Ethereum has been plummeting this month as it dipped from $1,800 to $1,200 in a week. The largest Altcoin then fell below the $900 mark last week indicating signs of concerns in the crypto sphere. ETH managed to claw back above $1,100 yesterday but the crypto is yet again dipping and is down 7% today. Institutional investors are now overlooking Ethereum due to under-performance and they are investing in its rival Solana instead.

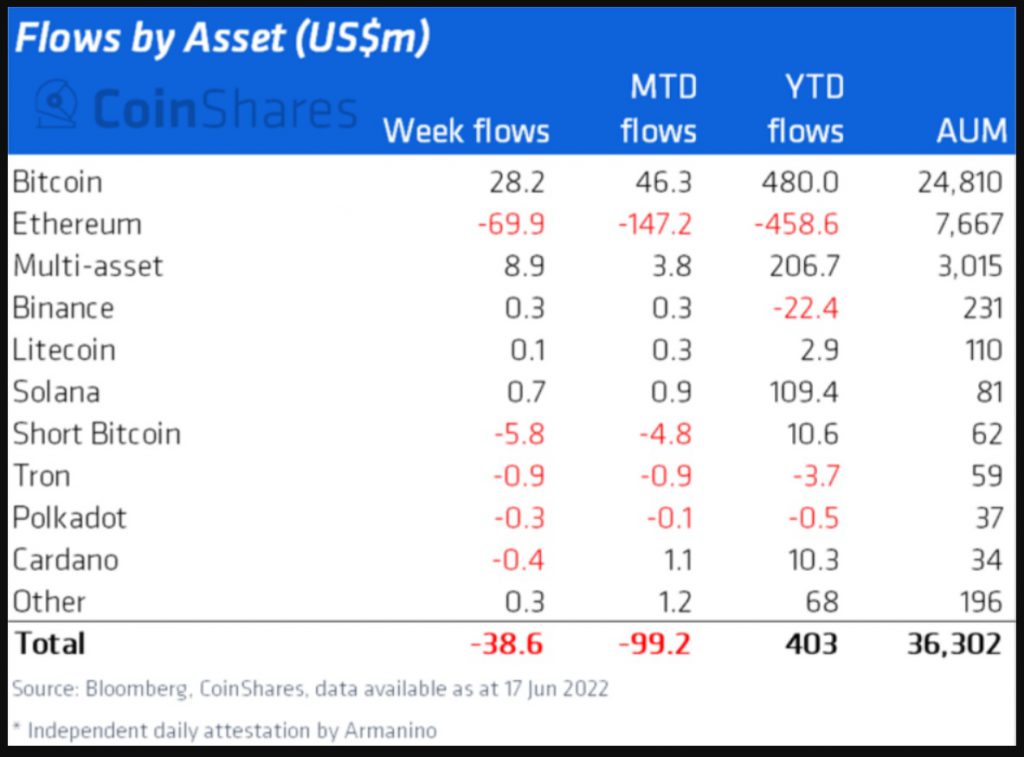

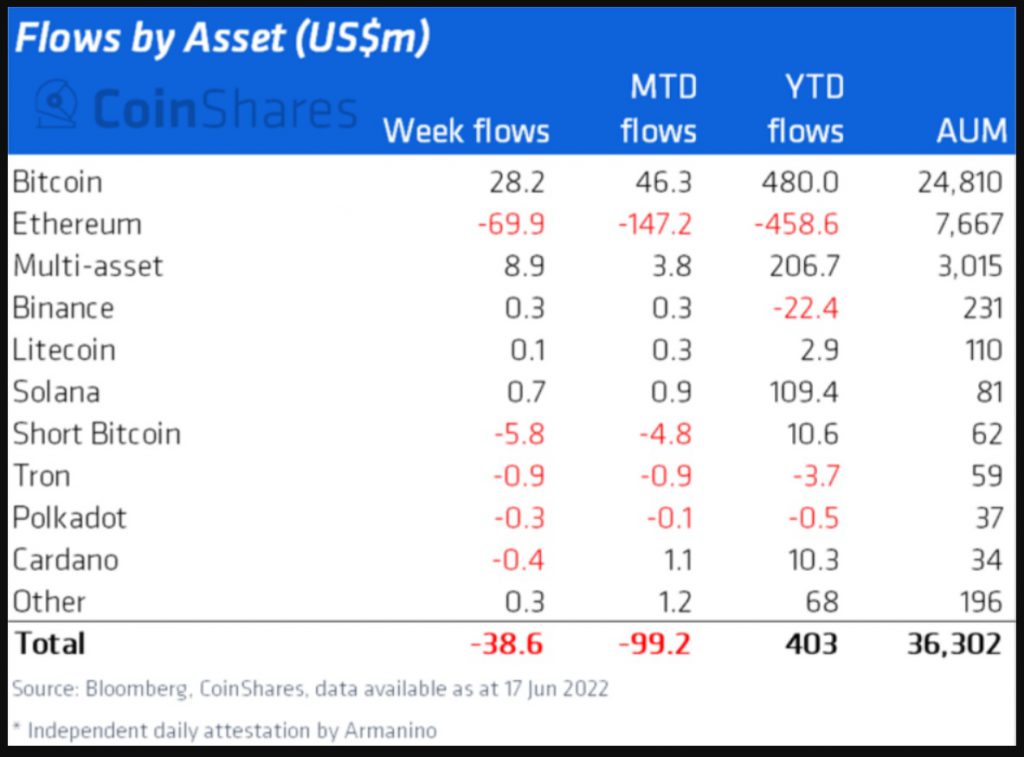

CoinShares, the leading digital assets firm released its ‘Asset Fund Flows Weekly’ report and data indicated that Ethereum has suffered 11 weeks of continuous outflows. The total institutional outflows for Ethereum stood at $459 million for 11 straight weeks. During the crash last week, Ethereum had an outflow of $70 million from institutional investors.

Read More: How Much Dogecoin Does Tesla CEO Elon Musk Own?

“Ethereum continues to suffer from outflows totaling $70 million last week. Having suffered 11 straight weeks of outflows, bringing year-to-date outflows to $459 million,” the report read.

Also, Solana is benefitting from the sufferings of Ethereum as institutional investments in SOL have spiked. “Solana looks to be benefitting from investors’ worries over The Merge (ETH2), with inflows of $0.7 million last week and $109 million year-to-date,” CoinShares report stated.

However, despite the large institutional inflow of funds, Solana is still trading on the backfoot. The 9th biggest cryptocurrency has been trading in the ‘red’ this month and it is down nearly 8% today. SOL fell 87% in 7 months from its all-time high of $259, which it reached in November last year.

Read More: Bitcoin Will Still Crash By Another 50%

Ethereum, Solana & All Cryptos Face the Hammer

The global economy is in murky waters as inflation has reached 8.6%, its highest in 40 years. Gas prices are up 233% in many U.S states and the price of daily essentials has drastically shot up.

On the other hand, wages have remained stagnant while the price of commodities and even rent are increasing at a rapid pace. The purchasing power among consumers has reduced and several analysts are speculating on an upcoming recession.

Therefore, both the stock and the crypto market might soon come under the hammer and face further corrections. It is advised to remain cautious during this period as pinpointing the exact ‘dip’ could get harder.