January was a great month for the cryptocurrency industry. After a tiring 2022, markets were slowly turning green this year. Bitcoin [BTC] in particular rose by 43% throughout last month. While Ethereum was mostly trading sideways, the asset managed to rise to a high of $1,704. However, this was limited to January. The real question is if these assets could carry this momentum into February.

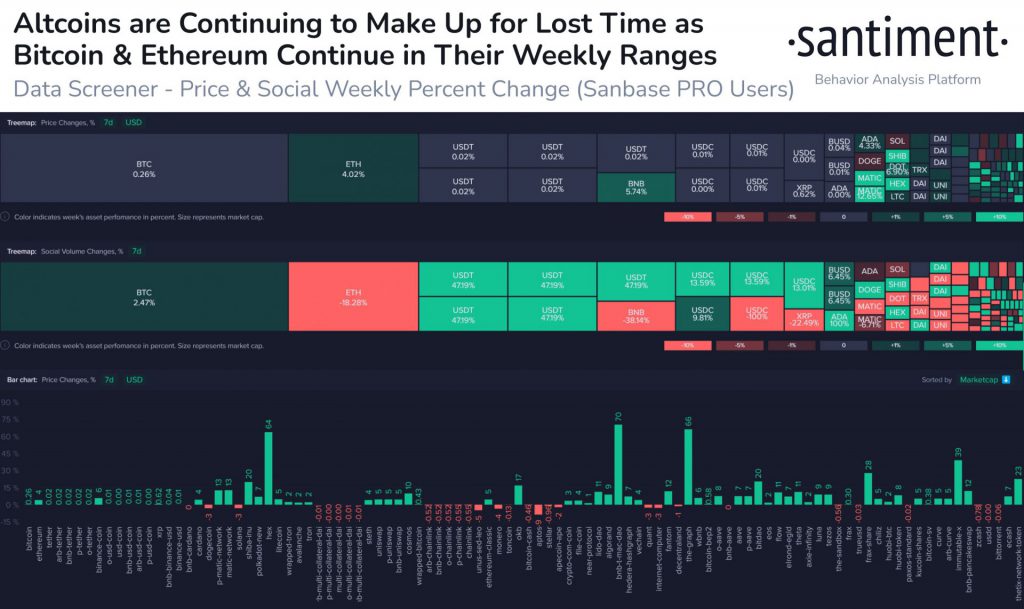

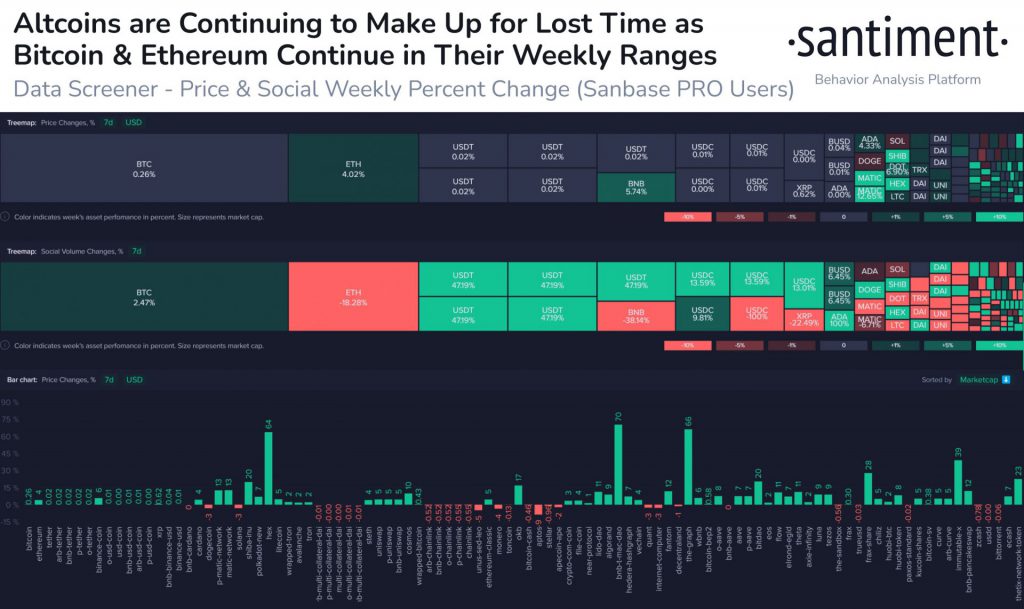

On-chain analytics firm, Santiment believes that the focus could be shifting to altcoins like HEX as opposed to big-cap coins.

According to Santiment, HEX and other altcoins like TMG and GRT have been recording rises ranging from 64% to 70% over the last week. Elaborating on the same, the firm wrote,

“February hasn’t seen a repeat of excitement for Bitcoin & Ethereum like we saw in January. But #altcoins like HEX (+64%), TMG (+70%), and GRT (+66%) have had other plans this past week. Be cautious, though, when money is cycling into mid/small caps without top cap rising.”

Time and again, the notion of how small-cap altcoins are being put forth by the community. While the focus currently lies on altcoins like HEX, individuals are still dubious about the persistence of this rally.

At press time, HEX was trading for $0.04217 with a 7.57% daily rise. Bitcoin, on the other hand, was stuck at $23,0182 with a 0.77% increase over the last 24 hours.

Investors Go on a HEX Buying Spree

The daily price chart of HEX shows that the asset’s bullish notion might prolong. As seen in the chart, the trend line signifies how the altcoin has witnessed ascending growth. If the cryptocurrency breaks through a prominent resistance line at $0.04442, it might once again be able to inch closer to $0.0500.

Additionally, the Relative Strength Index [RSI] indicator was in sync with the ongoing upswing. The RSI marker was seen in the overbought zone highlighting a bullish notion in the HEX market but opens the possibility of a reversal.