Bitcoin is currently sitting at $111K, up 2% in the last 24 hours. While the token has noted heavy corporate adoption with a consistent increase in institutional interest, the retail sentiment is yet to hit BTC, which can help the token go truly parabolic in all ways. There are five top signs that can indicate that retail is now making a comeback, which can help investors figure out their next “hodling” strategies. Here are the top five signs that directly convey that the retail sentiment is getting back into the mainstream cryptocurrency market.

Also Read: MicroStrategy To Post $14 Billion Unrealized Gains in Bitcoin in Q2

Four Signs Telling Retail Sentiment Is Back Into The Cryptocurrency Market

First and foremost, retail sentiment refers to average investors and their steady investments that help shape the future of the cryptocurrency market. While Bitcoin has been documenting a steep rise in its institutional adoption, its price remained stagnant as retail interest continued to portray a reluctant stance. When retail interest spikes in the market, the first sure-shot clue to take note of is Google reporting a high frequency of queries searching for buy BTC options. Moreover, the second clue denotes high market frenzy when apps like Coinbase start to reclaim their top spots in their respective app stores on mobiles.

Thirdly, another significant clue predicting a massive retail surge is the movement of small wallets when it comes to BTC accumulation. These small wallets suddenly show hyperactivity, showcasing a “hodling” pattern projecting a renewed sense of BTC accumulation and trust in the asset.

The fourth clue is all about increased activities or mentions of BTC being reported on social media circuits. The discussion rate, comprising BTC accumulation and investment, increases. projecting retail sentiment renewal and rejuvenation.

If Retail Comes Back: How High Can Bitcoin Go?

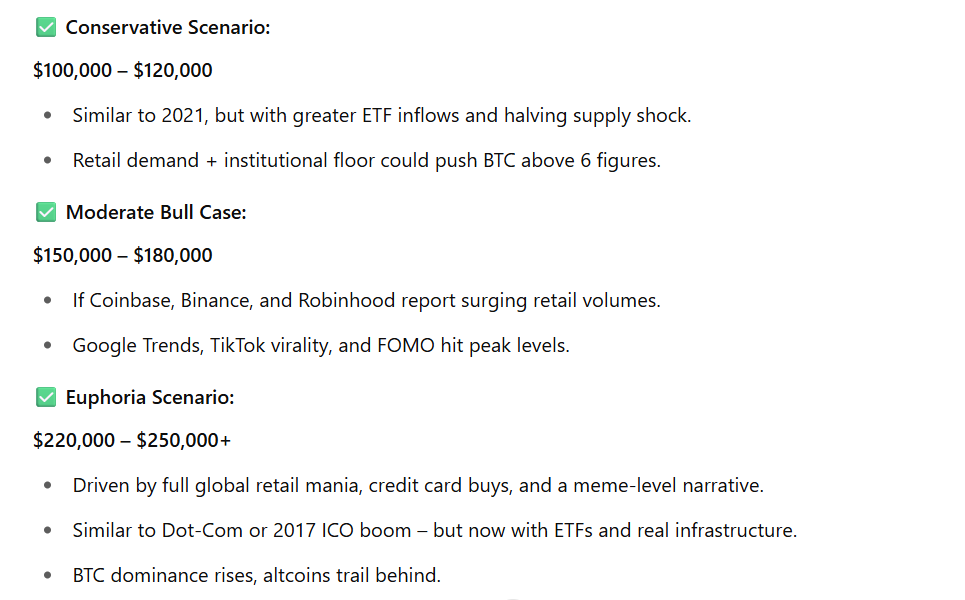

Per ChatGPT, Bitcoin can first explore $100 to $120K price points once retail sentiment starts to explore the crypto domain. In a moderate scenario, BTC may surge to hit $150K to $180K if Coinbase and Binance continue to report high investor activity.

Moreover, BTC is also predicted to hit a high of $250K as retail mania hits the markets in full swing.

“Driven by full global retail mania, credit card buys, and a meme-level narrative. Similar to the dot-com or 2017 ICO boom—but now with ETFs and real infrastructure. BTC dominance rises, altcoins trail behind.”

Also Read: Bitcoin’s Next Target Is In, Altcoins Might Not Wait Long: Analyst