The quantum computing market is heading toward a massive $125 billion valuation by 2030, yet several industry leaders and numerous analysts can’t agree on when we’ll see real-world quantum technology applications. Multiple quantum computing stocks show some serious ups and downs, perfectly capturing this tension between huge future potential and various current roadblocks.

Also Read: Malaysia’s PM Discusses Crypto Future with Binance’s CZ: A Step Toward Global Competitiveness

Navigating the Quantum Computing Landscape: Investment, Risks, and Opportunities

Market Sentiment Shifts After Industry Leaders’ Comments

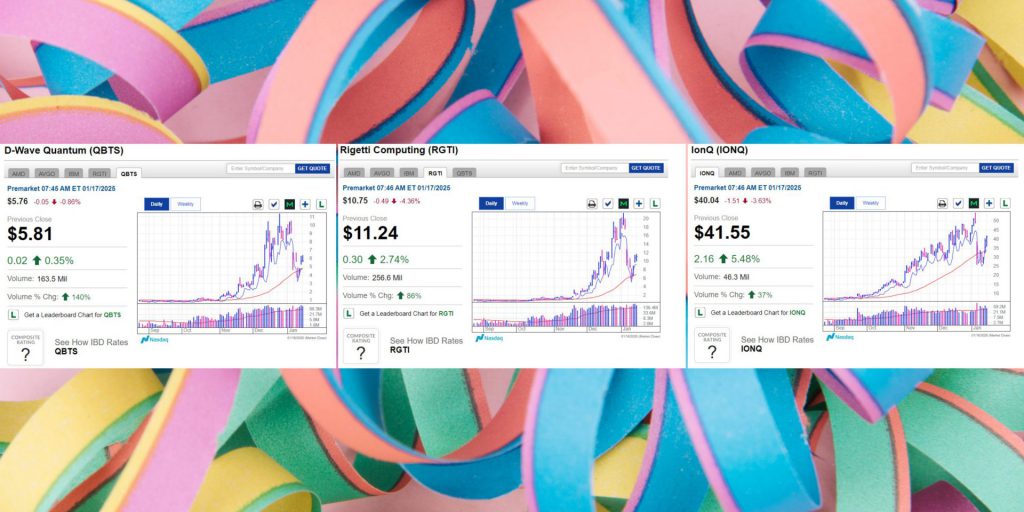

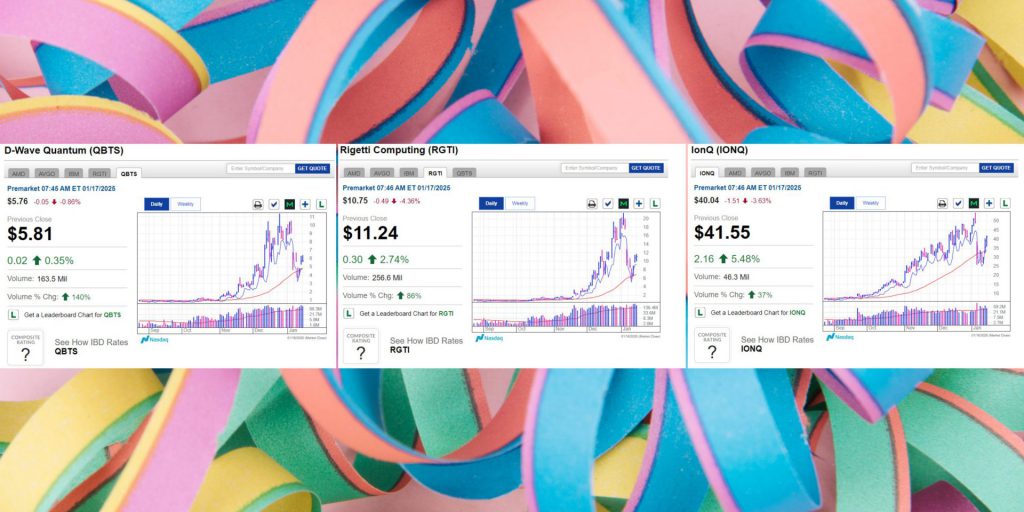

The quantum computing market took some wild turns after Nvidia’s CEO Jensen Huang dropped a truth bomb about quantum tech needing “decades to become very useful.” Multiple quantum computing stocks – D-Wave (QBTS), Rigetti (RGTI), and IonQ (IONQ) – initially tanked but have since bounced back with some impressive recoveries.

“It’s just too early in quantum computing to have any reasonable idea of future revenues and profits,” Bill Stone, chief investment officer at Glenview Trust, tells it straight.

Also Read: De-Dollarization: 2 Countries Mutually Abandon the US Dollar For Trade

Government and Corporate Investment Continues

Several quantum industry growth indicators remain strong despite the skeptics. In a wild turn of events, numerous quantum industry players are making serious power moves – D-Wave just dropped a game-changing partnership bomb with Carahsoft, while IonQ is flexing with their massive $1 billion “Capital of Quantum” initiative, bringing some next-level quantum tech vibes to the University of Maryland. “This partnership is crucial for speeding up the government’s adoption of quantum computing,” Lorenzo Martinelli, D-Wave’s chief revenue officer, said.

AI and Quantum Computing Convergence

The quantum computing market is getting seriously intertwined with AI development. D-Wave’s CEO Alan Baratz drops this knowledge bomb:

“There is massive potential for AI and quantum to work together to advance the limitations of today’s classical computing capabilities. Quantum will enable AI model training and inference that runs much faster with much lower energy consumption.”

Long-term Industry Outlook

Various quantum computing stocks are riding the wave of long-term potential while dealing with numerous short-term hurdles. John Chambers, former Cisco CEO, keeps it real: “Quantum will really make a difference. But perhaps we’re early. I’m still as optimistic long term on quantum as I was five years ago. But I do not see it in the short run.”

Also Read: The U.S. Dollar Could Get More Stronger in 2025

Multiple quantum technology developments continue attracting serious investment despite some market doubt. IonQ’s CEO Peter Chapman brings the heat, stating he “expects natively quantum AI to outperform classical AI,” highlighting the quantum computing market’s wild ride between today’s reality and tomorrow’s possibilities.