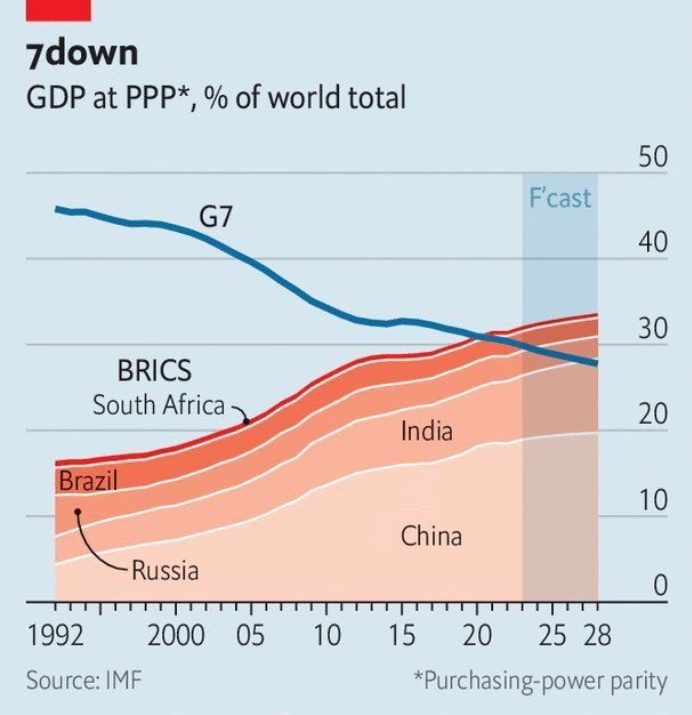

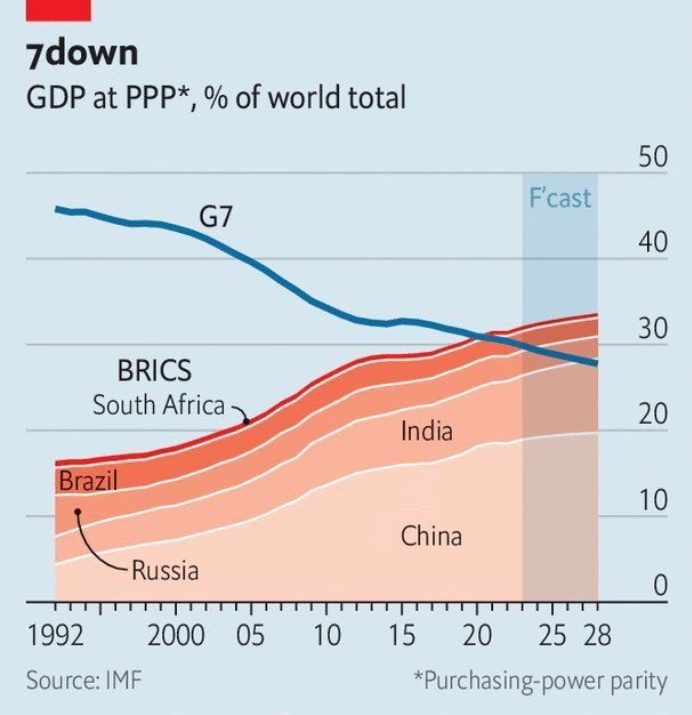

The latest chart from the International Monetary Fund (IMF) shows a major 21st-century shift where the BRICS GDP in purchasing power parity (PPP) is growing, while the G7 is on the decline. Countries such as China, India, and Brazil are growing at a faster pace compared to the West.

In 1992, the countries that are in the BRICS bloc roughly accounted for less than 20% of the global output. The G7 nations accounted for approximately 45% of the global output, making them distantly ahead of the rest. Fast-forward to 2025, the tables have turned with the IMF forecasting that the BRICS GDP in PPP will climb over 31% while the G7 will fall below 30% by 2028.

BRICS members China and India dominate the shift against the G7 in GDP (PPP). Both countries represent nearly two-thirds of BRICS output, thanks to their vast and ever-growing population, which results in productivity gains. For context, China’s GDP in PPP was 5% in 1990 and has climbed to 19% now. India was at 3% and has soared to 8% during the same timeframe.

Also Read: India, South Africa Lead BRICS Gold Buying: Official October 2025 Data

BRICS vs G7: The GDP Powerplay

While the economies of BRICS nations are growing, G7 countries are facing financial stagnation. They are also facing demographic headwinds that are limiting their growth potential. While this is not a direct threat to Western nations, it is symbolic, as it’s realigning the economic gravity. Western nations have always been at the forefront of all economic progress, while the East was catching up.

Also Read: MPs From Germany To Attend BRICS Summit in Russia

While the last 30 years realigned in favor of BRICS, the next 30 years could chart a new course and challenge the G7. In 2025, the G7 bloc remains financially healthy with strong currencies, job market, and commodities. Whether it will hold up for the next 30 years, only time will tell. The financial landscape is changing, and the upcoming decades will be much different from what we know today.