In a 2 June blog post, the co-founders of Gemini, Cameron and Tyler Winklevoss, announced that the crypto exchange was laying over 10% of their workforce. The execs attributed the layoffs to crypto winter and asserted that the “turbulent market conditions that are likely to persist for some time.”

Their blog post noted,

“After much thought and consideration, we have made the difficult but necessary decision to part ways with approximately 10% of our workforce.”

The Gemini founders went on to highlight that the company has shifted its focus on “critical” products. On the decision of job cuts, the blog stated,

“Every great company throughout history has faced similar challenges along the way and Gemini is no different. And as painful as this moment is, we ultimately see it as an opportunity to double-down on our strongest ideas and customer-centric products…”

Well, Gemini ain’t alone in the boat. Other prominent exchanges have also been feeling the pinch of crypto winter and have chosen to tread on the same path. Coinbase, for instance, has slowed down on hiring. Robinhood and BitMEX too have cut down staff.

Another ripple effect

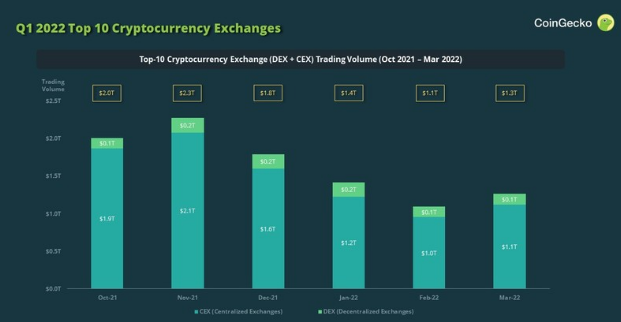

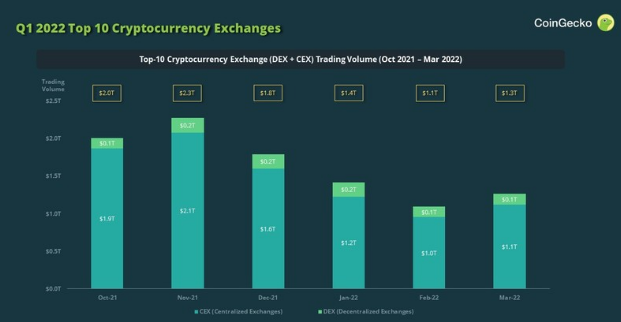

Well, over the past few months, crypto exchanges have been noting diminished volumes. Q1 2022’s spot trading volume across the top-10 centralized and decentralized exchanges declined from $6.08 trillion to $3.79 trillion when compared to Q4 2021.

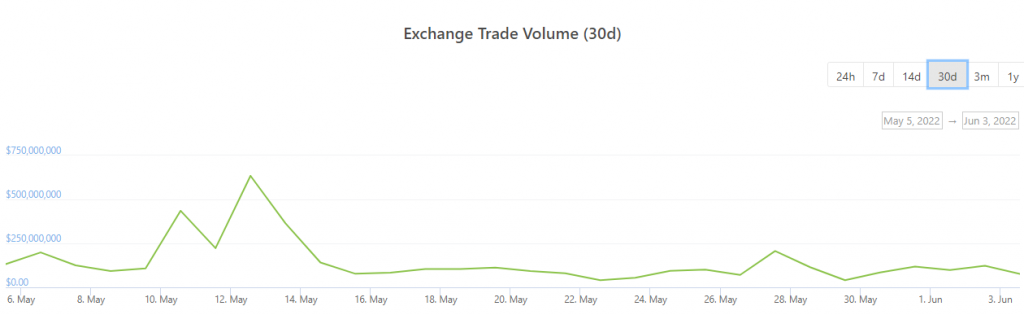

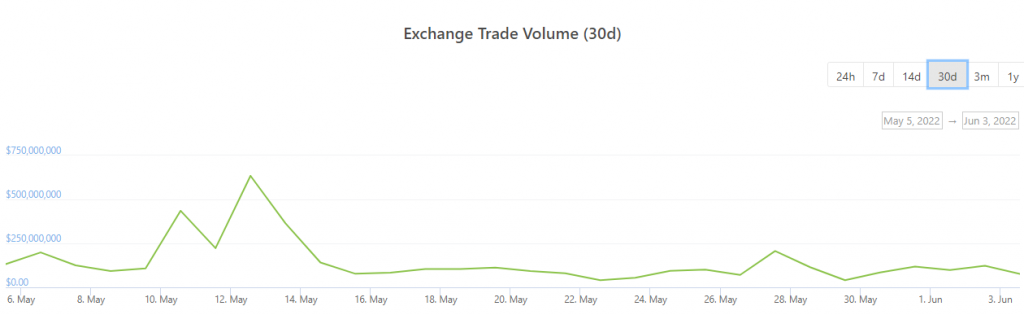

In fact, per the latest data too, the numbers have been shrinking only. On Gemini, the ETV created a local peak of $634 million around mid-May. Post that, the depletion began and the curve currently stands flat at $75 million.

Coinbase has also noted a similar trend. After locally peaking at $7.7 billion in mid-May, the number currently stands at merely $1.1 billion.

A drop in volume directly points towards a drop in revenue for exchanges. Cutting down costs during periods of cash crunches usually aids in keeping boats afloat. Crypto winter has always had more negative repercussions than positives. So, only when the state of the market improves on the macro-front, would things get back on track for exchanges.