Significant project updates have allowed Avalanche to remain relevant in the crypto sphere of late but the charts show that it hasn’t lived up to its potential. With a 24% spike still up for grabs, a renewed interest in network activity could just be the missing link to Avalanche’s puzzle.

Avalanche Daily Chart

Since January, the boundaries of an ascending triangle have dictated Avalanche’s price. The lower trendline ignited two strong rallies this year, each accounting for over 60% gains. However, AVAX did not seem to react as strongly after tagging this trendline for a third time on 12 April. Although a potential 24% rise was up for grabs, AVAX was still ranging and buyers were yet to flood the market.

Development Activity Vs Network Growth?

Avalanche’s success is often judged by the state of its subnets, which allow developers to set their own programming rules for a chain. Recently, a GameFi project called DeFi Kingdoms became the latest subnet to join the Avalanche blockchain. In just over a month, the DFK subnet generated 4 Million transactions and reached a $360 Million market cap, attracting massive interest among Avalanche users.

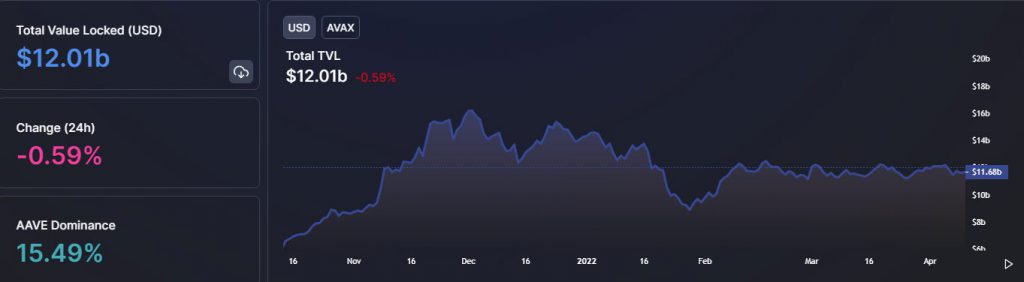

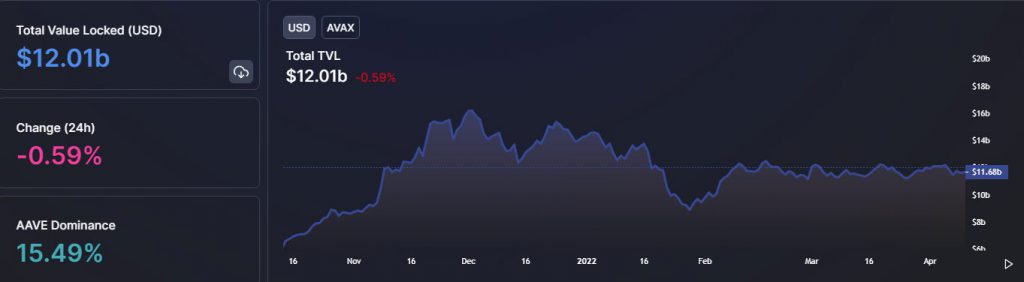

Unfortunately, however, Avalanche was unable to translate this individual success into defining price growth. As per DeFi Llama, the project’s Total Value Locked continued to remain stagnant, with liquidity protocols AAVE and Trader Joe largely responsible for the timid growth. TVL counts the number of users engaging with staking protocols and the same is often tied to price movements.

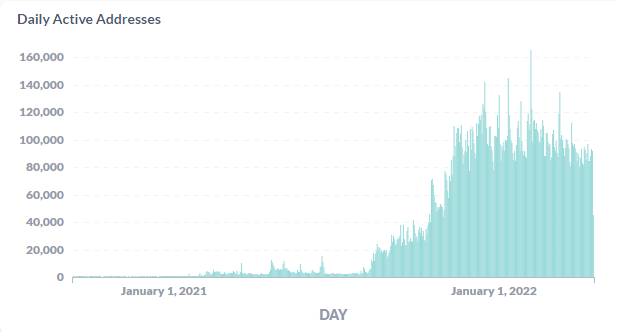

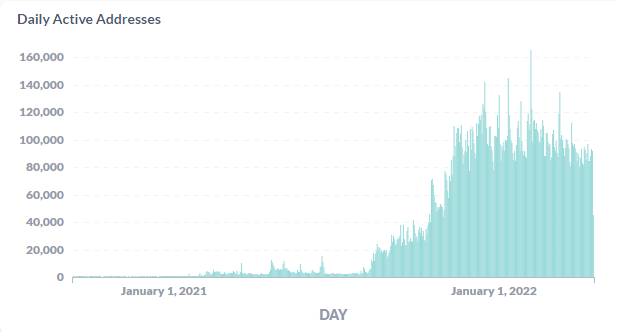

Furthermore, the DeFi project’s daily active addresses were not spectacular either. Data showed that cumulatively, users transacting on the blockchain have somewhat recovered over the past week but the figures were still drastically low from February and March levels.

Going back to the chart, one can assume that development updates were not having a greater than expected impact on the blockchain and uninspiring network growth may just be limiting Avalanche from realizing its potential.

However, a renewed interest in the network could just be a missing piece to the Avalanche puzzle. With Bitcoin awaiting a close above $45K for a rally, it will certainly be interesting to see where Avalanche’s price lands up, especially if its network activity starts to pick up the pace once again.