The crypto market bloodbath of May-June has left many with a sour taste. In the last week of June, digital asset investment products saw outflows of $423 million, the highest recorded outflows in recent history.

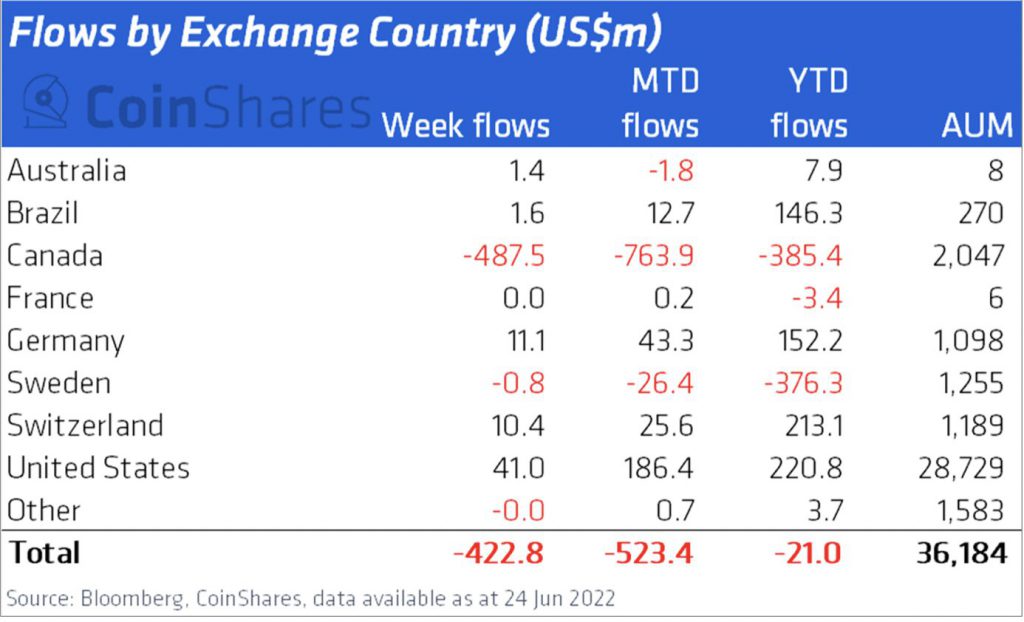

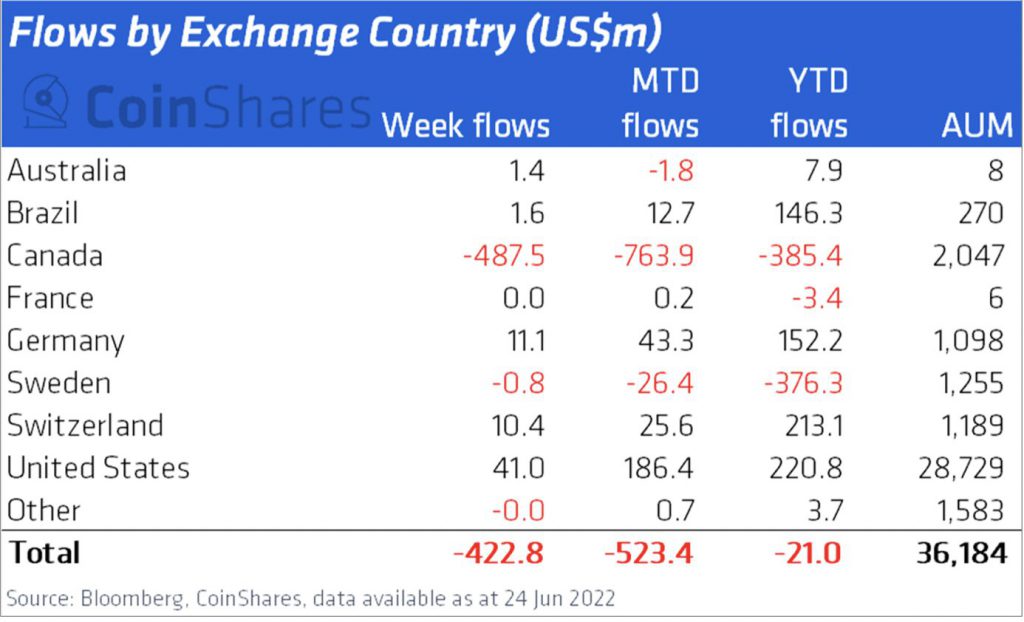

According to CoinShares’ weekly “Digital Asset Fund Flows” report, Canada represented almost all of the outflows. Between June 20 and June 24, Canadian investors sold off crypto goods worth a staggering $493 million.

Additionally, according to CoinShares, the Canadian dump on June 17 played a role in Bitcoin’s decline to US$17,760 that weekend.

The overall weekly withdrawals were offset by foreign inflows of $70 million, of which $41 million came from investors in the United States.

Investors from Germany and Switzerland contributed inflows of $11 million and $10.4 million, respectively, from outside the United States. On the other hand, Brazilians and Australians also contributed modest amounts ($1.6 million and $1.4 million, respectively).

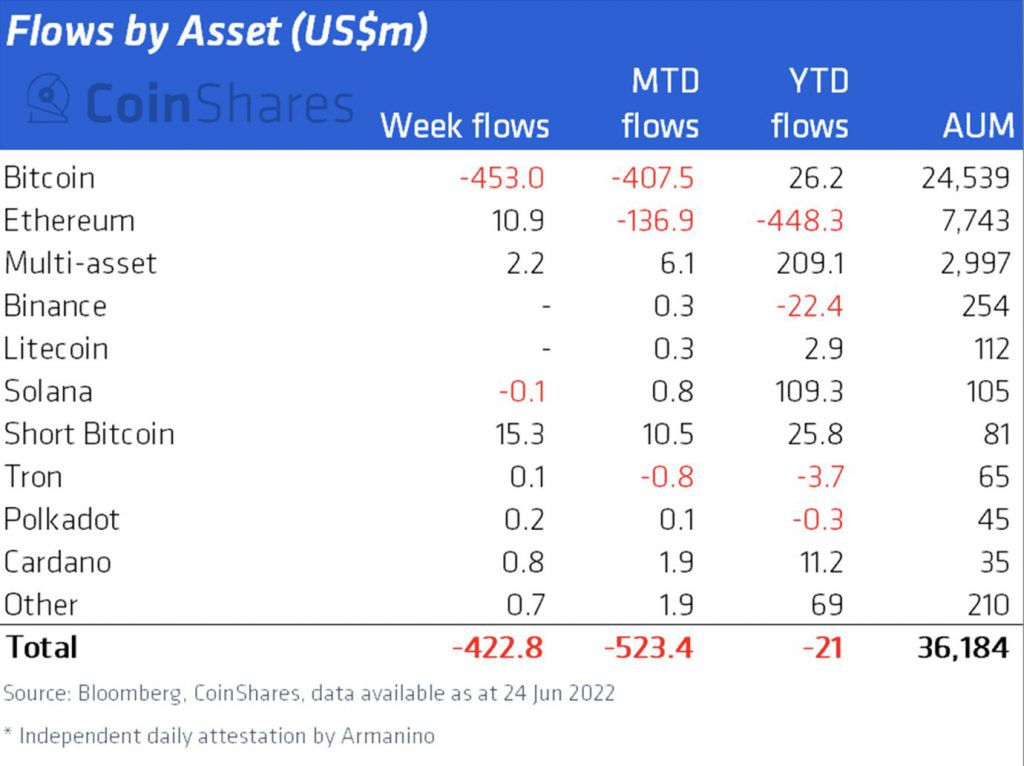

The $422.8 million in total withdrawals made the last week of June the worst weekly loss by institutional investors since CoinShares statistics have been kept. Notably, the amount is far more than the prior $198 million set in January this year.

Which crypto assets saw maximum outflows?

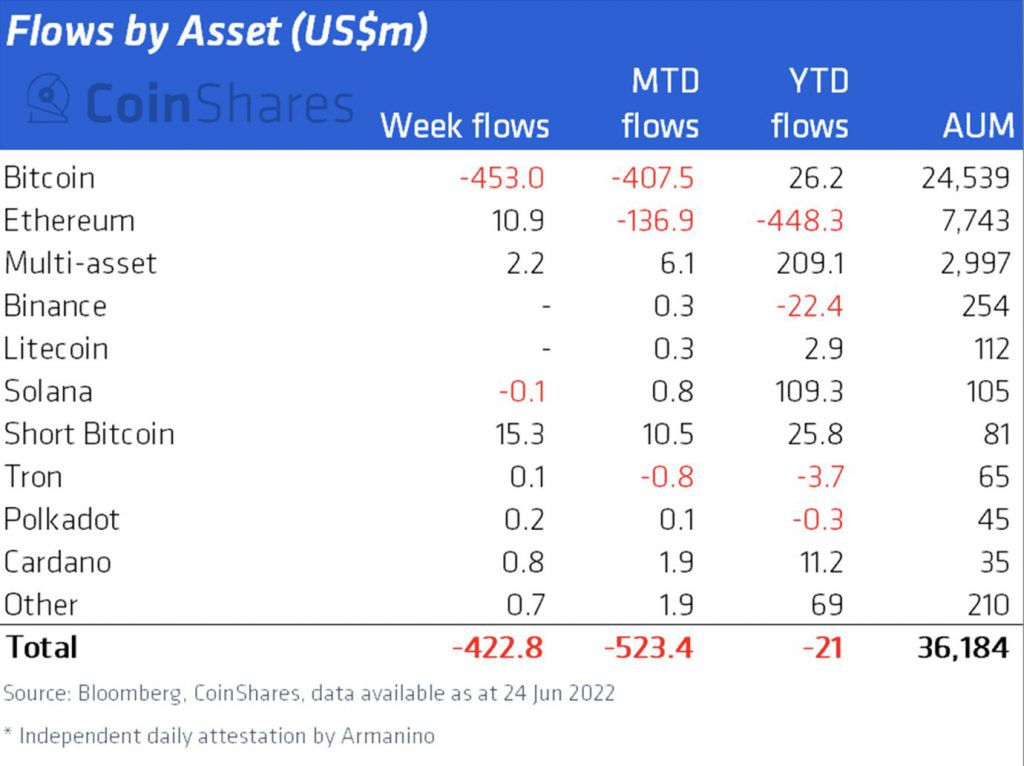

Regarding outflows by crypto asset, Solana (SOL) products also had a small outflow of $100,000, while investment products with exposure to Bitcoin (BTC) witnessed withdrawals of $453 million.

Moreover, the strong selling of BTC products in the last week of June almost caused the year-to-date (YTD) flows to turn negative, with only $26.2 million in inflows for 2022 as of CoinShares’ report published.

Additionally, the highest weekly inflows were from investment instruments with exposure to shorting the bitcoin price, totaling $15.3 million. This, according to CoinShares, was principally brought about by ProShares’ June 22 introduction of the first-ever short Bitcoin exchange-traded fund (ETF) in the United States.

On the other hand, Ether (ETH) investment products also saw inflows of $10.9 million, breaking an 11-week pattern of withdrawals. YTD Ether products have experienced outflows totaling $448.3 million as the least popular investment option among institutional clients this year.