Cardano [ADA] and Ripple’s XRP have had their own set of strifes throughout history. The tussle between both the crypto tokens has always been quite intense and on several occasions, they’ve managed to dethrone each other on the market cap leaderboard list.

Just bust a day back, XRP overtook Cardano in terms of market capitalization. Their positions got shuffled with each other for the first in nearly nine months. At press time, XRP was ranked sixth, while Cardano was ranked seventh on CMC’s list. With that, their respective market caps reflected neck-and-neck values of $40.93 billion and $39.72 billion.

Has Cardano been able to cope with the flip?

Cardano has been able to subsist with the flip pretty decently. Its on-chain activity continues to be its biggest strength. Right after Bitcoin, Cardano was the most active blockchain network in the crypto space, while XRP occupied the fifth position.

Over the past 24-hours, transactions worth $10.98 billion had been carried out on Cardano while XRP could only pull off deals worth $1.59 billion. In effect, the fee collected by the former platform largely overshadowed the amount amassed by the latter [$58.7k v. $3.29k].

In terms of address activity, however, Cardano seemed to be on a slippery slope. At press time, it was slightly lagging behind XRP on this front. As per Messari’s data, the smart contract platform had over 162.29k active addresses while the payment network blockchain boasted 174.06k active addresses.

Also, concerning the ROI, XRP holders were in a comparatively better position when compared to their ADA counterparts. In the three-month window, the former token managed to restrict its losses to -29.62%, while ADA HODLers had to bear negative returns upto 43.08% in the same timeframe.

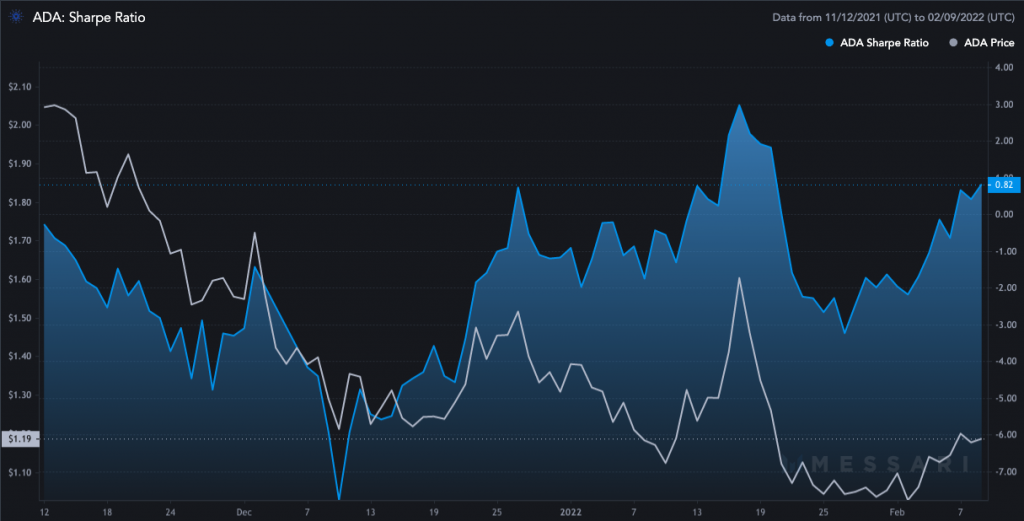

Nonetheless, on an individual note, Cardano’s performance has been improving. The token’s Sharpe ratio is now on the verge of stepping back into the positive territory after stooping to a level as low as -3.23 towards the end of January. If the uptrend continues here on, then investors would soon be adequately compensated for the risk borne by them.

Cardano’s on-chain activity continues to maintain its pristine state despite the flip. The return numbers would end up becoming better if Cardano manages to rightly tap on the broader market positive sentiment.

In all, Cardano’s dent caused by XRP doesn’t seem to be that deep this time.