A few hours ago, a report from the Federal Reserve Banks of Boston and New York suggested that stablecoins could transmit instability to the wider financial system. According to the report, the situation could be similar to previous money market stress phases registered during previous crises. In fact, JPMorgan strategists are on the same page and feel that stablecoin issuers could end up shattering the funding markets. In a recent note, they asserted,

“While prohibiting access to non-standard money-market funds makes sense from a financial stability perspective, it risks potentially disrupting the already-soft floor for money market rates that the Fed’s ON RRP currently provides.”

Also Read: Crypto AUM Could Rise to $500 Billion in 5 Years: Bernstein

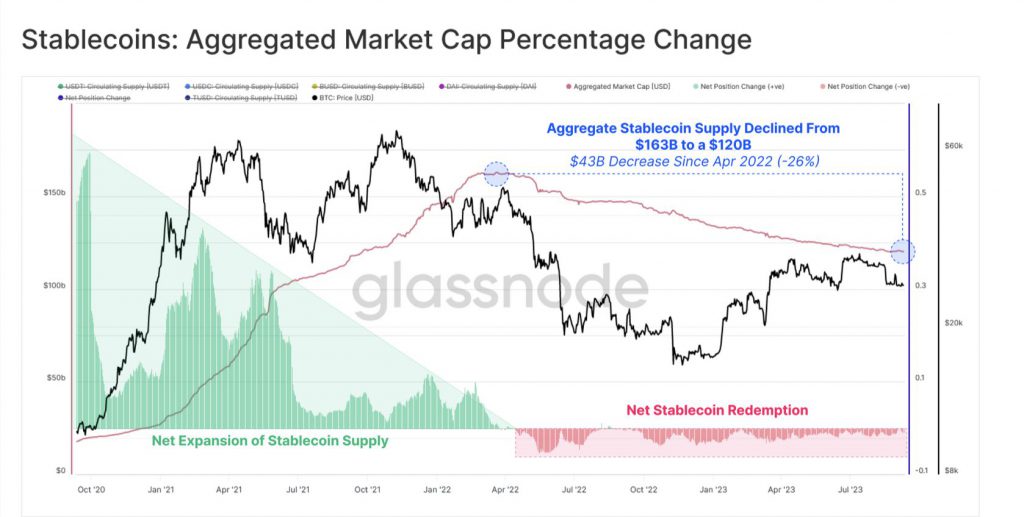

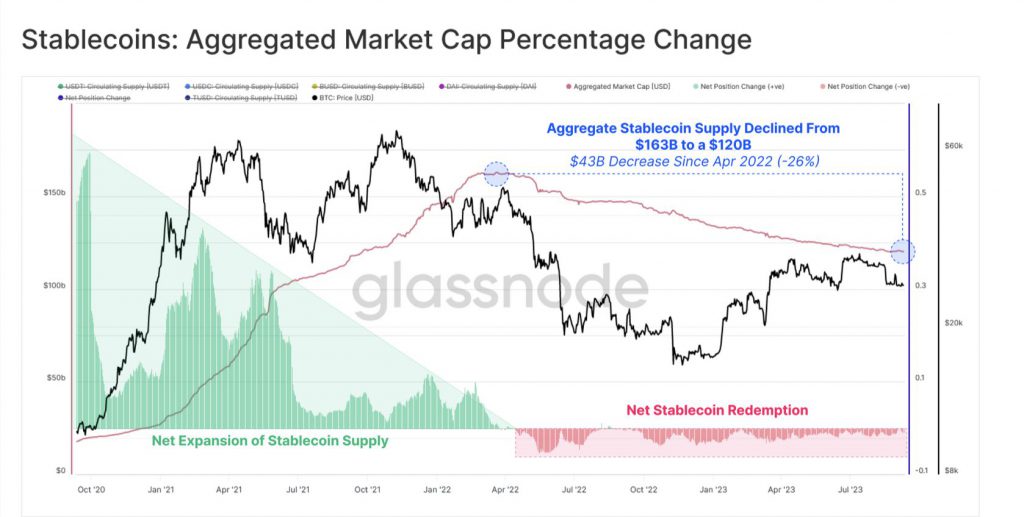

The stablecoin market has been shrinking in size since the beginning of 2023. A recent report by Glassnode pointed out that stablecoins have seen a $43 billion exit from the market since April 2022, marking a significant decline of 26%. The aggregate stablecoin market cap has been hovering around the $120 billion threshold of late.

Also Read: Japan: Binance to Launch Dollar, Yen, Euro Stablecoins in 2024

Stablecoin Market Risks Could Spill Over

In June 2023, the combined reserve portfolios of USDT and USDC were $114 billion. They had around 60% in T-bills and 25% in repo. Even though this figure represented merely 2% of the bill market, JPMorgan strategists said additional growth in stablecoins could crowd out other buyers. They additionally feel that this could intensify the supply-and-demand imbalance in the money market. Retrospectively, it could eventually lead to shortages in T-bills and repos.

With the boundary line between traditional and decentralized markets gradually fading, several believe that the risks will eventually spill over too. In fact, this could increase the exposure of the traditional financial system to turbulence in the crypto space. Several such scenarios have unfolded in the recent past. Terra’s UST crash in 2022 was followed by a bank run in the U.S. that turned into a nightmare. In fact, the Fed and other giants had to step in to bring the situation under control.

According to JPMorgan, the swift and massive liquidation of other high-quality liquid assets like Treasury bills by one stablecoin issuer could impact the NAV of other issuers and money-market funds holding T-bills. In effect, this could trigger even more liquidations. The report concluded by highlighting,

“While it is a tail risk, the crypto market seems to be more prone to it. Furthermore, any massive liquidation would likely be constrained by dealer balance sheets and their limited capacity to intermediate, which could also impact the NAV of other stablecoin issuers and other liquidity holders.”

Also Read: SBF Documentary ‘Downfall of the Crypto King’ Goes Live on BBC