As crypto has gotten more popular, so has its use for illicit activities. According to a new report by Elliptic, cross-chain bridges and decentralized exchanges (DEXs) are becoming the new frontier for laundering funds. The study noted that bridges and DEX’s have allowed an unobstructed flow of funds between crypto assets.

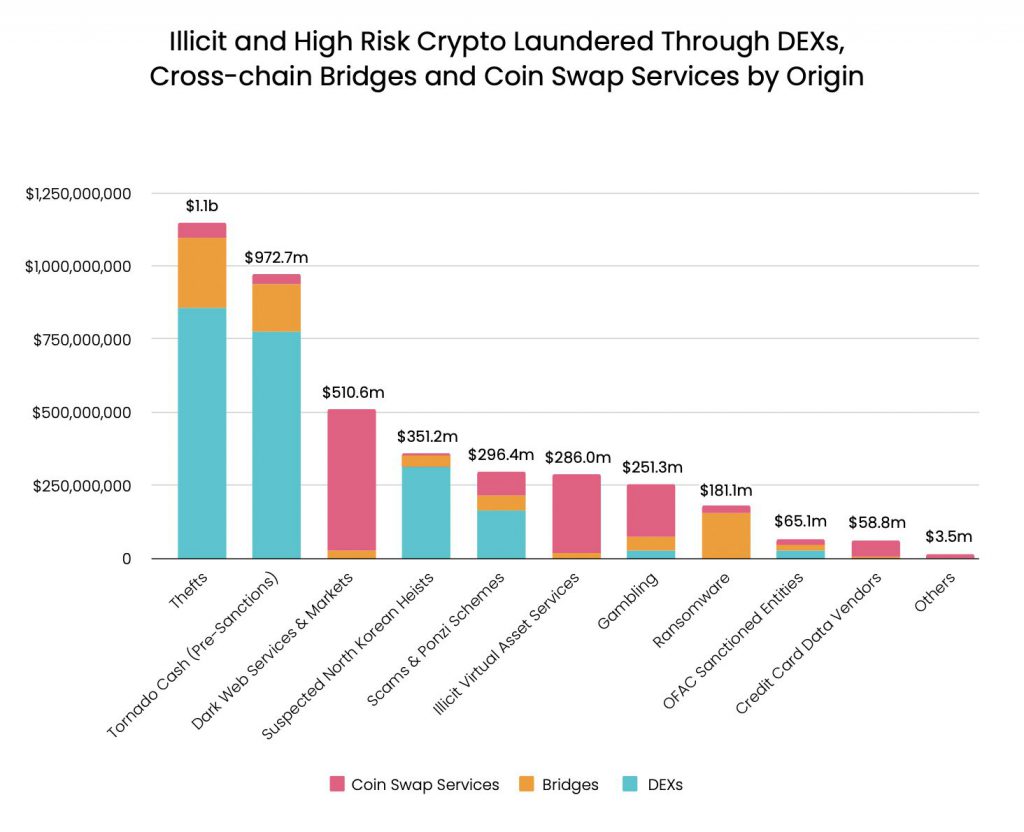

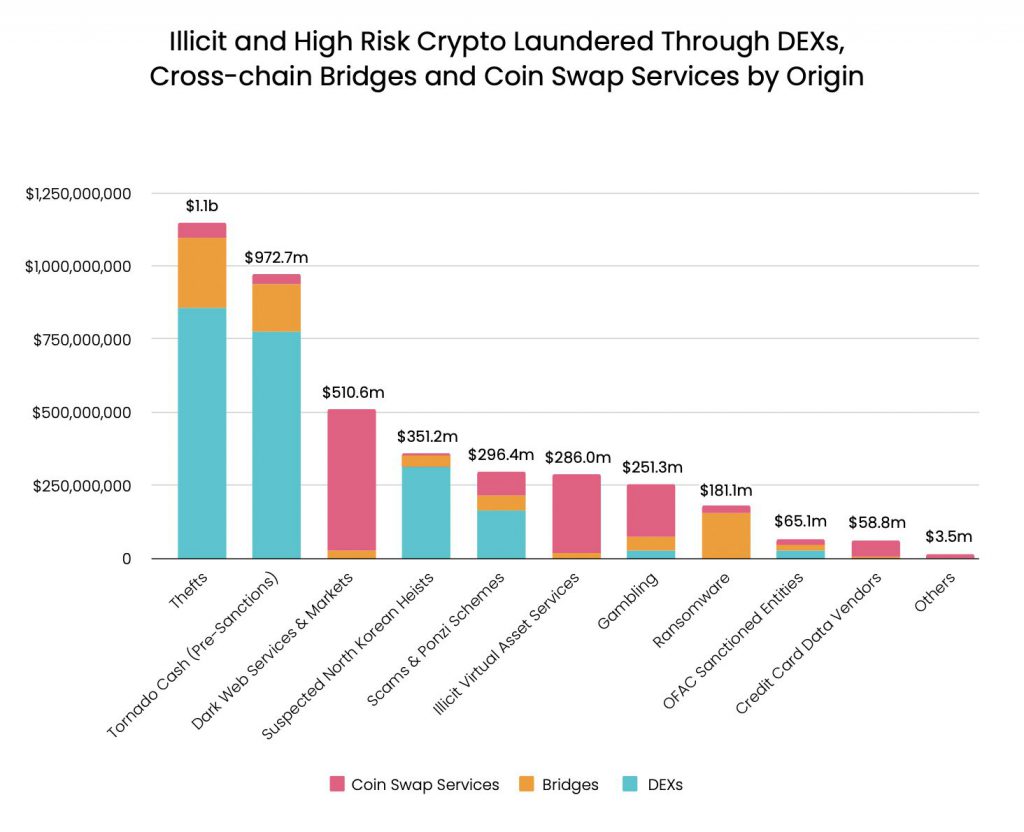

As per the report, at least $4 billion worth of illicit cryptocurrency gains has been laundered using cross-chain bridges, DEX’s and coin swap services. Over $1.2 billion, which is over a third of the surveyed incidents, was traded on DEX’s. An additional $1.2 billion has been laundered using coin swap services.

Cross-chains allow users to send crypto assets from one blockchain to another. DEX’s on the other hand allow cross-asset swaps on the same blockchain. And coin-swap services allow users to exchange different assets without the need to create an account. Criminals are attracted to these services due to the lack of AML (anti-money laundering laws) and KYC (know-your-customer) checks.

The report names Ren Bridge as the most popular cross-chain bridge to launder crypto assets. More than $540 million worth of illicit assets has passed through the Ren Bridge, according to data. Meanwhile, Curve and Uniswap were responsible for over half the swaps that took place on DEX’s.

The Ronin bridge was exploited in March by the North Korean group Lazarus. The hackers swapped stolen USDC for ETH using two DEXs. Soon after they began laundering the funds through Tornado Cash mixer. Some of the funds were bridged via a cross-chain to the Bitcoin (BTC) blockchain. These were then laundered using Blender.io mixer.

Are these crypto services only used for crime?

The report clarifies that the use of DEX’s by criminals does not represent the complete use of these exchanges. The study noted that a majority of uses are still for legitimate purposes.

Furthermore, in August of this year, Ellicit created a tool to trace crypto assets between and across blockchains. This is an effort to combat the cross-chain problem in the industry.

Last month a group of Stanford researchers proposed a new method to combat crypto thefts. It surrounds an opt-in token standard called ERC-20R, which allows transactions to be reversed.