After a quiet showing in April thus far, Cardano’s price could finally get the ball rolling on the chart. With its price trading within a bullish technical pattern, renewed interest in the Cardano network could reward investors with a period of gains heading forward.

Cardano’s start to April had not gone according to the script. After tagging $2.4 on 4 April, ADA faced tremendous sell pressure as a 25% drawdown dragged its price back below the $1-mark. However, bulls have made headway over the past couple of days. The price formed three highs at $0.98, aligning within a bullish technical pattern on the hourly chart. The pattern indicates possibilities of positive price action ahead.

Meanwhile, technical indicators, such as the RSI and Directional Movement Index also painted an optimistic picture. Both metrics indicated that Cardano would most likely be profitable for short-term buyers.

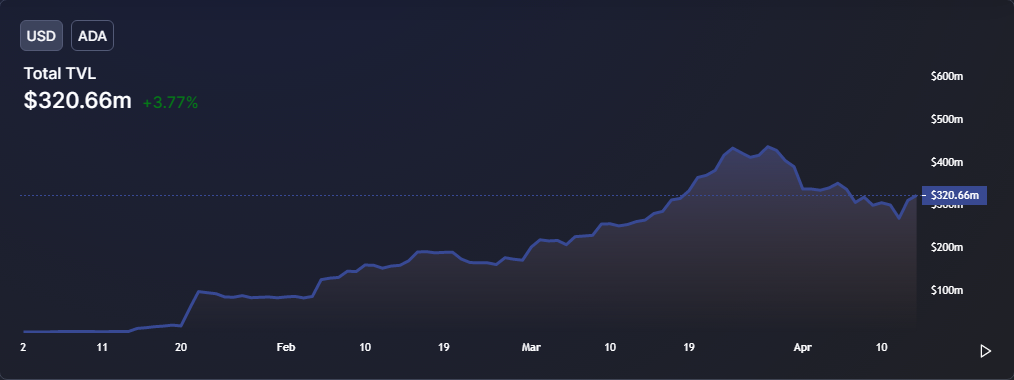

Moving outside of the charts, Cardano’s Total Value Locked was finally showing a turnaround after slipping consistently for the last two weeks. The change came largely due to the latest decentralized exchange launched on the Cardano mainnet, WingRiders. In a matter of just 48 hours, WingRiders’ individual TVL spiked by nearly 9000%, rising from $570K to its press-time value of $49 Million.

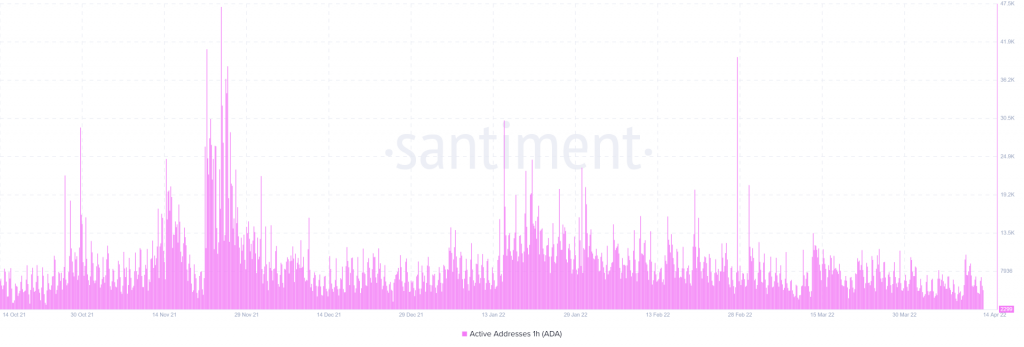

Furthermore, Cardano’s network activity presented no immediate hurdles, with the hourly active address count averaging around mid-December 2021 levels. Notably, the same period offered returns of nearly 30% to Cardano investors.

ADA Price Strategy

Factoring in the abovementioned points, a buy trade was a logical bet on Cardano’s hourly time frame. Traders can set up buy orders at $1.00 and take-profit at 11 April’s high of $1.07. However, caution must be maintained if ADA slips below its previous swing low. A stop-loss can be maintained at $0.92. The trade setup carried a 0.88 risk/reward ratio. Hence, it is not a profitable trade at the moment.