH). The latter has been observed as one of the most integrated and utilized blockchain networks that the industry has to offer.

Conversely, both assets are similar in a few ways. Specifically, they both offer digital currency that is traded through cryptocurrency exchanges. Yet, there are still distinct differences that separate the two, and present ETH as a positive investment, especially in a long position.

Ethereum is a blockchain technology that was created in 2015, and supports use cases that extend beyond simply digital currency. Moreover, Ethereum enables the building and deployment of smart contracts and dApps with no downtime or control from a third party.

This is done with the use of the network’s own programming language that turns on its blockchain. Alternatively, Ether is utilized as a digital currency, held as an investment, utilized for the purchase of certain goods, or USD on the Ethereum network to pay certain transaction fees.

Since the highly publicized Merg development that saw the consensus mechanism change from a proof-of-work (PoW) to a proof-of-stake (PoS) model. Subsequently, the asset presents a good opportunity for those who desire to take a long position on Ethereum (ETH).

What is Longing ETH and How Does it Work?

The idea of longing Ethereum is essentially just predicting that the price of ETH will increase over time. Moreover, if that prediction, or wager, does come to fruition and the price does increase, you could make a profit. Alternatively, if the price decreases, you would make a loss.

Alternatively, the process is quite simple when it is defined. Essentially, you will fund your long position with some of your own funds, and some funds that are borrowed. Moreover, you would pool together these various funds in order to then buy ETH.

After the ether is purchased, you would hope to sell the asset for more than you paid. Subsequently, fulfill the entire purchase of your investment. Moreover, you would hope that when this sale does take place, it will come with a profit that you’ve made. Conversely, when the trade has closed, you would be required to pay back the borrowed funds in full, despite what the outcome of the sale was.

The Concept of Leverage

Leverage crypto trading is essentially the practice of using borrowed funds to enhance your buying or selling power. Moreover, the process allows traders to open larger positions than the funding they have for specific investments. Although it changes regarding the exchange used, traders could leverage as much as 100x the account available in their balance.

Subsequently, leverage allows traders to buy or sell assets even if they don’t specifically hold that leverage. Moreover, it paves the way for investors to then open a long or short position regarding a cryptocurrency, based on the collateral that was deposited.

Before using leverage, the trader must have a funded account. Subsequently, the initial capital deposited into the trading account is called collateral. Thus, depending on factors such as leverage, the value of the position you seek to hold and the crypto, the collateral required, or margin, will change.

The amount of that leverage will typically be expressed as a ratio. Moreover, a 1:10 leverage position shows that the trader is seeking to increase their position size tenfold, or 10x. For example, if we would like to invest $1,000 into Ethereum with 10x leverage, we would be required to input collateral of 1/10 of that $1,000. Specifically, you would be depositing $100 to open a $1,000 position on Ethereum.

Alternatively, caution is strongly recommended, as the trader will be required to pay both interest on any borrowed capital and losses on the leveraged position. Thus, proper leveraged positions can be a great way to make money and increase your ETH as the price rises.

How to Long Ethereum

In this step-by-step guide, we’ll break down how to long Ethereum (ETH) on the Binance exchange. Moreover, the guide will show you how to take profit orders, amid the process of longing Ethereum.

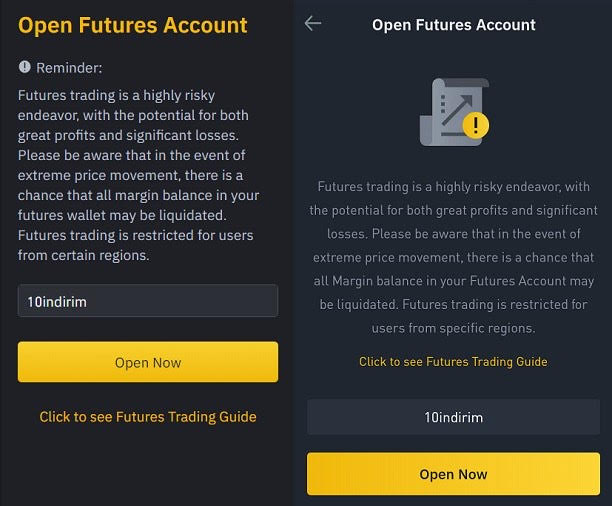

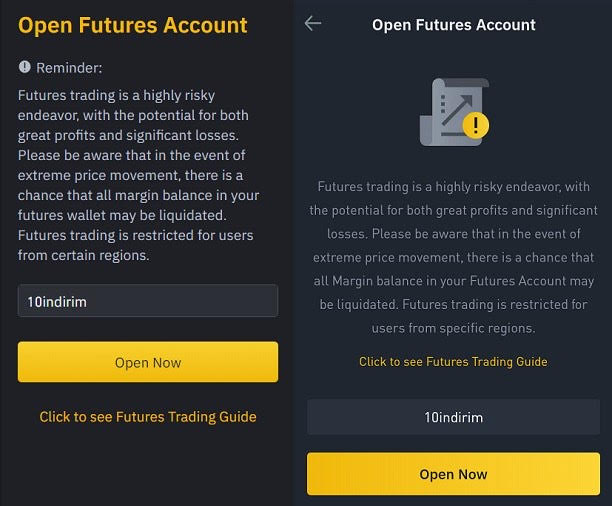

Open a Binance Futures Account

The first thing you will need to do is open a Binance account. Specifically, you will open your Binance Futures account. Opening an account is a rather simple process, especially if you already have an account on the platform.

From there, you will click on the futures tab on your mobile device, or the USDS-M Futures under the derivatives dropdown feature on the exchange’s website. Then, you can click to either pair the ETHUSDT or ETHBUSD under the USDS-M tab. Conversely, you can select the ETHUSD pair under the COIN-M tab to open a long position on Ethereum.

Place a Buy/ Long Order

After opening your account, you will be prompted to select the leverage of your choice. However, it is important to note that if your account is new, you won’t be allowed to use more than 20x leverage. It is set to increase after 60 days of opening the Binacen Futures Account.

Then, you will click “Buy” to place your long order. Conversely, “sell” is for opening short positions or closing your long positions. If you were to select the “S” beside your leverage, you could alter the asset mode from single-asset to multi-asset. Yet, if you utilize the isolate margin mode, you won’t be able to change it to multi-asset mode.

Then you’d want to open up your long position. Subsequently, after entering the price you want to open your position at, and the position in either ETH or USDT, you can click the “buy/long” option to place the order. Conversely, you can place a market order to open a long position if you don’t have a specific price in mind and want an immediate order to be filled.

After your buy/long order is filled, you will be able to see your position under the “positions” tab. Additionally, the liquidation price is the price at which your position gets liquidated, so you will lose your margin balance. Moreover, PNL displays your unrealized profit loss, and ROE is the equivalent figure presented as a percentage.

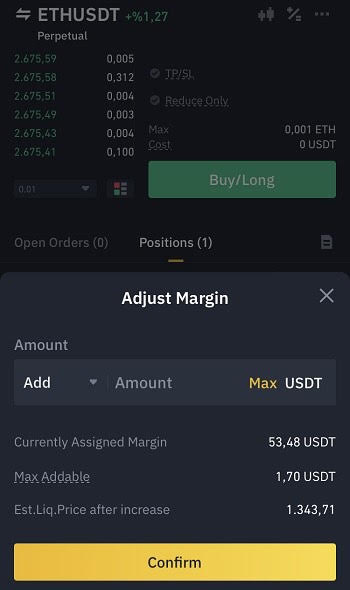

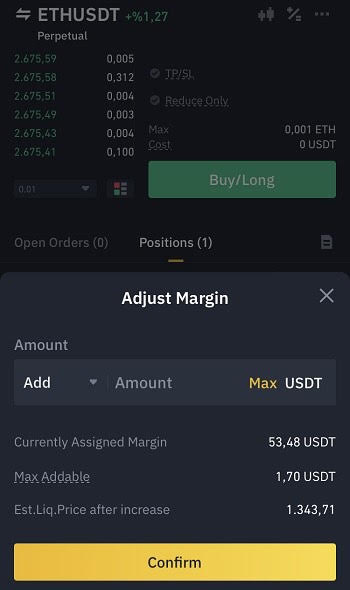

Adding or Removing Margin

The process of longing Ethereum comes with the risk of liquidation. Additionally, that risk increases if the price falls below the entry price. However, you can lower the risk of liquidation by adding a margin to your position. To do so, you can click the plus icon that is next to the margin.

By adding margin to your position, you can lower the real leverage as the position does not fluctuate. Subsequently, liquidation becomes less likely than before. Alternatively, it is possible to remove the margin from your position when you have unrealized profits.

If you can’t remove margin from your position but still want to, you’d have to increase leverage. Thus, by lowering the margin required for your position after increasing leverage, you can remove the margin from your position. However, removing margin will increase the risk of liquidation along with the liquidation price.

It is important not to confuse increasing leverage with an increase in your profit. The profit, or loss, is calculable based on both the size of your position and the price. Subsequently, adding or removing margin does change the position size.

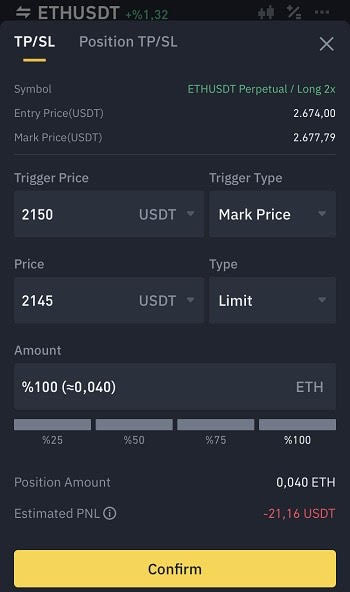

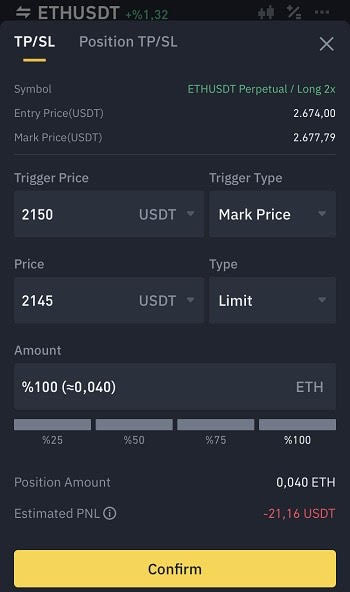

Profit Orders

Placing a stop loss and taking profit orders is as easy as selecting the “stop profit and loss” button available on the futures page. Moreover, you can opt to “sell” and change the order type to “stop limit.” Thus, placing a stop loss and taking profits from your long position.

In order to place a stop-loss order on your long position, you’d want to input a trigger price below your entry price. Then, input a limit price that is either equal to or below the trigger price.

You are able to close your entire position, or even a part of it, through a stop-loss order. In order to take a profit from your long position, you’d have to enter a trigger price above the entry price. Then, input a limit price that is equal to or above the trigger price. Additionally, your take profit and stop loss orders are viewable under the “open orders” tab.

It is important then to note that USDS-M Futers has a maker fee of 0.02% and a taker fee of 0.04%. Thus, it is important to calculate the trading fee that you will pay when you open or close a position. Conversely, there are Binance Fee Calculators available for spot and futures trading. Moreover, these tools can be immensely valuable.