A well-known name in the finance world for almost two decades, Jim Cramer has given his advice to investors amidst the FTX crisis. In no uncertain terms, Cramer urges them to “Cash out on crypto.”

With the fallout of one of the most well-known cryptocurrency trading platforms going under, uncertain times lie ahead for the market. Even so, Cramer’s advice may be a little too reactionary, considering his stance in September.

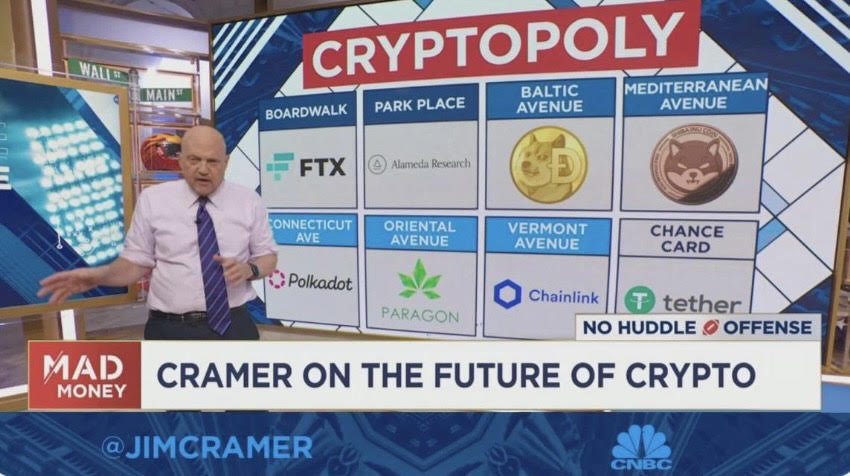

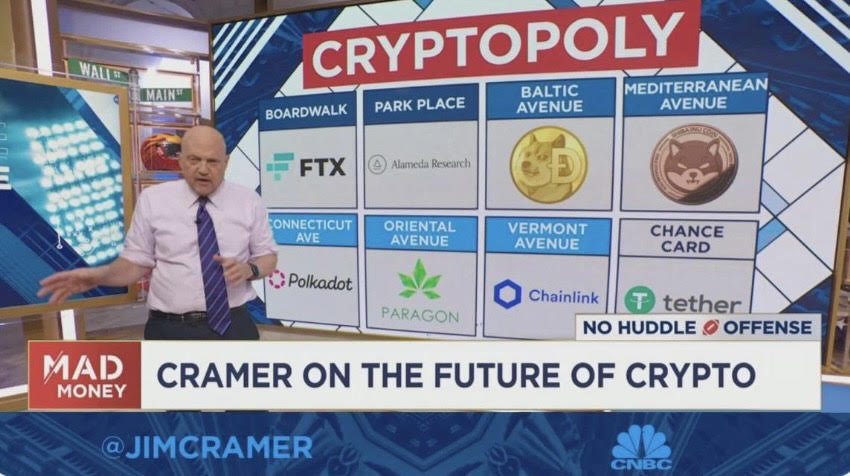

Cramer’s Mad Money Advises Against Crypto

Jim Cramer’s popularized television series, “Mad Money”, has just made a surprising proclamation on where cryptocurrency investors should go. Stating bluntly, Cramer advised they should, “Cash out on crypto while they can.”

The tone- as certain and dire as it was- follows Cramer’s statements in September of 2022 that proclaimed Sam Bankman-Fried as the “JP Morgan” of cryptocurrency. This declaration has aged poorly when considering the downfall of SBF’s cryptocurrency exchange platform.

The devastating failure of FTX has been unlike anything the cryptocurrency market has ever seen. There has been a week full of negative headlines, cascading into eventual bankruptcy fillings for the platform. Crashing $FTT, failed acquisition bids, and reports of the misuse of customer funds preceded the filings. Subsequently, this led to the resignation of Bankman-Fried as the CEO while the platform attempts to resuscitate itself.

It is certainly a concern, as the platform was among the most trusted and well-known within the industry. Yet, Cramer seems to be getting big ahead of himself. With the confidence in the cryptocurrency market already taking a hit, FTX competitors have already begun combating lessening faith. Efforts in transparency via proof-of-reserves have already taken place only a week after the FTX debacle.

Binance CEO Changpeng Zhao recently spoke on the devastating effects awaiting the market following FTX’s fate. But he ended with a clear message, “The market will heal itself.”

It may take some time, and certain investors will heed the call of Cramer and the like. But with Binance and others, the market will continue to rebuild. Cryptocurrency and the blockchain industry have a bigger trajectory than FTX, and it will continue to move forward after the exchange’s fate is decided.