The Internal Revenue Service [IRS] announced that cryptocurrency investors in the United States who receive rewards from staking services will be taxed. They will be required to report the value of those rewards as part of their gross income in the year it was received.

Gross income usually encompasses all forms of income, including money, property, and services. Staking rewards is the latest to join the list. Crypto staking has emerged as a significant revenue stream for both cryptocurrency exchanges and investors. However, like other aspects of the industry, staking activities are now being scrutinized by various regulatory bodies. The IRS is the current regulator to focus its attention on crypto staking.

In a recent decision, the IRS clarified that cryptocurrency investors who receive rewards for participating in validation activities on a proof-of-stake [PoS] network must consider those rewards as income in the year they gain control of the tokens. The ruling further read,

“The fair market value of the validation rewards received is included in the taxpayer’s gross income in the taxable year in which the taxpayer gains dominion and control over the validation rewards.”

In this context, “dominion” refers to the point when the investor obtains control and the ability to sell, exchange, or dispose of the cryptocurrency rewards obtained through staking.

Furthermore, those staking crypto assets through a cryptocurrency exchange will also have to deal with this ruling. If the investor “receives additional units of cryptocurrency as rewards” from the staking process, they must include the value of those rewards as part of their gross income.

Also Read: ARK Sells ~250,000 Coinbase Shares Amid Staking Vulnerability

Crypto community ‘disappointed’

After the recent ruling, many members of the community came forward to express their views. Jason Schwartz, a tax partner and co-head of digital assets at Fried Frank, expressed disappointment with the IRS’s latest decision.

Ryan Selkis, Messari’s founder, believes that the IRS’s treatment of crypto staking is similar to that of stock dividends. He believed that by including crypto staking rewards in gross income, the concept of a “stock dividend” has been applied to the crypto space.

Additionally, some individuals expressed confusion regarding which tokens would be subjected to taxation. The ruling does not provide specific clarity on whether it applies to the native tokens of a PoS blockchain. One Twitter user wrote,

“The ruling does specify native tokens of a Proof-of-stake blockchain. But the IRS has all types of crypto generally under the same umbrella (staking ETH/SOL vs staking an NFT). I believe this rule will apply across the board on all staking activity unless the IRS specifies.”

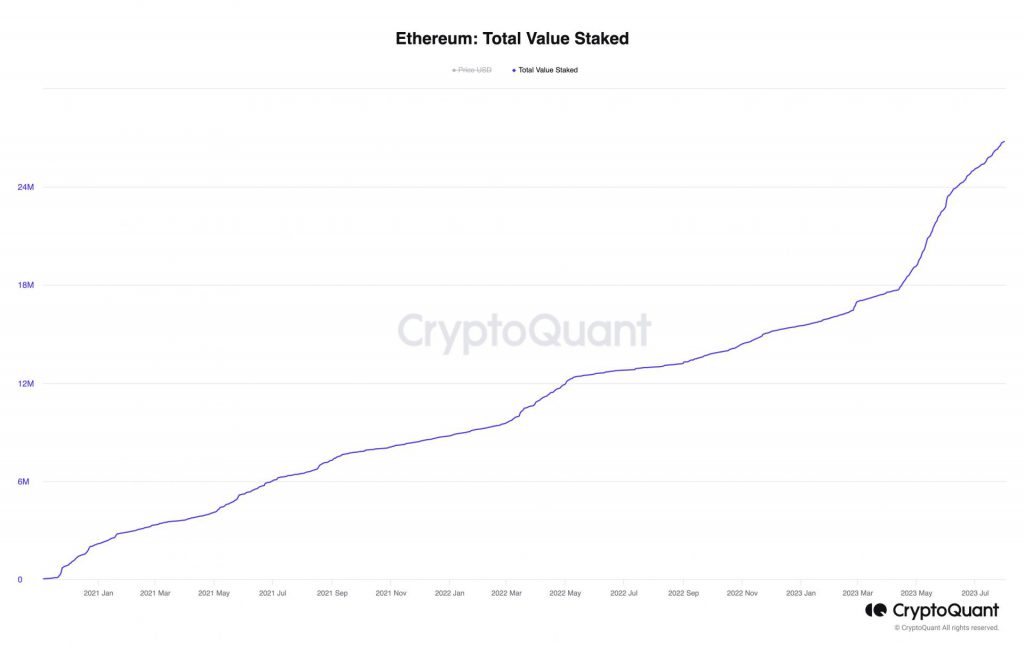

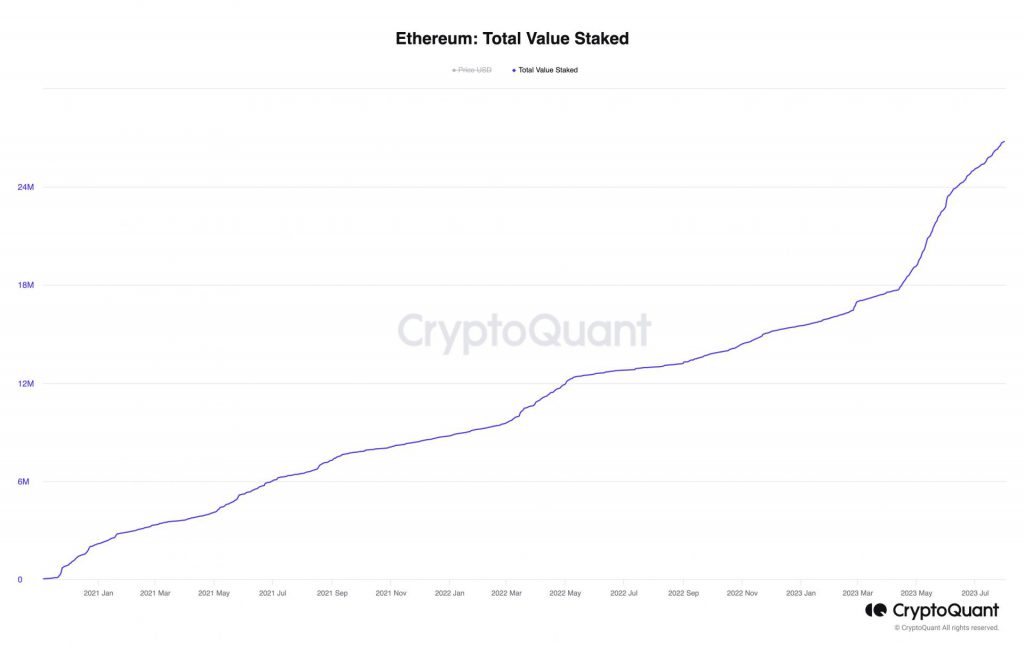

Currently, Ethereum’s total value staked is at a high of 26.789 million.

Also Read: Rise in Ethereum Staking Still Carries Major ‘Lido’ Risk