While Bitcoin [BTC] and other cryptocurrencies try to thrive through the bear market, projects in the industry were falling apart. Regulators seem to be more stringent than ever. Indian authorities in particular haven’t warmed up to the industry yet. Prominent crypto platform Vauld seems to be swimming in troubled waters as the Enforcement Directorate [ED] of India had eyes on it.

On Thursday, the ED went on to freeze a whopping $46.5 million [Rs. 370 crore] worth of assets at Vauld.

The timing of this development couldn’t have been more wrong. It should be noted that Vauld went on to suspend all deposits, withdrawals, and trading on its platform back in July. While the firm has been trying to work its way through bankruptcy it recently sought protection from creditors. It was further brought to light that the firm owes a whopping $400 million to its creditors.

With the ED freezing its assets, Vauld could land in more trouble.

Is the Indian crypto scene on the verge of dying?

The love-hate relationship that Indian authorities entail with the crypto industry has been a difficult sight to watch. Just last week, the ED froze assets worth $8 million on WazirX. It should be noted that WazirX was one of the earliest crypto platforms and it is currently the largest exchange in the country. Its volume had even exceeded $43 billion back in 2021.

It’s likely that the ED would take control over several other Indian Non-Banking Financial Company firms. Money laundering seems to be a significant concern to them at the moment.

Amidst all of this, the 30 percent tax on cryptocurrency has taken a toll on the market.

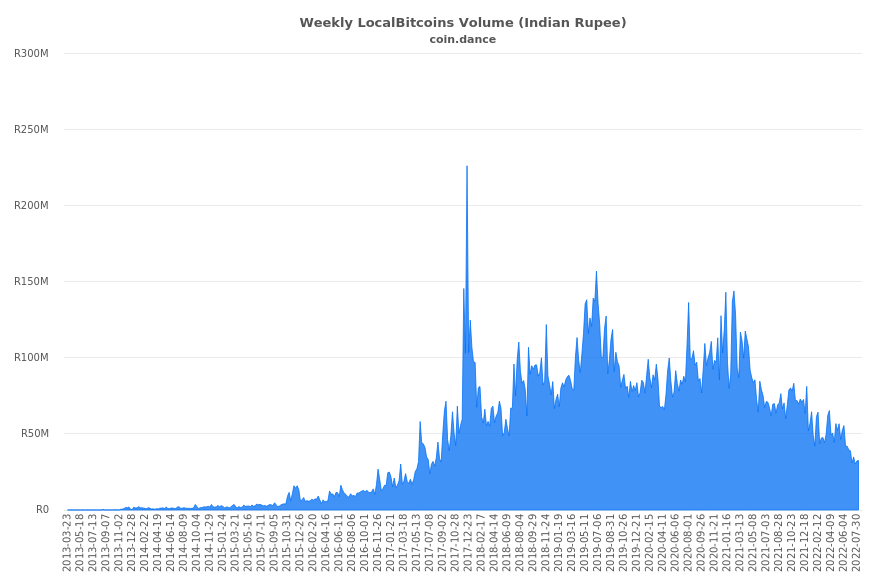

The above chart shows how the weekly LocalBitcoins volume of the country has witnessed a gradual decrease. While the entire globe has been embracing crypto, Indian authorities have been heavily scrutinizing the industry.

Additionally, if this notion persists, the likelihood of the collapse of the Indian crypto scene was guaranteed.