Amid a host of trading strategies in the digital asset industry, short selling is an immensely attractive option. Moreover, as the industry continues to fluctuate due to inherent volatility, the concept has become popular with those who forecast a price decrease, and observe profit-making potential. So, let’s discuss in greater detail how to short Ethereum (ETH).

Ethereum is among the most widely known names in the digital asset industry. Nevertheless, the blockchain platform has increased its value exponentially since its arrival in 2015. Yet, as macroeconomic factors have influenced the industry, it may well be shaping up to be a good time to short.

So, let’s observe the trading strategy, and its potential profit for investors, amid Etheruem’s long-term outlook.

What is “Shorting”

The trading concept of short selling, or going short, is a widely known financial strategy. Specifically, it constitutes an investor borrowing crypto, and selling it with the expectation that the price will go down. Moreover, if the price indeed drops, the investor is set to purchase back the same number of digital assets at a lower price, return them to the original lender, and collect the difference.

With Ethereum, short selling means essentially the same thing, but with a focus on ETH. Subsequently, short selling is the process of borrowing with the intention of selling, while waiting for the perfect time to buy back the assets to be returned.

If done correctly, short selling can generate recent profits. Moreover, modern technology has made the process as simple as it has ever been. Specifically, some platforms can orchestrate the entire process in an automated way.

The only requirement for the trader is to observe market trends and conclude whether prices could rise or fall. If you confirm that the prices will fall, you opt to short-sell and pocket the available profits.

Understanding the Risks

Conversely, like all trading strategies, it is vital to understand the risks. Chief among those risks is the potential to lose more than you have deposited, which is why judgment and analysis are incredibly important before any decision is made.

Some traders can suffer from over-trading, which is overleveraging trades amidst high volatility. Subsequently, a tumultuous market could see the investor suffer from an ETH upswing of hundreds in mere minutes.

Another risk is what many call unlimited downside potential. This is essentially the idea that when prices fall they can only reach $0, but they can feature an unlimited rise. Thus, unexpected developments could invoke a price spike that wasn’t accounted for.

Volatility is another key risk in the digital asset industry, but short selling specifically. Now, price volatility can absolutely equate to profits, but the opposite could become a reality as well.

Subsequently, protection against these downsides can come from active management. However, it is impossible to forgo the risks available to all traders. Conversely, a focus on price developments, a grasp of market fundamentals, and technical levels could be the difference between large losses and holding steady in the digital asset sector.

How to Short Ethereum

Margin on Exchanges

One way to short Ethereum is to utilize the margin facility that is present on a cryptocurrency exchange. Moreover, this option allows a transaction for your short trade to take place without your knowledge of the person for whom you are borrowing.

The process of using margins on exchanges is an automatic function. All that is required of you is to hit the “sell” button to short, and the “close” button to close. Moreover, the process becomes immensely easier, only requiring an understanding of the trading fundamentals to know when to short.

Using the margin facility on exchanges also presents the ability of margin trading to users. Moreover, this allows the borrowing of more coins than the size of your trading account. Subsequently, the opportunity for profits is presented.

Go Short by Going Long

Another interesting way to go short on Ethereum is to go long somewhere else. Specifically, by observing an inversely correlated market, you could take advantage of the opposite direction of a different asset.

Subsequently, if you, for example, observed that Bitcoin could outperform Ethereum, you could initiate this process. By purchasing and going long on Bitcoin, you could exchange it for Ethereum after the price has fallen. Then you would be set up to benefit from the ETH price decline. Yet, without having to have gone short on the asset itself.

PrimeXBT

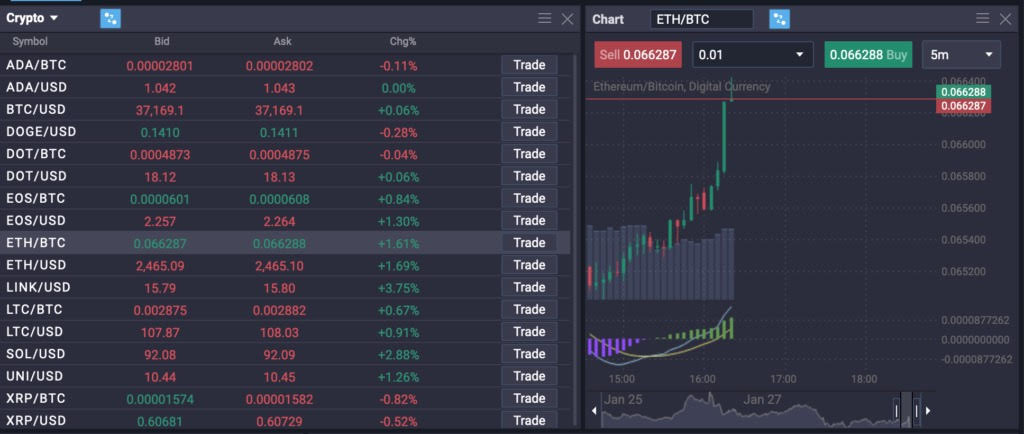

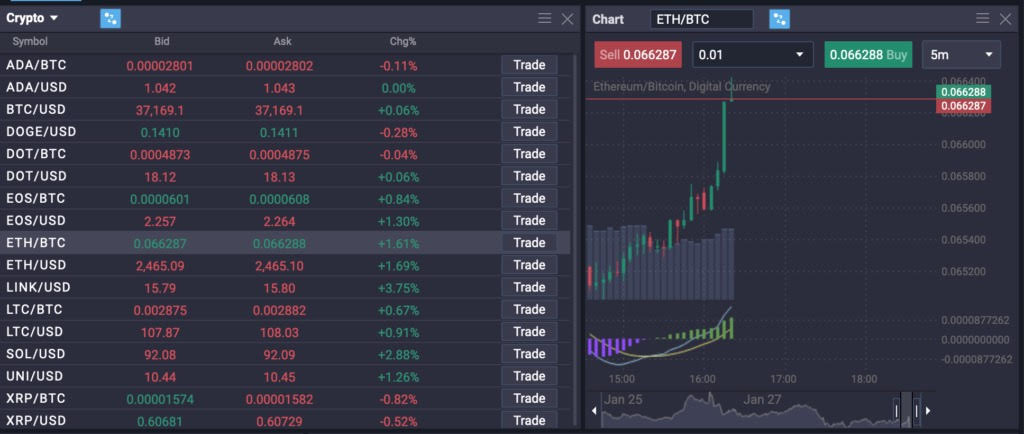

Another way of going short on Ethereum is by using the PrimeXBT platform. The user interface of the platform makes the process very simple. Specifically, you only have to choose the cryptocurrency you want to short on the market list. Then, the platform will display the price chart of Ethereum. Alongside this, you have a host of different functions and trading tools at your disposal.

In order to short Bitcoin against Ethereum, per se, you would select ETH/BTC. Then, you would profit when the price of ETH falls in relation to the price of Bitcoin. Conversely, if you want to short against USD, then you’d simply select the ETH/USD option.

Subsequently, you’d utilize your own trading and technical analysis to make an informed decision. Doing this would allow you to observe and locate a profit opportunity on the market. Finding technical levels that could benefit you is important to help you develop a high-probability trading setup.

Once you’ve located the level that you want to short, you can define the trading size. Here, you’d take into account the leverage ratio and the required margin to conduct the trade. Moreover, an example would be if ETH is trading at $2,000, and you want to purchase 10 ETHs. If you wanted 100:1 leverage, your margin would be $200.

Moreover, you would need to have at least the necessary $200 in your account in order to open the trade. Specifically, understanding and making note of your required margin is tremendously important.

Subsequently, when you’ve observed your position size, you can click the “sell” button, and your trade will appear in the “positions,” portion of the platform. Thus, you would have shorted Ethereum and hopefully been able to profit from the coin’s descending process.

When Should You Short?

Although shorting is a good financial strategy, knowing when to short becomes a very tricky prospect. There are a host of market factors that could be vital in defining when it is an appropriate time to short. Alternatively, various factors could be signaling that shorting Ethereum is not optimal for profit potential.

Ultimately, the best way to know when to short is by looking for various technical factors on the ETH chart. Specifically, observing things like bearish patterns, a head and shoulders pattern, or a bearish wedge could signal a good short-selling opportunity.

Alternatively, uncertainty could indicate a good short-selling window. Regulation concerns, or high market risk that could lead to an overall downturn are good instances. Conversely, staying up to date on technical analysis of Ethereum, and the best times to short sell will eventually show themselves.